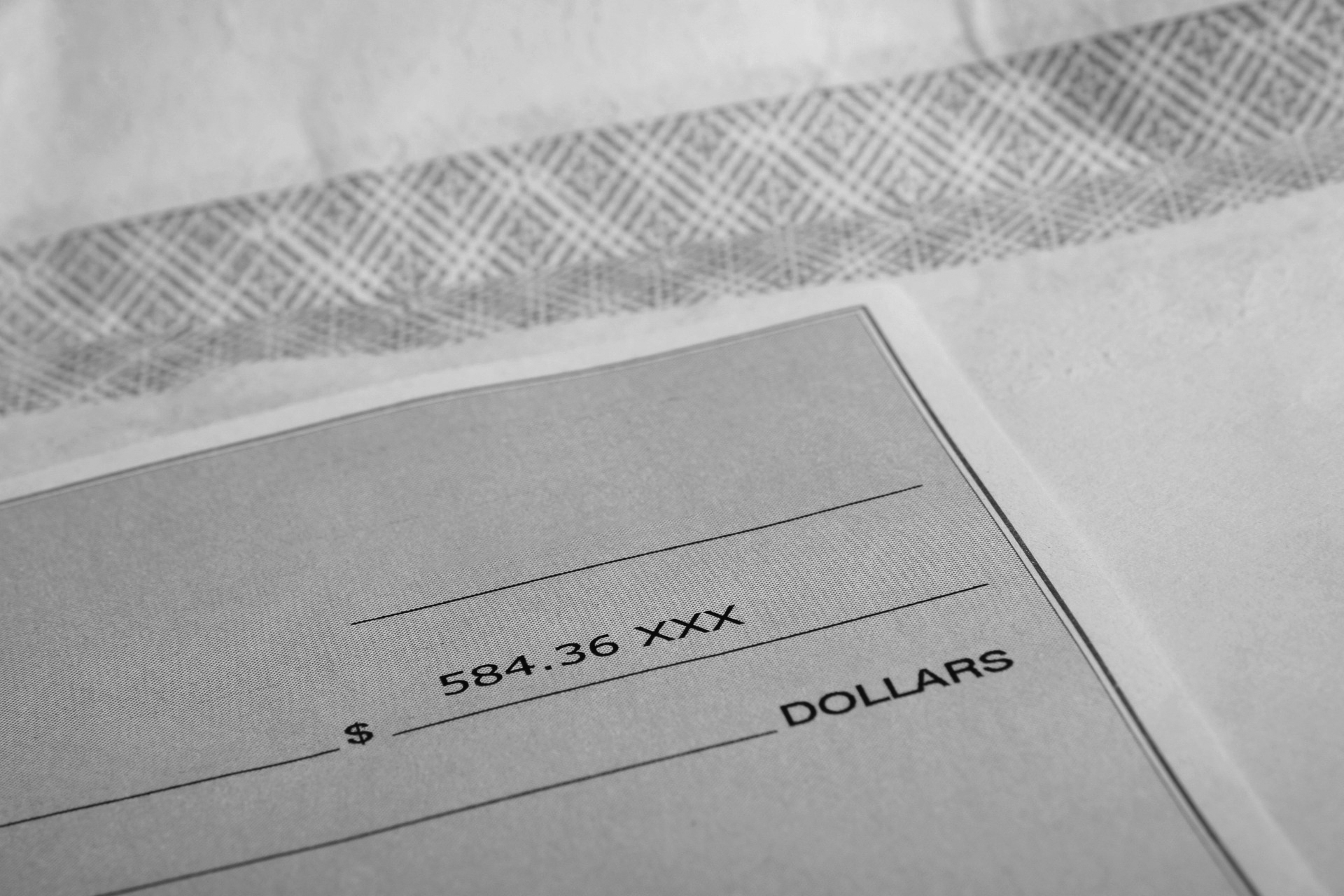

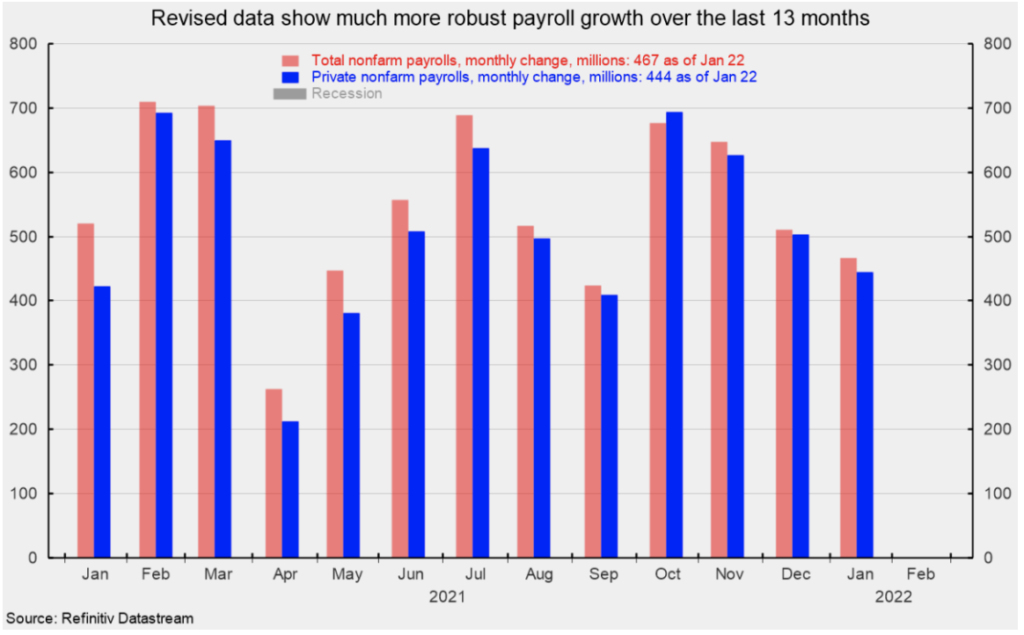

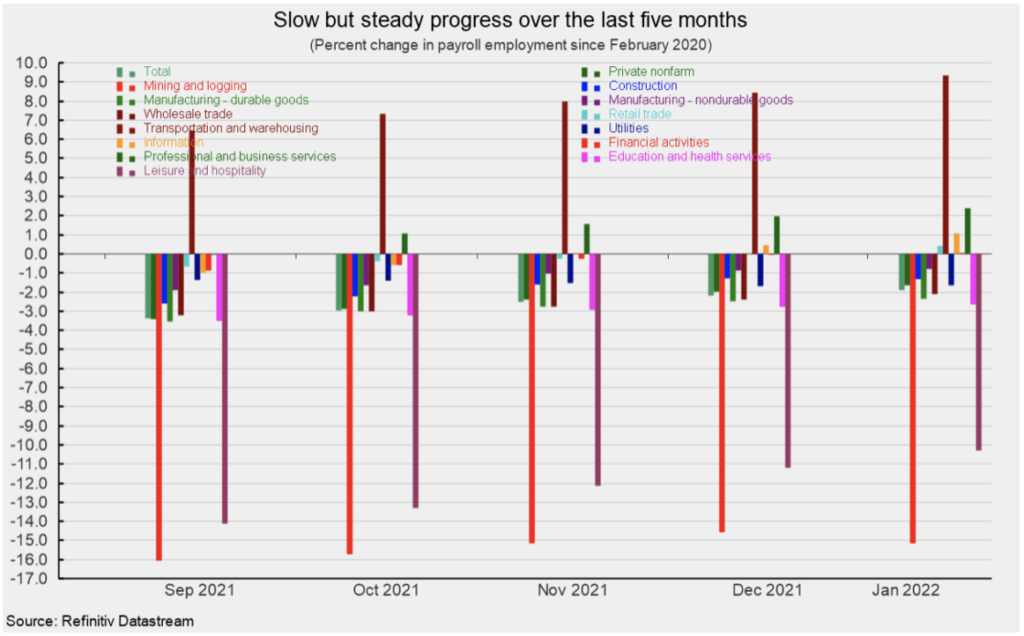

US nonfarm payrolls added 467,000 jobs in January, easily beating expectations. The January data reflects annual benchmark revisions, as well as updates to seasonal adjustments. The revised data now shows more robust payroll growth over the past 13 months, with an average monthly gain of 549,000 (see first chart). Private payrolls posted a 444,000 gain in January, with revised data now showing an average monthly gain of 514,000 (see first chart). Both total nonfarm payrolls and private payrolls are less than 2% below their February 2020 peaks (see second chart), with total nonfarm down by 2.9 million and private payrolls down by 2.1 million. At the current average monthly gain, both should completely recapture losses within six months.

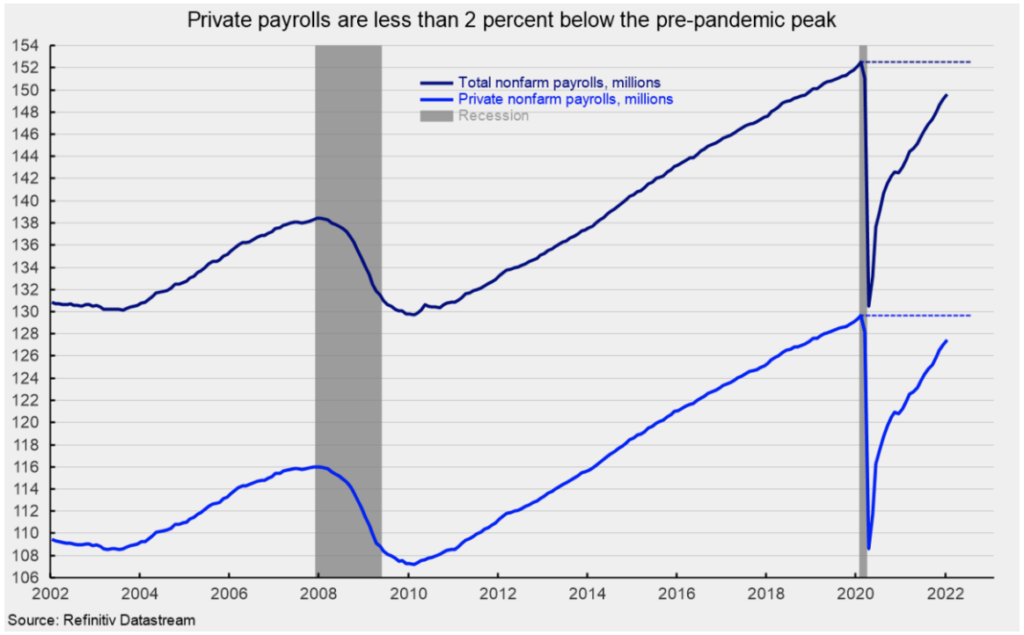

Revised data also suggests that gains have been generally more broad-based. Within the 444,000 gain in private payrolls, private services added 440,000 versus a 12-month average of 474,000, while goods-producing industries added 4,000 versus a 12-month average of 48,000.

Within private service-producing industries, leisure and hospitality added 151,000 versus a 12-month average of 196,300 for the month, business and professional services added 86,000 (versus 92,000) in January, retail employment rose by 61,400 (versus 34,600), transportation and warehousing gained 54,200 (versus 38,000), education and health services increased by 29,000 (versus 47,900) and wholesale trade gained 16,400 (versus 13,000; see third chart).

Within the 4,000 gain in goods-producing industries, construction added 22,000, while durable-goods manufacturing increased by 8,000 and nondurable-goods manufacturing added 5,000, while mining and logging industries decreased by 4,000 and construction lost 5,000 (see third chart).

Over the past six months, data now shows steady improvement in terms of industries reaching pre-pandemic levels of employment. In September 2020, only transportation and warehousing were above the February 2020 level. Since then, professional and business services, information, retail and financial have all recovered to pre-pandemic levels (see fourth chart).

Average hourly earnings rose 0.7% in January, putting the 12-month gain at 5.7%. The average hourly earnings data should be interpreted carefully, as the concentration of job losses and recovery for lower-paying jobs during the pandemic distorts the aggregate number. The average work week fell to 34.5 hours in January, possibly reflecting the impact of new Covid cases. Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls gained 0.5% in January. The index is up 9.6% from a year ago.

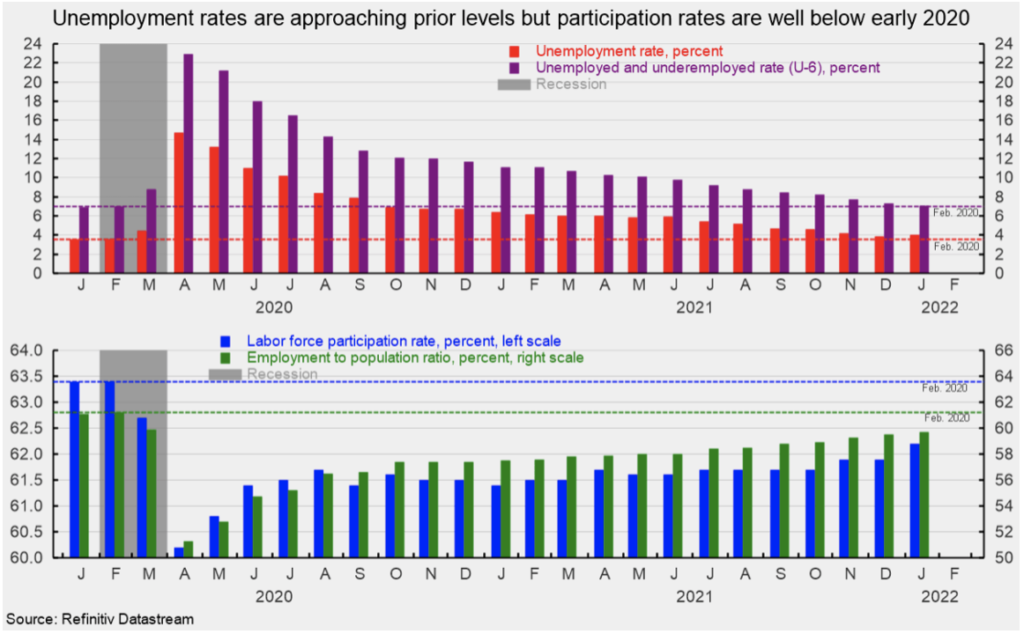

The total number of officially unemployed was 6.513 million in January. The unemployment rate came in at 4.0%, while the underemployed rate, referred to as the U-6 rate, was 7.1% in January. In February 2020, the unemployment rate was 3.5%, while the underemployment rate was 7.0% (see top of fifth chart).

The employment-to-population ratio, one of AIER’s Roughly Coincident indicators, came in at 59.7 for January, still significantly below the 61.2% in February 2020 (see bottom of fifth chart).

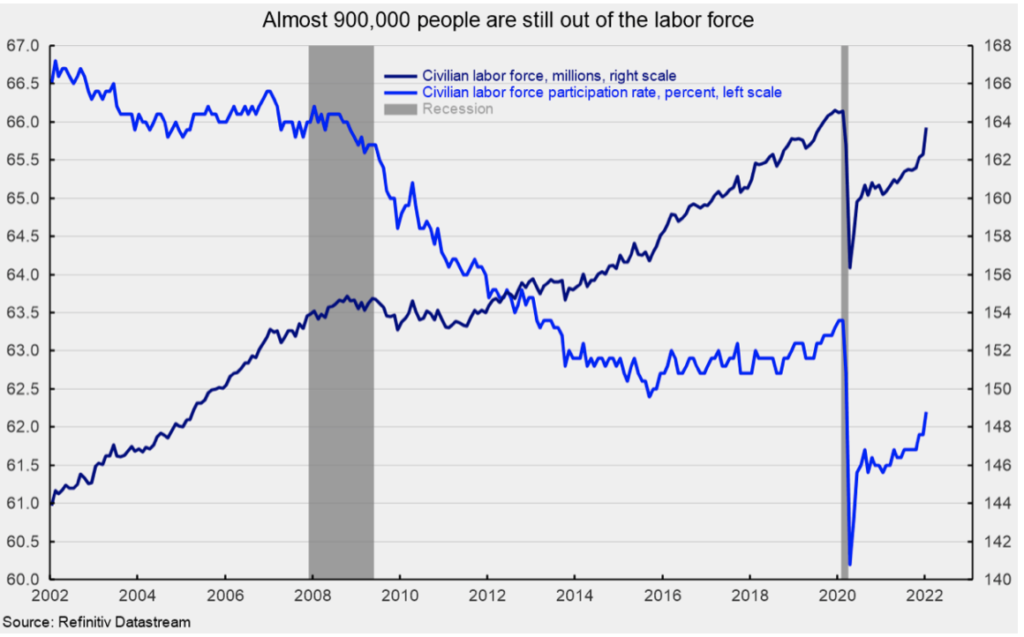

The better progress on achieving the pre-pandemic unemployment rate is largely due to people dropping out of the labour force. Approximately 896,000 workers have dropped out of the labour force over the past two years (see sixth chart).The overall participation rate was 62.2 in January versus a participation rate of 63.4% in February 2020 (see bottom of fifth and sixth charts).

The January jobs report shows total nonfarm payrolls posted an unexpectedly strong gain, especially in light of the wave of new Covid cases spreading across parts of the country in January. Private payrolls were also strong. Revisions for all the data show generally more robust gains over the past year. At the current average monthly pace of gain, the US economy could completely recover all the lost jobs within the next six months. Getting employees back on payrolls should help ease ongoing materials shortages and logistical problems, thereby easing upward pressure on consumer prices. Slowing consumer spending would also help ease pressures.

Overall, the outlook is for continued recovery. However, even with favourable signs, such as stronger payroll growth, upward price pressures are likely to continue for a while longer. Those pressures are leading to a new cycle of Fed policy tightening, raising the risk of a policy mistake. Furthermore, 2022 is a Congressional election year and may lead to unexpected events given the intensely bitter partisan atmosphere and a deeply divided populace.

Originally published by The American Institute for Economic Research and reprinted here with permission.