Since the GFC, Spain has seen a dramatic change in the commercial real estate debt market. Not only has the consolidation of banks helped the sector to deal with non-performing loans more effectively and restore confidence in the banking market, regulation has also influenced how each lender takes risks and prices loans, consequently changing bank’s business behavior for good. These changes have since created opportunities for new lenders to enter the market, such as insurance companies, pension funds and private debt funds.

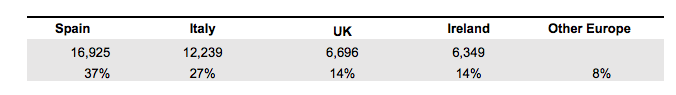

So far Spain has become known for its large non-performing loan transactions. NPLs and REOs have continued to be the focus of many private debt funds throughout 2018/19, as Spain has been the most active seller in the European market, accounting for 37% of the European sales transactions. Private debt funds have been acquiring large portions of this market obtaining discounts up to 70% of the nominal value. Nevertheless, even though these opportunities remain of interest to investors, they are becoming narrower due to the high competition and the fact that most banks have managed to dispose of most of their NPLs and REOs they had on their balance sheets. However, Sareb still accounts for a large portion of these portfolios and it may continue to be a key player in this market.

Figure 1: European Distressed RE Loan and REO Sales (as per June 2018 in Eur million)

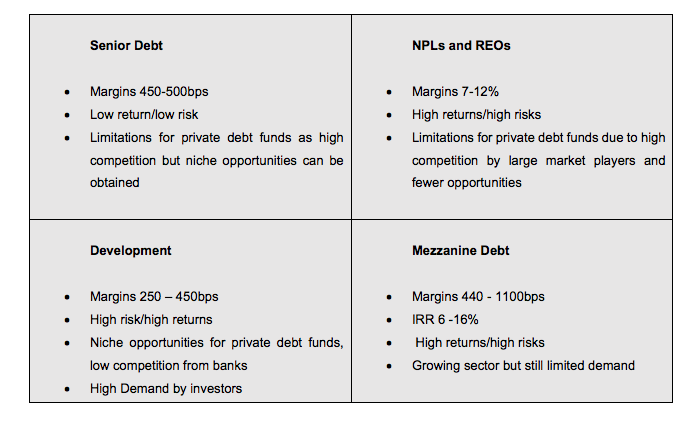

It is time for private debt funds to focus on new strategies. In search for yield, investors in private debt funds are seeking higher return strategies and our research has identified at least four key areas for private real estate debt funds looking to invest in Spain. Whilst traditional banks (domestic and international) are usually dominating the lower risk senior debt space, private debt funds can find opportunities in mezzanine lending, development lending and the purchase of non- or sub performing loans.

Figure 2: New opportunities for Debt Funds

In the senior debt space, private debt funds are offering margins of an averageof 450-500bps (2018). Despite the fact that their margins have decreased since 2013 and offering slightly higher LTV than banks, they encounter great competition with other lenders, such as international and Spanish banks as well as insurance companies, which offer lower margins at 160 – 280bps respectively. Therefore, senior debt opportunities can be rather limited. However, niche opportunities can be found as some banks have expressed moving towards origination-and-syndication strategies and consequently, private debt funds can collaborate with banks in large transaction deals. Furthermore, as real estate values increase, traditional banks must put aside more equity (risk capital) against real estate loans in order to meet the requirements of the European Central Bank, therefore this limits their origination of new loans.

Private debt funds are clearly filling up the gap in the Spanish debt market, offering mezzanine loans up to 85% LTV at a margin between 400 to 1100bps, taking advantage of the LTV limitations experienced by traditional banks. Although this niche sector remains limited in the Spanish market, we envisage growing appetite for this product, especially for smaller loan sizes. Another opportunity is development finance, especially for ground-up developments or refurbishments in residential and commercial property. Development finance especially provides opportunities to those private debt funds who are willing to provide development finance at a more flexible approach, including the financing of the land, something that traditional banks are not offering. Furthermore, there is also evidence that by entering into partnerships with other investors or larger platforms, deal sizes could be significantly increased, matching transaction sizes found in other markets such as in Germany or UK and providing further interesting opportunities for debt funds in Spain.

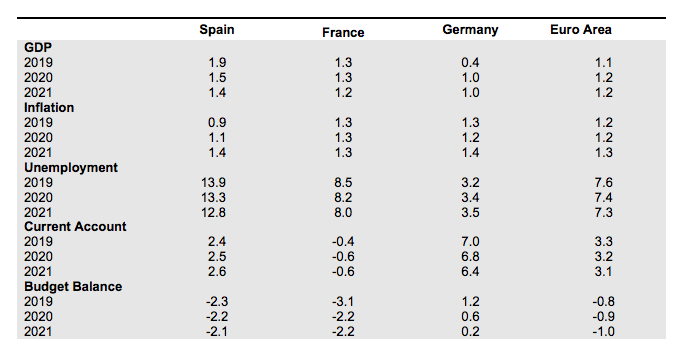

Finally, the Spanish economy has demonstrated resilience and the strong recovery is supported by structural changes, providing a more stable and sustainable growth. The macroeconomic outlook of Spain is still looking favourable in comparison to other Eurozone countries.. This ranges from GDP growth (1.9% for 2019, 1.5% and 1.4% for 2020 and 2021), low inflation level (0.9% for 2019, 1.1% for 2020 and 1.4%nfor 2021), positive balances in foreign trade and lower unemployment rate (reduced from 26.9% since 2013 and now sitting at pre-crisis level at 13.9%).

Figure 3: Macroeconomic Outlook 2019. Source: European Economic Forecast

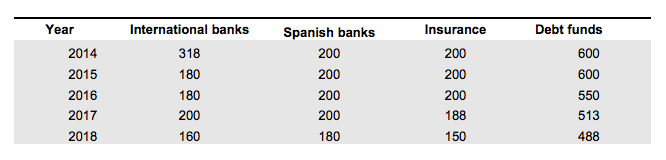

Despite the positive macroeconomic prospect for Spain, there are also indicators that show that the real estate market cycle is reaching its peak. Marginshave contracted to their lowest point in 2018 due to high competition in the Spanish commercial real estate debt market and in light of a growing economy. Supply and demand are getting tight, and investors as well as lenders are experiencing a lack of high-quality assets, hence we observe a shift to alternative assets.

Figure 4: Margin Comparison – Debt Funds vs Lenders

Although the Spanish real estate market is at its peak, there is evidence that lenders and investors are still closing deals in this