The R rate has become synonymous with the COVID-19 pandemic. If R is above 1, infections rise exponentially, if R is below 1, the virus eventually disappears.

The impact of online spending on retail rental growth is also exponential and can be expressed in a similar form: the R rate for the High Street. The High Street R can be used to explain the accelerating fall in high street rents and rising cap rates post the Global Financial Crisis (GFC).

The R for an infection will naturally wane as the susceptible population declines. Similarly, in time, the growth of online retailing must also decline. This gives hope to investors for better rental growth prospects ahead, although for some retail property, rents will have fallen below that achievable for other uses and are likely to be converted well before this point is reached.

However distant the inflection point is from today, the expectation of improving rental trends would be expected to translate into a slow reversal of the rise in cap rates, even as online sales continue to grow.

High street rental growth and household spending

Retailers have suffered during the COVID-19 crisis, firstly due to the lockdown and then to the reluctance of shoppers to return to the high street. Many retailers had already been struggling due to the increase in online shopping and the pandemic has proven to be their death-knell.

Going forward, shoppers will return, but the rapid growth in online shopping is also likely to continue. Rental levels are therefore unlikely to return to pre-COVID levels anytime soon.

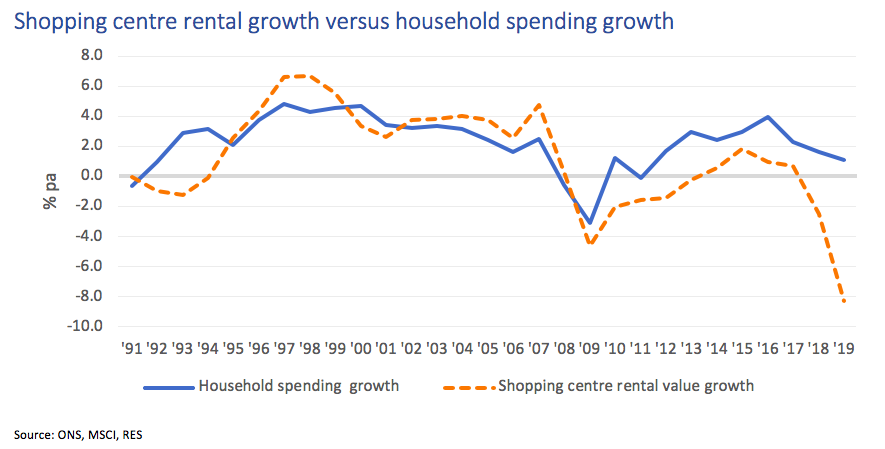

A similar effect was seen after the GFC. Until the end of the last decade, shopping centre rental value growth had a direct relationship to household spending growth: falling in the recession of the early nineties, but then recovering strongly.

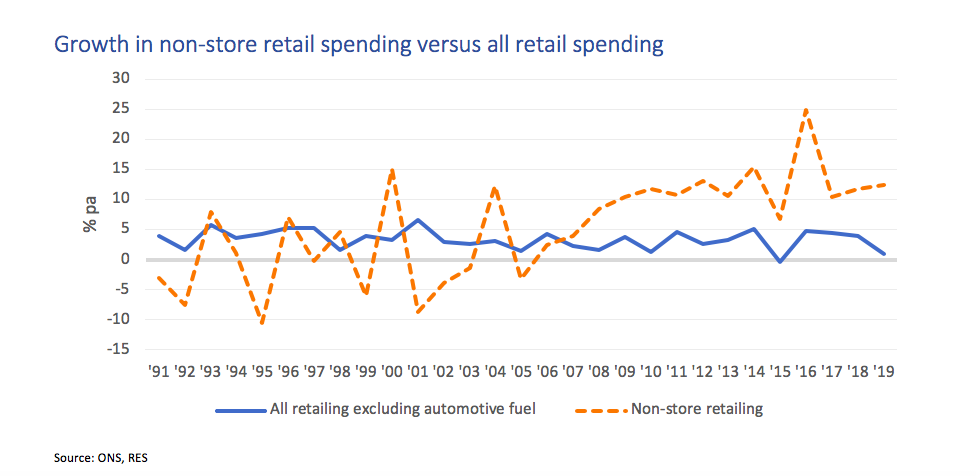

After the GFC, rental value growth on shopping centres did not recover in line with the growth in household spending. This period coincided with the rapid development of non-store retailing. Firstly, online sales predominantly replaced mail-order, but then ten-years of further double-digit growth eroded store-based retail sales. The result was firstly a failure of shopping centre rental growth to keep up with household spending growth and then a precipitous decline in rental values.

High Street R

We can quantify the expected impact of online sales growth on high street rental growth using the growth rate of online retail sales divided by household spending growth:

High Street R = ((1+Growth in online retail sales) / (1+household spending growth)-1)*100

Just as with an R > 1 for the transmission of an infection, the higher the High Street R, the lower high street rental value growth is likely to be. Further, the longer this continues, the faster the decline in rental values.

To illustrate:

- Assuming online spending accounts for 20% of all household spending, in other words for every £100 of household spending, £20 is spent online.

- If household spending grows by 2%, then total spending will rise to £102.00.

- If online spending grows by 10%, a High Street R of 7.8, then online spending rises to £22.00 and the proportion of online sales will rise from 20% to 21.6%.

- Sales on the high street remain flat at £80.00.

If we continue this sequence for twelve years, then online spending would account for almost half of household spending and high street spending growth would be falling by nearly 5% per annum.

The effect on high street cap rates

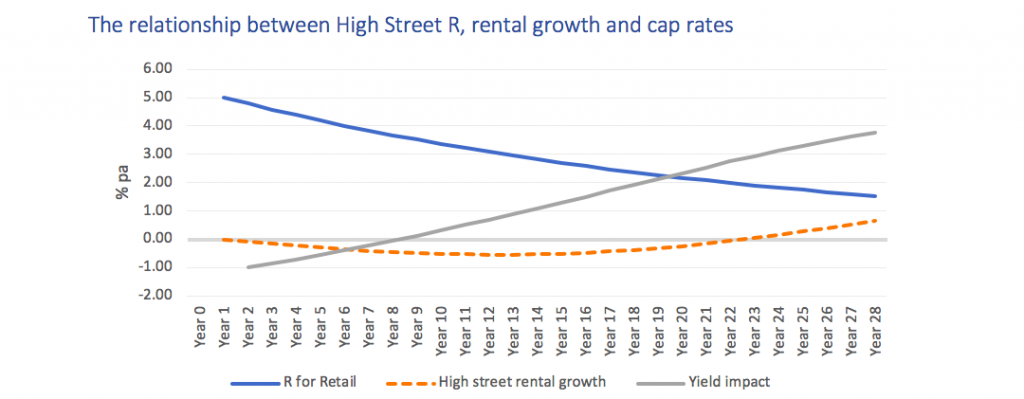

A deteriorating outlook for high street rental growth would be expected to feed through to cap rates.

If we use an adjusted Gordon Growth Model, then the high street cap rate is composed of:

- the risk-free rate, plus;

- a risk premium, minus;

- rental growth (after depreciation)

As online spending takes an increasing share of household spending, so high street rental growth would become more negative and cap rates would rise.

The effect of a High Street R of over 1, therefore leads to both an accelerating fall in high street rental growth and an accelerating rise in cap rates. For some retail property this will spur conversion to other uses commanding a higher rent and lower cap rate.

Susceptibility

However, at some point the fortunes of the surviving retail property will recover.

The R rate for an infection falls over time as the susceptibility of the population declines through exposure to the virus. Similarly, online spending growth will tend to fall as the proportion of all household spending most competitively serviced by bricks-and-mortar retailers rises as a proportion of total household spending.

The High Street R will therefore naturally decline over time. Firstly, the speed of the decline in high street spending growth would be expected to abate and then high street sales will begin to grow once more. Eventually the expected rate of high street rental growth will recover back to the trend growth rate in household spending.

In anticipation of this recovery, high street cap rates would rationally begin to fall before the inflection point in high street rental growth. The rental growth rate in our cap rate model is a forward-looking growth rate (we have assumed a 10-year forward view in the chart below). This will start rising several years ahead of the turning point in annual rental growth.

Initially the impact of the cap rate fall on capital values will only partly off-set the drag from negative rental growth, but as the High Street R declines further, investors will benefit from both rising rental values (from a significantly lower base level) and a positive yield impact to generate much stronger capital growth.

Summary

Looking forward, we can expect high street rental growth to eventually return back to the trend rate of household spending, although prior to this we can expect the pricing of high street retail to recover. How quickly, and by how much, depends on the High Street R and the susceptibility of household spending to online retailers.