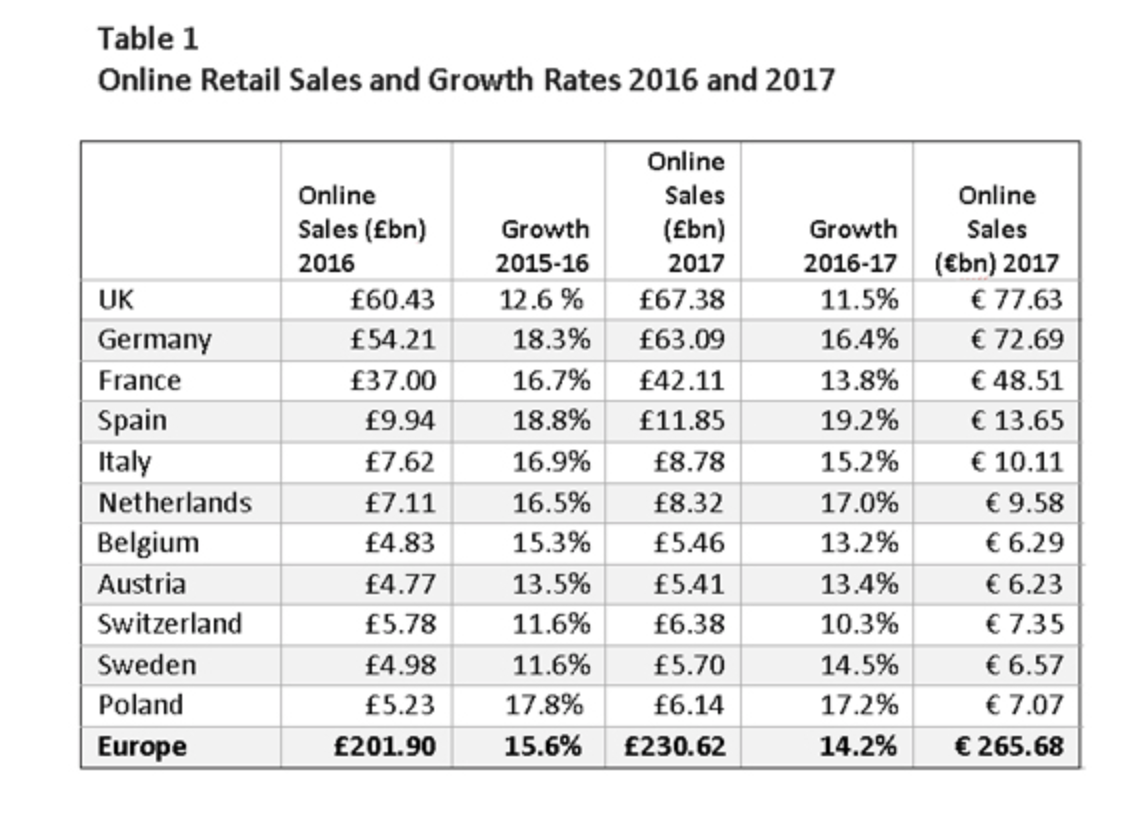

E-commerce is the fastest growing retail market in Europe and North America. Online sales in Western Europe and Poland grew from £174.76 bn [€201.33 bn] in 2015 to £201.90 bn [€232.60 bn] in 2016 (+15.6%). In 2017, we expect total e-commerce online sales to increase to £230.62 bn [€265.68 bn], a rise of 14.2%. Further growth of 13.8% in 2018 should mean that online sales reach £262.46 bn [€302.37 bn].

Retail spending only. These figures relate only to retail spending, defined as sales of merchandise to the final consumer, excluding cooked food, restaurants, automobiles and vehicle fuel.

Countries covered. The survey covered UK, Germany, France, Spain, Italy, Netherlands, Belgium Austria, Switzerland, Sweden and Poland. This year the survey has covered additional European countries so cannot easily be compared with previous studies. The U.S.A and Canada have been included as before.

The Research

This independent study for 2017-18 has been funded by RetailMeNot as a contribution to discussion on trends within the sector. RetailMeNot is a leading digital savings destination, providing hundreds of thousands of digital coupons and offers on its websites. There were more than 675 mn visits to its websites in y/e 30 September 2016 and 19.2 mn unique mobile visitors in 2016,Q2. The portfolio of coupon and deal websites includes RetailMeNot.com (U.S.), VoucherCodes.co.uk (UK), Ma Reduc (France) and the French cashback service Poulpeo.

Online Growth in North America

Online sales in the U.S. in 2015 were $349.25 bn [£269.46 bn] and grew by 14.4% to $399.53 bn [£308.26 bn] in 2016. In 2017 U.S. online sales are forecast to reach $459.07 bn [£354.20 bn] (+14.9%) and grow to $529.76 bn [£408.74 bn] in 2018 (+15.4%). Canada’s online sector is now starting to develop rapidly, helped by a depreciating Can$. It is forecast to grow by 22.6% in 2017, from US$12.69 bn [£9.79 bn] in 2016 to reach $19.97 bn [£12.57 bn] in 2017.

The Study

The Centre for Retail Research has forecast the trends in online retail sales for Europe (and the US for more than ten years. The calculation is based on the sales of goods (excluding fuel for vehicles and sales of prepared food in cafes and restaurants). Tickets, holidays, gambling and insurance are also excluded because they are not classed as retailing. ‘Online’ is defined as sales where the final transaction is made over the internet or at a distance, irrespective of whether the internet has been used for browsing and price comparisons. Sales made using mobile phones and tablets are included in our figures.

One thousand shoppers in each country (a representative demographic cross section) have been surveyed for this project and 100 online traders in each country, although 600 consumers and 60 retailers in the smaller countries. We have taken advantage of new data to produce results that are more accurate overall.

Main Results: Regular and Unceasing Growth (so far at least)

The online retail sector is the main driver of growth in European and North American retailing, achieving in Europe growth rates of 18.2% (in 2015), 15.6% (2016), and expected increases in 2017 of 14.2% and 13.8% in 2018. In contrast, the annual growth rates for all types of retailing (from stores and online) have ranged between an average of 1.5% and 3.5% pa.

The recession induced many shoppers to buy online rather from traditional stores. The fact that internet search is comparatively easy and predictable has made online retailing attractive for a wide range of products. Retail focus on the growing use of mobile technology is an additional factor in making online retailing attractive and convenient.

As before, the European online market is dominated by the UK, Germany and France. These three countries are responsible for £152 bn online sales, equivalent to 75.1% of European online sales.

Market Shares

Market Shares

Apart from the UK and Germany, market shares were comparatively low in many European countries. In 2015, the average online share of the European countries surveyed was 7.0%, 8.0% in 2016 and is expected to reach 8.8% in 2017. Figure 1 shows the UK online share was 16.8% in 2016 and is forecast to be 17.8% in 2017 (in 2010 it was around 9.4%). The countries with the highest online shares of their internal markets are: the UK (17.8% forecast for 2017); Germany (15.1% for 2017); and France (10.0% forecast for 2017). Other countries with high market shares are Sweden and The Netherlands. Germany has had the fastest-growing online sector for the last few years, but in 2017 its 16.4% forecast growth will be exceeded by Spain (+19.2%), Poland (17.2%) and Netherlands (17.0%).

In previous surveys the CRR argued that the very rapid growth of the smaller ecommerce countries then occurring compared with the slower growth in the larger ecommerce countries meant that the smaller countries would have caught up in the next four or five years. From the vantage point of 2017, this now looks unlikely as the gap between the larger ecommerce countries and the smaller ones is not diminishing. However there is no doubt that most of the countries surveyed will achieve online market shares of at least 18%, the only question is the timescale and no longer whether it will occur.

US Online Spending 2014-2015

US online spending is forecast to rise from $399.53 bn [£308.26 bn] in 2016 by 14.9% to $459.07 bn [£354.20 bn]. If we use the same definition of retail sales that is used in Europe then the US online share of retail (ie sales of goods) was 12.7% in 2015, 13.9% in 2016, and should be 14.8% in 2017. In comparison, the European online market share was 7.0% in 2015, 8.0% in 2016, and is expected to be 8.8% in 2017. There has been a lot of discussion in the US about when the online share would break through the 10% barrier but this has already been achieved if one eliminates the broader non-retail merchandise from the US definition of the retail industry as is already done in Europe.

The US is still the leader in online retailing compared to Europe. The eleven European countries have a total population of 414 mn compared to the U.S. 316 mn., However 208 mn (66.0% of the population) of the US public were eshoppers compared to 219 mn (52.8%) in Europe in 2016. Every online shopper in Europe spent an average of £921.83 [$1,194.77 or €1,062.02] in 2016 compared to £1,477.71 [$1,915.23 or €1,702.43] in the US.

Mobile ecommerce

Many retailers already report that up to 70%-80% of website browsing occurs through customers using mobile devices, both smartphones and tablets. Actual spending via mobiles (both tablets and smartphones) has been slow to match browsing percentages, but by 2016 it was 23.4% in Europe compared to 33.9% in the U.S. Individual European countries had higher rates, such as the UK (35.6%), Germany (34.0%) and Sweden (29.6%). However, the major growth in online sales is likely to be the result of higher sales via mobiles (+89.2% expected in Europe during 2015-2017) with only 14.5% of online growth being made using PCs and laptops.

Effect on Traditional Stores

The growth of online sales at the current rate will inevitably reduce the market for traditional shops. In Europe, online sales in 2015-2017 are expected to grow by +32.0%, but All Retail Sales by only 3.4% in the same period. By the time that online sales represent 5% or more of domestic retailing then the continued growth of online retailers is likely to come largely at the expense of conventional stores. In Europe as a whole, online retailers in 2017 alone are expected to grow by 14.2% in a fairly stagnant retail market (growing by 1.4% average), hence sales through stores are expected to diminish by -0.85% overall this year, and as much as -1.58% in Germany, -1.51% in Sweden and -1.22% in the Netherlands. The comparable figure in the U.S. is -1.1%. The UK figure is -0.55%. The fall in market share of existing store-based retailers is creating major strategic issues for them. For policymakers, the results will be fewer physical stores and reduced employment in this key sector.

Stages in Market Development

We think there are three stages in online market development and business strategy:

Maturity – market share of 9.5% or above, 55%+ of the population are internet shoppers, rapidly developing mobile use (15%+ of all online in 2014), multiple online providers throughout each sector and 12+ purchases pa by each shopper.

Mid range – market shares of 6.5% to 9.5%, a wide range of suppliers, more than ten purchases pa per shopper, 45% are online shoppers and a smaller mobile use.

Immature – online market share below 6.5%, patchy takeup (regionally or demographically) of online retailing, fewer than ten purchases pa, and some trade sectors are comparatively less developed.

Mature markets, such as the US, the UK, Germany and (from 2017) France, are expected to grow more slowly, recruiting a percentage of non users but mainly growing because existing eshoppers place more orders or buy more expensive items. However online growth in Germany is continuing at a very high rate, so maturity is a tendency rather than a scientific law.

Mid range markets, such as France, The Netherlands, Sweden, Switzerland and Austria, will grow by recruiting more users as well as persuading shoppers to buy more frequently.

Immature markets, such as Italy, Spain and Poland, have to overcome structural issues in the quality of their telecommunication networks, but can be expected to develop rapidly by increasing the number of eshoppers in their population and then inducing them to purchase more regularly.

Are the statistics right?

Methods

The statistics are problematic as state statistical research organisations often tend to underestimate the size of the sector, because conventionally they are best at collecting information from companies that own retail shops. There can be problems in determining online sales from abroad, because UK statistical authorities may not be fully aware of their scale, foreign firms may not wish to comply fully with UK statistical needs, and sampling may be problematic as a result of rapid sector change. There are important issues about whether to include mail order when it is mainly online and how to account for partial online ordering such as click and collect. Other issues include the definition of ‘retail’ where US authorities seem to combine food services (cafes and restaurants) within retail, which is not the case in Europe. However in Europe and the US fuel for cars is normally included as ‘retail’ but as this is not the retailing of goods and would be difficult to sell over the web we have attempted to adjust our estimates to take account of this.

Please note that our figures are based on a strict definition of retailing, a term which is increasingly used in a loose fashion to mean ‘anything relating to consumers’, such as ‘retail banking’ or ‘retail travel agents’. Including holidays, tickets, travel, motor fuel and insurance as ‘retail’ is all very well but it will usually produce figures that are three times higher than those provided here. So who is right and who is wrong? The CRR is interested in how the retail industry develops over time rather than how or whether different industries like tickets and travel operate online. Hence we use the strict definition of retail and do not study travel, restaurants, tickets, transport etc because it ain’t the retail industry.