Battle lines redrawn for our consumer good.

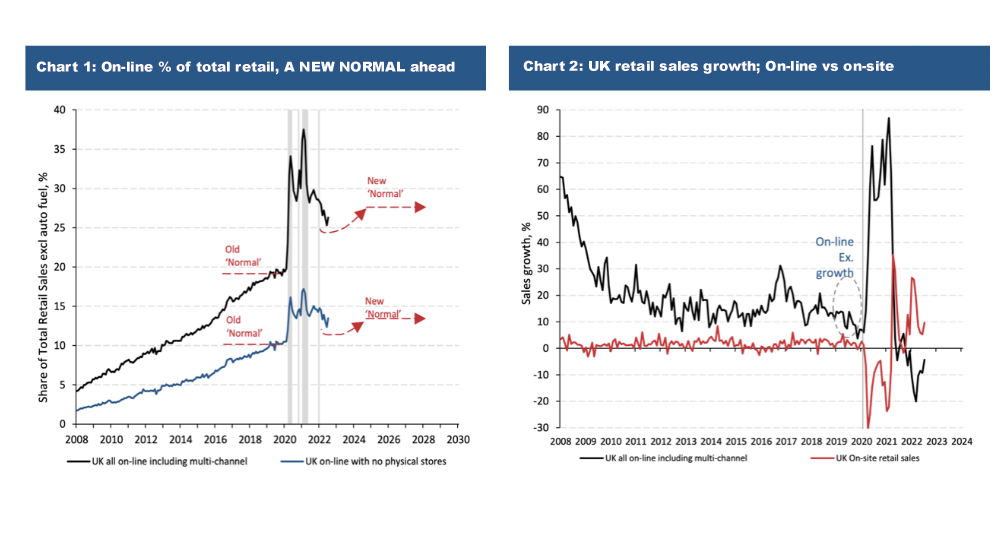

By the time coronavirus so abruptly and harmfully struck, those businesses plying their consumer goods trade from premises on high streets, shopping centres and retail parks, had already lost considerable market share to rivals delivering direct into our hands (chart 1). This accepted, in the handful or so months before they had their doors locked, there had been some respite for on-site retailers, thanks to e-commerce sales slowing to single-digit year-on-year growth (chart 2). Then, with consumers abruptly and quite literally locked out of retail premises, e-commerce sales surged. Indeed, the race between on-site and online stopped being a contest, and simply a one-horse parade. Now, with UK customers finally free again to make their own choices over how they shop, we are not surprisingly seeing the beginnings of the move to a new normal in the balance between off and online retail.

To best understand where we are heading in regard to the ‘new normal’ share of online, we need keep at the fore the following facts: Those running exclusively online realised just how much volume their existing capacity could reasonably deal with during the height of lockdown. They saw, too, what uplift this meant for their bottom line. At the same time, those with a multi-channel offering and, all the more so those with close to zero in the way of online, realised they had to have a greater internet presence, ‘just-in-case, or else’.

Let us recap. In the closing months of 2019 and early part of 2020 before we were incarcerated, internet selling appeared to have gone ‘ex-growth’ at a share of c20% of all retail (6% for groceries). As we know, lockdown – hardly surprisingly – sharply elevated the proportion of e-commerce in our spending. Post-lockdown the share of e-commerce has, again hardly surprisingly, come down from its heady lockdown heights, not least for those selling clothing, footwear and household textiles. This has meant those selling from bricks and mortar stores – and so too their landlords – are enjoying a relative rebound in fortunes. However, be warned, neither the on-site retailers themselves nor the owners of the real estate they operate from should become overly complacent or drop their guard, because another onslaught from online is coming. This said, for their part, online will not avoid a counter-attack from on-site.

“Against the backdrop of online platforms wanting to reclaim their market-share highs and on-site retailers with everything to gain from gaining customers, an entirely new battle for our custom will commence”

The reality is that many ‘newcos’ – some merely re-packaged ‘oldcos’ – have been starting up on high streets, shopping centres and retail parks with, no doubt, more to follow. In a great many instances these newbies can boast refurbished premises and less onerous rental terms than their predecessors with turnover rents ever more common. In addition, these retail ‘phoenixes’ have close to clean debt slates and, in some cases, have the cash-buffer benefit from bounce-back loans and other exchequer ‘bounties’. Against the backdrop of online platforms wanting to reclaim their market-share highs and on-site retailers with everything to gain from gaining customers, an entirely new battle for our custom will commence.

In short, despite rising sourcing and labour costs, we could well see a new round of fierce competition in the UK retail market. Competition, which for all the consequences for gross margin – remember this is about raising sales volume so as to sweat fixed assets and so lower net margin – will help (quite) quickly bring down inflation in the consumer price index.

To summarise. We are in an interregnum between what appeared to be a peak – or is it a pause in the growth? – of Retail Internet Penetration (RIP) just ahead of the accursed virus, and the post-coronavirus ‘new normal’. We have to patiently wait and see at what share of total retail online sales settle as the ‘new normal’, different of course, for each category of good. This accepted, these new shares are certain to come in higher than appeared to be the case immediately pre-pandemic. Yes, higher ‘normals’ than the old, but below the high-water marks when e-commerce enjoyed monopoly rights.

The point to really push through is that we know that thanks to their lockdown induced monopoly privilege, online retailers enjoyed sharply elevated net margins. Be in no doubt, having tasted such highs, they hunger for them again. Hunger, that is, for strong volumes even if these mean being so competitive on price they may, in these cost inflationary times, take a hit on gross margin.

What makes what awaits so very intriguing is that online platforms are now up against on-site rivals who are far fitter to competitively fight back and are no less keen on getting customers through their doors and spending. We are about to see a contest which will help ease cost of living inflation, one where the UK consumer will be less a spectator, more a grateful exploiter.