Following a look at historical proptech impacts and then the current innovation and productivity challenges faced by the wider real estate industry, this final piece in our three-part mini-series will conclude by mapping the current proptech landscape and its likely impact.

With digitalisation at its core, the current proptech wave is observable along the entire real estate value chain.

Deal evaluation

Legal due diligence

AI-enabled search engines conducting title search, reviews of property tax arrears, liens and mortgages and archeological encumbrances, using satellite imaging, will streamline the evaluation process. Necessary privacy law modifications and database normalisation will be some of the obstacles to overcome.

Technical due diligence

For brownfield sites the use of VR/AI supported soil and groundwater testing and contamination history investigations will support risk assessments and pricing.

Traffic/location analysis

AI/VR enabled traffic-flow and density evaluations combined with real-time data and demographic development assumptions allow for advanced infrastructure planning. Optimised grid systems, adaptive signalling and modular/on-demand transport systems will reduce congestion and support air quality. Data about traffic patterns and infrastructure congestion will allow a radical rethinking of cities, ranging from ‘walkable cities’ all the way to de-urbanisation.

Climate/geographical due diligence

Big-data/AI supported modelling can be used to stress-test locations and structural designs ensuring appropriate storm and flood proofing and HVAC dimensions. Drone technology integrated with geo-data and building-design software allows climate/environmental risk mitigation (such as flooding, mud slides, high-velocity winds, melting soils).

Demographic due diligence

Big data/AI supported demographic modelling will be used to evaluate future demand pattern driven by industrial clustering, domestic and cross-border migration.

Financing

Underwriting

AI-enabled asset/debtor risk analysis can consider risk appetite using real-time loan book data, ALM valuations and regulatory requirements.

Debt management

Efficiency gains will arise from integrated document/process-flow applications, loan and covenant monitoring, risk scoring/reporting.

Securitisation

Granular data is key for pricing, risk management and repackaging of cash flows. This relates to the ability to obtain real-time risk, concentration and maturity information to address issues surrounding concentration (geography, lender, income streams/employers etc.), cash-flow deficiencies and regulatory transparency/early-warning ability.

Design and construction

Building design and civil engineering

Aiming for building flexibility, logistical simplifications and energy efficiency, the following solutions are emerging: 3D concrete printing, smart and kinetic paving, smart bricks, conductive concrete/tarmac (de-icing, battery charging), polymer-reinforced concrete, solar roof shingles and multi-directional elevators.

Procurement and contract management

Implementation of standardised contract/material workflows will include vendor integration to enhance transparency and site logistics. Sensor-enhanced contract milestone tracking will be used to support cost transparency and reduce non-payment risk for sub-contractors.

Construction and site management

Aiming for adherence to health and safety standards and efficiency, the following technologies are being developed: smart hard hats (fatigue tracking, RFID location, mixed reality), iust-in-time materials ordering/tracking using RFID technology, exoskeletons (for reduced physical stress), self-driving site vehicles and machinery, enhanced health and safety monitoring using AI enabled CCTV/sensor-tracking combined with risk modelling, robot-enabled prefabrication/3D on-site manufacturing, drone use for construction and safety monitoring.

Operations

Smart homes and sustainable services

Self-leasing technologies and hotelification of rental properties are recent innovations.

Asset/ portfolio management

Effective portfolio management applications are a particular concern for the investment management industry. Developing front-to-end solutions supporting impact modelling for a wide array of events, interfacing with other risk management tools (planning and due diligence phase), will be key. Portfolio optimisation (add-on acquisitions, extensions, re-letting etc.) and risk management using big data and machine learning are other relevant areas to be covered.

Property management

PM applications concerned with the leasing process, risk assessment for prospective/roll-over tenants, a predictive maintenance approach and remote building management and monitoring are the subject of the following technologies: AI enabled tenant scoring to reduce liquidity risk, acquisition analysis using predictive models to analyse cash flows and behavioural patterns, sensor-based (on-demand) maintenance scheduling, operational expense optimisation using sensor tech and smart-metering, (virtual) self-touring of rental properties, real estate as a service, age-conforming space adaptation, (remote) building inspections using drone technology, and remote management using sensor-based building tech.

Workspace management

Driven in part by covid-related structural changes, workspace allocation to accommodate hybrid office use as well as sensor-driven HVAC automation are emerging trends.

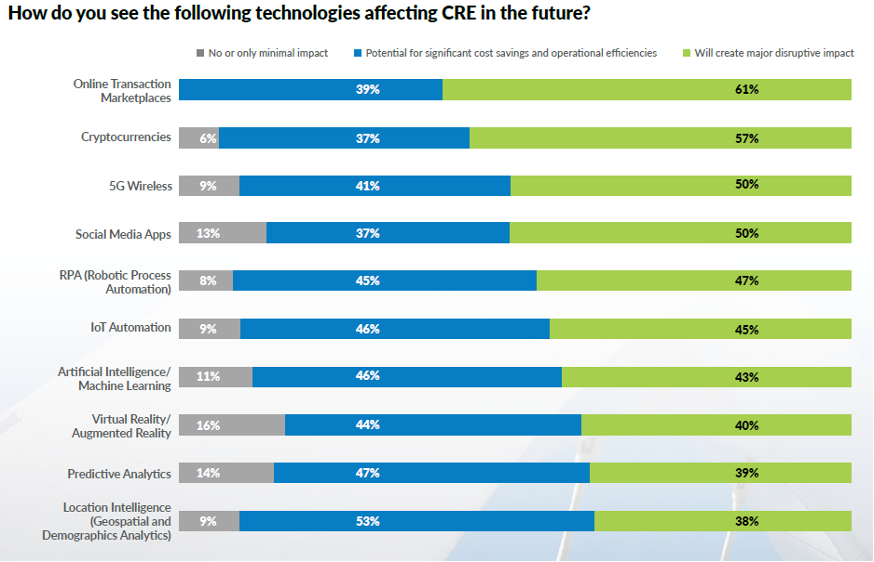

According to Altus Group’s 2020 survey, proptech’s potential is viewed rather positively by industry professionals.

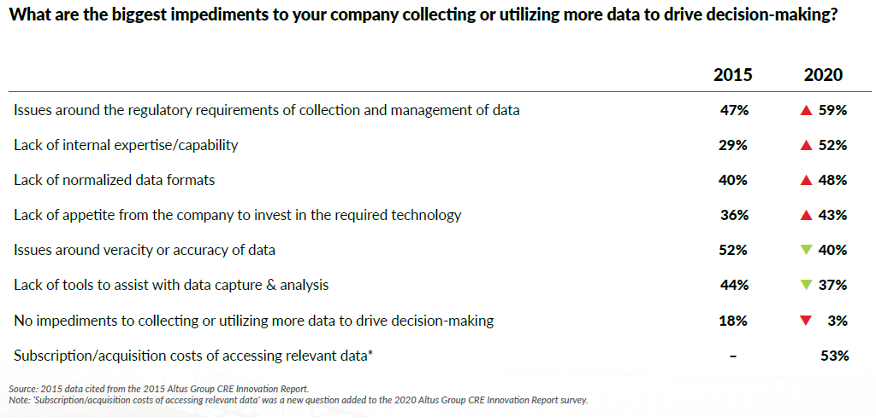

However, a reality check with the same industry players reveals significant implementation hurdles, related to data capturing, structuring and privacy.

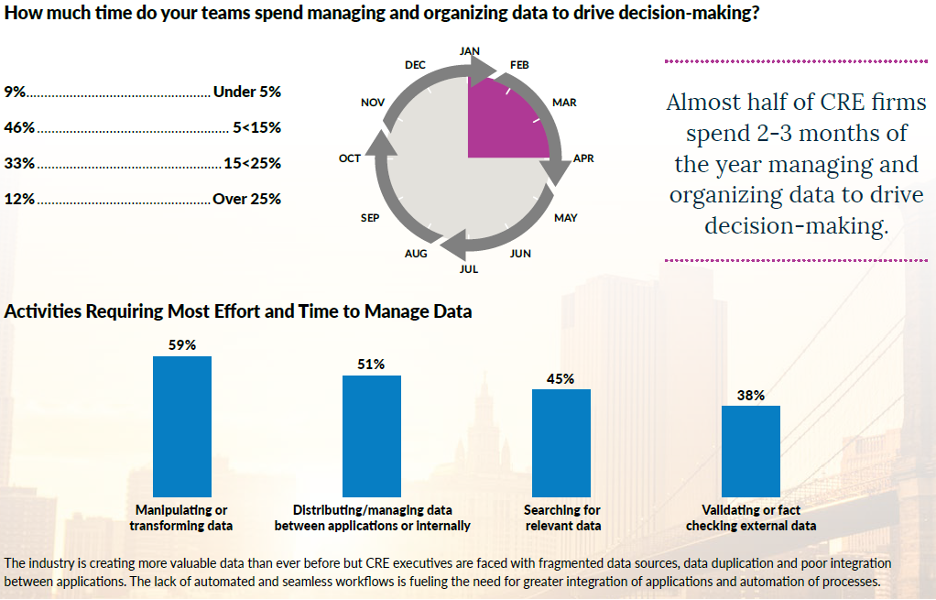

Proptech’s commercial real estate efficiency potential is best described by looking at the workforce component.

So, where so we go from here? According to Oxford University’s “Proptech2020 – The Future of Real Estate” report, investments focused primarily on analytical applications and smart real estate with big data, data analytics, smart home applications and the internet of things are leading the pack.

With Big Tech joining the race, sensoring will move to the forefront. Demographic shifts will boost robotics’ attractiveness. In an increasingly volatile world, prefabrication (for speed) and modular building tech (for flexibility) will gain momentum.

While fintech is high on a lot of investor wish-lists, it might run into regulators’ crosshairs in the medium to short term.

Major industry-drivers will be concentrated data collection, structuring and application. This will advantage IT multinationals and is likely to result in rapid industry consolidation.

Developing a clear data strategy before investing in proptech tools is key for real estate players, as is a better understanding of market dynamics and risk factors for proptech providers.

Change is coming, driven by covid-19 probably at an accelerated pace, and will have a profound impact on pretty much all of our jobs in the commercial real estate industry – so we had better buckle up and get ready.