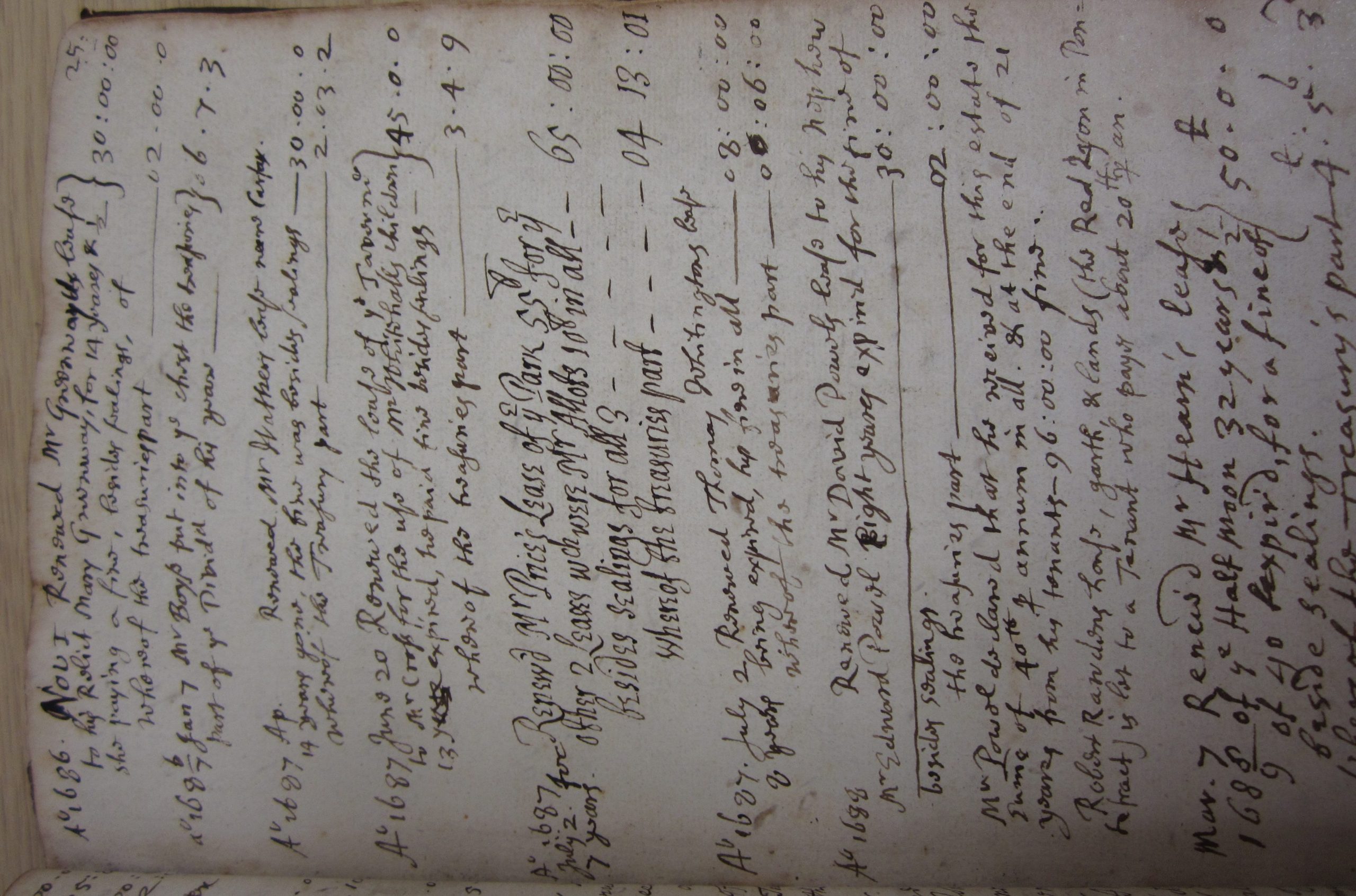

Above: Extract for the 1680s from a register recording the payments of entry fines to University College, Oxford

© The Master and Fellows of University College, Oxford

In the early sixteenth century Oxford colleges, like many landowners in England, faced a comparatively new challenge: the 16th century was a period of unpredecented inflation. The incomes of many colleges remained unchanged at this time: these bare figures might suggest that all was well, but closer analysis, based on calculations of inflation rates at this time, shows otherwise. By the early 1570s, for example, the income of All Souls College possessed barely half the value it had had at the start of the century.

Something had to be done. In 1576 the MP Sir Thomas Smith, a Privy Counsellor and former Provost of Eton, guided an act through Parliament which revolutionised the way that Oxford and Cambridge colleges, and also Eton and Winchester, managed their estates. It was decreed that for agricultural properties the existing annual rent should stay the same, but one-third of it should be paid in a quantity of wheat and malt, or the cash equivalent. The original cash calculation was based on the prices in 1576, but in future years this would be based on the current market prices in the relevant town.

At first, this arrangement may appear over-complicated, but actually it was a clever way of inflation-proofing the colleges’ incomes. A tenant would start with, say, a lease of £3 a year, of which £2 was always paid in cash, and the remaining £1 in an agreed portion of wheat and malt or the cash equivalent. The price of that portion inevitably fluctuated, usually upwards, not least in time of dearth, when crops were especially expensive. Colleges’ incomes therefore soared in real terms: All Souls, at its lowest financial ebb in the 1570s, found its real income rising to levels it had never enjoyed before. Admittedly, when a good (i.e. cheap) harvest succeeded a bad (i.e. expensive) one, a college’s income would fall accordingly, but colleges seem to have been content to ride that particular rollercoaster, knowing that in the long term the sums would work out all right.

Meanwhile, another development occurred independently to benefit the colleges. It became the custom that, every time a tenant signed a new lease with the college, they had to make a one-off payment known as an entry fine. This sum was calculated afresh every time a new lease was signed, based on such factors as the presumed value of the property, how long the lease had to run, or whether the tenant’s property needed repairs. Several guides for calculating entry fines were published: one such guide was even attributed to Sir Isaac Newton.

The entry fines were treated by colleges in very different way from its rents. The rents went into the general college accounts, but the entry fines were almost always kept in a separate account. At the end of each year, the money accruing from entry fines was divided among the head of the college and the fellows, the fellows usually getting one share each, and the head two.

Under this system of leases, known as “beneficial” leases, tenants were responsible for the maintenance of their properties, not the colleges. It was quite common for a college property to be passed down several generations of tenants, to the point that tenants could almost believe that they owned the freehold, subject only to modest annual rents and, every few years, an entry fine.

There is surprisingly little change in the colleges’ management of their finances during this time, apart, inevitably, from the upheavals of the Civil War and the Commonwealth. In particular, the colleges’ finances were still managed by fellows, the posts of bursars being elected annually as before.

One change, however, does occur in the later 18th century. For the first time, some Colleges start to invest money in government stocks and annuities, and not just in estates. When, for example, in the 1770s University College sold some land in Oxford for the site of a covered market, it spent the money, not on land, but on government stocks. By the early 19th century, some benefactors even presented colleges, not with land, but with money in stocks.

Sometimes colleges invested money given them for special purposes. In 1710, All Souls received £10,000 from a former fellow, Christopher Codrington, to build a new library. The college took time to spend such a remarkable sum, and so they invested much of it in such investments as South Sea annuities until it needed to be spent.

In general, this system of corn rents, entry fines and beneficial leases worked well: stipends were paid to fellows and scholars, and wages to staff, and running repairs sorted out. However, when a college wanted something larger, such as a new building, then they needed extra funding. Sometimes a single benefactor footed the bill, but many buildings in Oxford from the 17th century onwards owe their construction to determined fundraising by the colleges among their old members and friends.

This was in general a quiet time for the Oxford colleges and their finances. After 1850, however, they would receive a rude awakening.