Price discovery in the private real estate market is always a challenge when there is a sudden change in the market as we have now with COVID-19. As happened during past recessions, the number of transactions grinds almost to a halt making it difficult for appraisers to estimate market value. When this happens, we often see a disparity between what is happening to the value of publicly traded real estate (REITs) and values in the private real estate market as measured by appraisal-based indices like the NCREIF Property Index (NPI). Some will argue that this means the public market values are correct because the private market values have so called “appraisal lag.” But just because there are transactions of REIT shares in the stock market, does that mean these are the correct values?

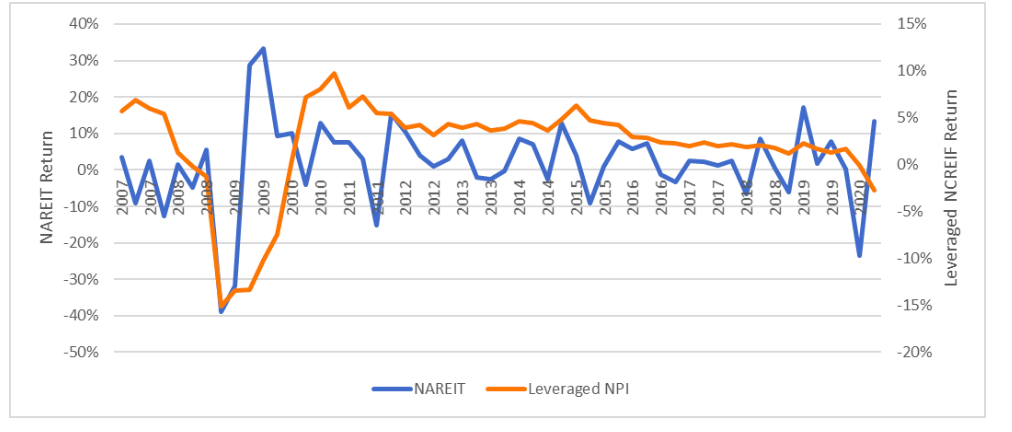

The NCREIF Property Index (NPI) which tracks about $700 billion of commercial real estate held by institutional investors showed a decline in value this quarter and negative returns as expected. For the entire portfolio of properties in the index, the quarterly unleveraged return was about a negative 1% and for those properties that have leverage, the quarterly leveraged return was a negative 2.76%. In contrast, REITs had a negative return of -23.44% in the quarter ending in March but then a positive return of 13.25% in the quarter ended in June. Did real estate values really fluctuate that much over the two quarters or did REITs over-react when COVID-19 first rattled markets and REITs were swept down and back up by the same tide that affected the overall stock market?

Leveraged NCREIF vs NAREIT Quarterly Returns

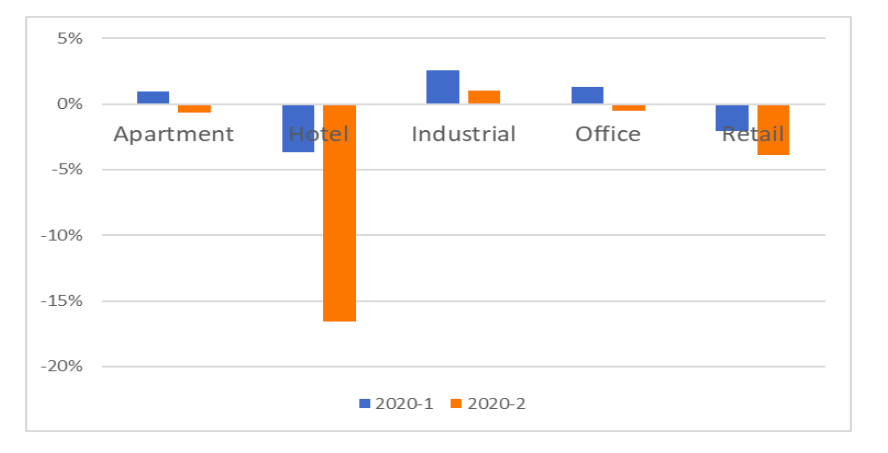

Clearly in the long run we would expect REIT prices and returns to reflect the value of the underlying real estate. But from quarter to quarter, there can be significant differences in the perceptions and motivations of the marginal investor in private vs. public markets. It isn’t that the real estate itself has a different value in the private market versus the public market. But REIT prices can sell at premiums or at discounts to the underlying real estate value. At this point, it seems clear that commercial real estate values have fallen, but it may be several quarters if not longer until we have a clearer picture by how much. There will also be different impacts on different property types and geographic areas that need to be sorted out. The impact of COVID-19 on the returns for the different sectors within the NPI were quite different this quarter with hotel being the hardest hit followed by retail which had turned negative last quarter. In contrast, industrial warehouse returns remained positive although down from the prior quarter.

NPI Total Quarterly Unleveraged Returns by Property Sector

Whether values and returns will continue to fall is difficult to say at this point. Based on past recessions, we are likely to see a few more quarters of decline given the significant decline in the GDP recently released. But the cause of this recession is very different from previous ones and only time will tell how things turn out this go around.