The resilience of prime residential markets was highlighted over the second half of 2020. Savills World Cities Prime Residential Index recorded an average capital value increase of 0.8% for the cities in the index at a time when global GDP was recovering from the impact of covid-19 and subsequent lockdowns.

The positive capital value growth recorded in the second half of 2020 was large enough to more than offset the 0.3% decline seen in the first half of the year, leaving annual growth at +0.5% for 2020.

This turnaround coincided with activity returning to residential markets around the world as lockdown measures were loosened. Bolstered by stimulus measures, low interest rates and demand for properties with more space, many residential markets experienced a robust recovery in demand.

Some of the strongest performers over the last year were cities where effective management of the virus allowed economic activity to be comparatively less impacted, such as Seoul, Hangzhou and Berlin. Supply and demand dynamics, however, also remained an ever-important driver.

Rental values and yields

The prime rental market on average fared worse during 2020 compared with the purchaser market. Demand for prime residential rental properties is often more international and from corporate tenants, and travel restrictions hindered these sources of demand. A fall in tourism has also led to many rental properties previously on the short-let market being added to supply.

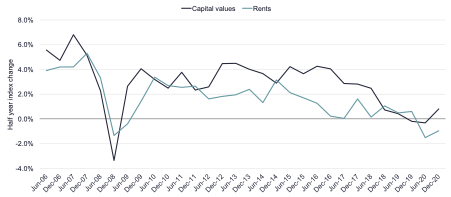

Prime rents in the second half of 2020 fell 1% on average for the cities in the index. This followed a 1.5% decline seen in the first half of the year, leaving total annual prime rental growth down 2.5%. Yields have, however, held relatively steady. The average gross yield for the index stood at 3.1% as of December 2020, down marginally from 3.2% a year prior.

Modest impact compared with previous recession

The impact of the pandemic on prime residential prices has so far been modest in comparison with the global financial crisis (see chart). Unlike the global financial crisis, this recession is not rooted in the banking sector. Current distress levels are much lower than in the previous downturn. Interest rates remain at record lows. Higher-earning professionals have also been less susceptible to income disruption to date.

Average half-year prime capital value and rental growth

Looking ahead

Entering 2021, much still remains uncertain. Sentiment is, however, improving as the rollout of covid-19 vaccines begins in many countries. Despite the uncertainties that linger, the market for prime residential property is expected to remain active.

Our prime residential forecasts for the 30 cities in Savills World Cities Prime Residential Index highlight the stability of prime residential property. Average capital value growth for the cities in the index is forecast to be 1.6% for 2021.

Many of the factors that helped drive prime residential markets in the second half of 2020 are expected to continue to do so through 2021. These include the desire for more space and low levels of supply in some locations.

Historically low interest rates, which are expected to remain low for some time, also make the sector attractive for wealth preservation. These factors, and the sector’s strong fundamentals, mean positive price growth is expected in 19 cities in 2021, while nine are expected to see small price falls.

Prime rental growth potential is likely to remain limited for many cities while travel restrictions are still in place. But with the rollout of multiple vaccines, a resumption of international mobility could occur in the not too distant future. This could help once again drive rental growth and hence yield potential.

The long-term implications of covid-19, and what this means for the ways in which people live and work, are still uncertain. The attractiveness of the prime residential sector, however, is likely to remain strong in 2021 and beyond.