Continuing our three-part series on proptech, a look at the innovation gap in real estate.

Following our walk down proptech’s memory lane last week, today we will look at the real estate industry’s innovation gap. This in turn will set the stage for evaluating the current and emerging proptech landscape in next week’s final piece.

So, how are we doing?

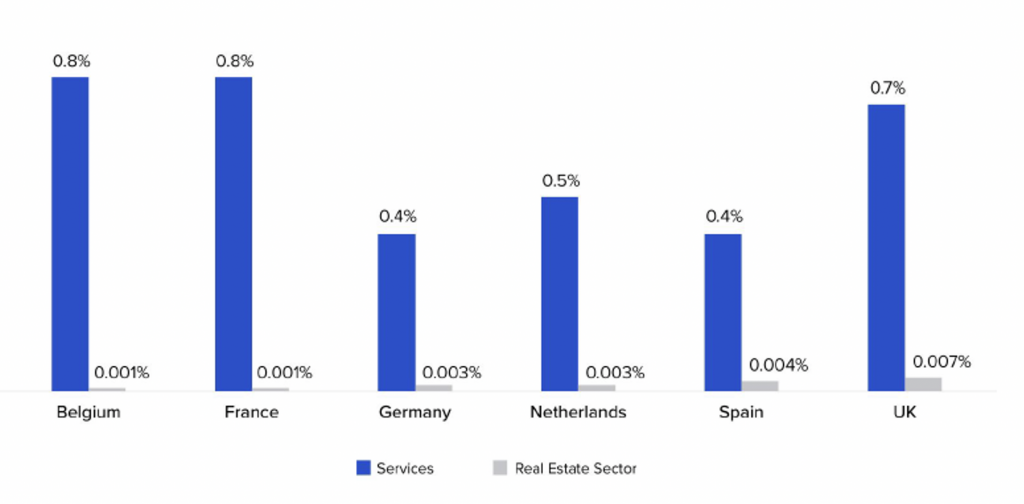

Compared with other industries, the real estate sector tends to be rather conservative, with a limited willingness to spend on R&D. This traditionalism is reflected in the following comparative graph for major European markets:

R&D expenditure (real estate vs other services) as a percentage of production

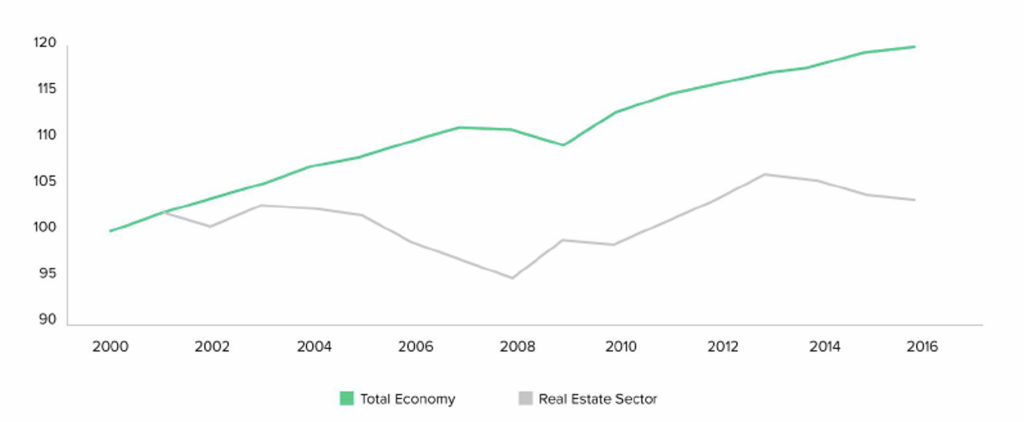

This lack of innovation in turn hampers comparative labour productivity growth, as shown in the following comparative graph for the EU28 economy as a whole.

Growth in real estate sector labor productivity – EU28

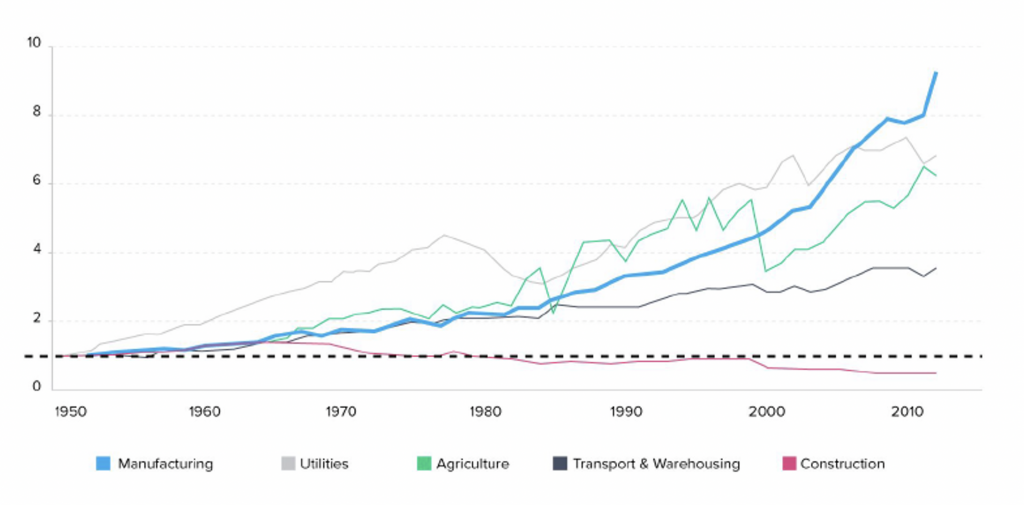

These inefficiencies are even more striking when broken into individual industries as outlined in the statistics compiled by CURT, the Construction Users Roundtable, a US industry association. In particular, the gap between productivity advancement in the wider manufacturing industry and construction over the past 60 years is remarkable. Not only is the productivity per employee severely lagging in the construction sector, but it is singled out by having declined since the 1950s.

Construction productivity (US, 1950-2012)

However, as shown in the historical digression (outlined in the first part in this series), this has not always been the case. Throughout history, technological innovation has spurred significant changes in the way buildings are constructed and, in turn, the way humans live and interact with the spaces surrounding them.

Is it just complacency, or do we need to look further?

With respect to the construction sub-sector, CURT has identified five major issues that must be tackled in order to change the status quo:

Issue #1: Unique projects build by varying teams under varying site, regulatory and weather conditions.

Impact: low level of standardisation in terms of design, execution and material use.

Issue #2: Procurement systems based on competitive rather than collaborative teams, i.e. lack of integration between design and construction teams, poor collaboration, and risk-averse CYA behaviour.

Impact: low-balling of tender quotes with later cost-overruns; ‘blame games’ between architects, contractors and sub-contractors to the detriment of investors (expensive gap-financing, delayed leasing).

Issue #3: Poor use of data based mainly on paper documents produced by highly fragmented teams.

Impact: lack of informed decision-making resulting in execution delays, delayed leasing, cost overruns, or installation failures with limited recourse.

Issue #4: Business environment characterised by cyclical material and labour costs (boom and bust cycles).

Impact: increased planning/costing/financing risk for investors; quality and safety impacts due to unavailability of sufficiently trained labour force.

Issue #5: Industry characterised by many small firms performing a significant portion of the work; lack of sufficient scale to invest in innovative methods to enhance productivity;

Impact: insufficient incentive to invest in innovation due to unclear return expectations/high-risk perception.

Specific issues apply to the investment management portion of the industry.

The current wave of digitalisation is about to have a profound impact on the real estate industry

Mercer Consulting and Backstop Solutions recently published a survey geared towards a better understanding of “how much time institutional investors were spending on core investment tasks versus other non-core tasks”. The most astonishing results of the survey include:

● Investment teams are spending 30% of their time on relatively lower-value, non-core jobs, such as searching for documents on shared drives, downloading/uploading of documents, or retyping handwritten notes into a system.

● Investment professionals are spending just 50% of their time on meeting or analysing new and existing (external) managers, a core element of forming an actionable investment worldview.

● 75% of survey respondents are indifferent to/not satisfied with the tech functionality available to them, giving their respective organisations low ratings in terms of their ability to access and share information.

● 65% of respondents welcome tools, solutions, and systems to address this data handling dilemma.

So, where is the beef?

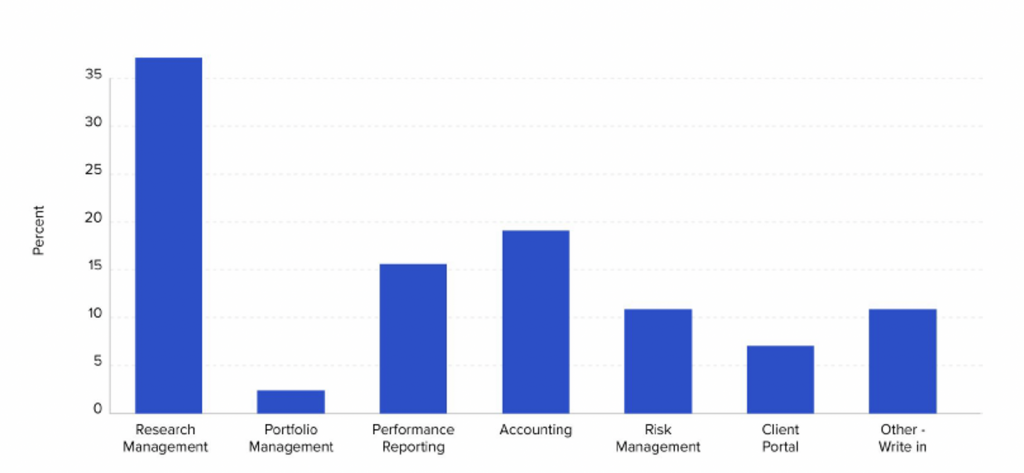

The Mercer/Backstop survey provides some direction for particular areas where technology is perceived to be ineffective, such as portfolio management, risk management and client services.

Investor degree of satisfaction with technology

How do we overcome this dilemma?

Using a page from the playbook of the late Jack Welch (Control Your Destiny or Someone Else Will), non-real estate players have been moving into the game and are about to change some of the rules.

In particular, over the past ten years, the real estate industry has been characterised by a new wave of broad-based technology-driven innovations, commonly referred to as proptech.

Starting with a paltry $725m in 2013, total capital flows into proptech investments had reached $16bn by 2019, with further growth on the horizon.

The current wave of digitalisation is about to have a profound impact on the real estate industry.

The upcoming third and final part of this series (“Proptech: buzzword or true innovation?”) will provide an overview of the current and emerging solution landscape. Helping prospective investors to shape their thought process and capital allocations, it will also discuss the expected bottom-line contribution, implementation issues and current investor/user sentiment.

Stay tuned!