Why the industry must be an active force in driving change

“Sustainable investment is about the responsibility and potential the real estate industry holds to reach climate and environmental sustainability targets. In a rapidly urbanising world, the real estate industry has a critical role and increasing responsibility to act as a catalyst to reach climate and environmental sustainability targets. Investors, occupiers, cities as well as governments can and have to play a key role to achieve a reduction of greenhouse gases in the context of the construction and operation of real estate.”1

The World Bank estimates that the real estate sector must

reduce CO2 emissions by 36% before the year 2030 in order

to prevent global warming from going beyond a 2°C increase. This is the target set by the Paris climate conference in 2015

that 195 countries have signed on to. If the world fails to keep global warming below this threshold, disastrous results are predicted including increasing natural disasters, rising sea levels, the spread of diseases, scarcity of food and fresh water, and displaced refugee migration that makes today’s migration seem minor by comparison. The United Nations Intergovernmental Panel on Climate Change (IPCC) estimates that a 1.5°C average rise may put 20-30% of species at risk of extinction. Indeed the headlines on 6 May declare that 1m species are threatened with extinction according to a new report by the United Nations. And humans will suffer the results.2 Increasing frequency of extreme-weather events like storms and floods will have a major impact on economies and investment as well as real estate property values and returns.

The World Economic Forum states in their report ‘Environmental Sustainability Principles for the Real Estate Industry’, that the real estate sector consumes annually over 40% of global energy p.a., that buildings originate 20% of global greenhouse gas emission, and use 40% of raw materials globally (World Economic Forum, 2016).

Governments and cities around the world are rushing to establish new policies in an attempt to mitigate the long-term harmful effects of climate change. Because buildings are such a major contributor to global energy consumption as well as greenhouse gas emissions, the real estate industry will be a prime target for new legislation and regulation. It is in the industry’s interest to attempt to preempt forced changes by adopting new building techniques and practices that promote conservation and sustainability. While the industry has been moving in this direction for a long time with the institution of many green building initiatives such as LEED (US), Energy Star (US), BREEAM (UK), CASBEE (Japan), DGNB (Germany), and the SB Alliance (uniting different standards), new building construction as well as the retrofitting of existing buildings still has a very long way to go.

As it is nearly impossible to draft a universal definition of

a sustainable building due to the inherent complexity of

the concept and different approaches among the world’s nations, certification systems offer a practical solution for assessing buildings’ sustainability. The value of certifications for practitioners is still in some areas questionable, partly due to the high cost and time of getting the certifications. Nevertheless, the market place is increasingly demanding certifications as proof that buildings meet certain sustainability standards. Furthermore, many government organisations and publicly traded corporations are writing sustainability standards into their new leases with requirements that the buildings meet specified standards or certifications.

Green buildings pay

For industry practitioners at all points of business, weaving climate and sustainability considerations into key decisions is a responsibility. But what many do not yet realise is the fact that guiding market decisions toward sustainable, climate-friendly outcomes will actually generate financial and economic payoffs for the real estate industry and for investors, especially in the medium and long term.

Sustainable property investments have developed from

a niche concern to a mainstream product for new real estate developments and investment products over the past decade. Green buildings represent a significant share of global development projects – a share that is expected to continue increasing.

The World Economic Forum (2016, p. 13) sites a number

of academic studies on the benefits of incorporating green building practices. The studies show sales price premia as much as 18% higher, occupancy rate benefits ranging from 2% to 18% higher, and operating cost reductions as high as 30%.

Employer demand for greener buildings is increasing. The motivations are not only associated with lower building operating costs, especially for energy consumption, but also for healthier employees who get more work done and have fewer absentees.

According to a 2018 report published by STOK, the estimated cost premium for building high performance buildings is

$20 per square foot. By designing for the occupant, they estimate that owner-occupants and tenants can gain $3,395 per employee in annual profit, or $18.56 per square foot. This translates to $115 per square foot over 10 years – an enormous cost/benefit ratio in favour of high performance buildings.

Most people work in buildings that were not designed for their well-being. High performance buildings (HPBs) are designed specifically to enhance the occupant experience. Essential features include “indoor air quality and ventilation, thermal comfort thermal comfort, natural and artificial lighting attuned to circadian rhythms, noise and acoustics, active design, views and biophilia.” (STOK, 2018, p. 5.)

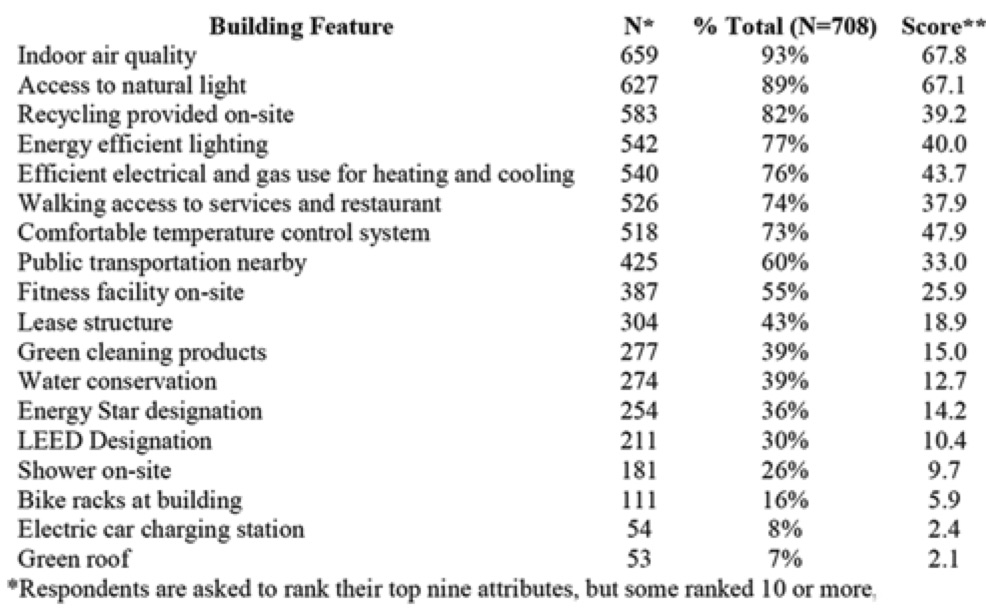

Tenants also are indicating a strong preference for green features. In addition to the above list, tenants desire walking access to services and restaurants, public transportation, fitness facilities, and showers on-site. The table below shows office tenants stated willingness to pay for green features.

Businesses and other organizations are also increasingly looking for ways to reduce their ecological footprint. These new imperatives may be intrinsically motivated or in anticipation of increased legislation that will push them along the path. Publicly-traded corporations and global companies may feel this pressure sooner than smaller local businesses.

Reducing energy consumption is the most important way to reduce greenhouse gas (GHG) emissions. Buildings in the United States consume 41.7% of total energy; in Europe the figure is 38.1%; in China it is 20%.3Building energy consumption is lower in China because the building stock is older and fewer buildings are enclosed with mechanical system ventilation.

The benefits for lowering GHG emissions by reducing building energy consumption depends on how much energy is from renewable sources. Thus the benefits are lower in Norway where most energy comes from hydropower than in the United States where most energy comes from fossil fuels.

Retrofitting existing buildings is one of the most important ways to reduce GHG emissions. “Approximately two-thirds

of the building stock today will still exist in 2050. Currently, building renovations affect only 0.5-1% of the building stock annually.”4A very important benefit from renovating existing buildings is reducing ‘embodied carbon’ – the carbon footprint for manufacturing construction materials. Embodied carbon accounts for 11% of total annual GHG emissions and 22% of building stock emissions. Thus, increasing the rate of renovations is essential for meeting Paris Agreement targets.

Conclusion

The real estate industry controls one of the keys for preventing the destruction of life on Earth as we know it. Given the central importance of the impact on greenhouse gas emissions both for the existing building stock and new buildings tobe built between now and 2050, the real estate industry must become a more active participant and driving force in achieving sustainable building objectives. The industry faces an ethical imperative to do more to reduce its carbon footprint – “to meet the needs of the present without compromising the ability of future generations to meet their own needs.”5

1Peiser, Richard and Thomas Wiegelmann, ‘Sustainability: the green imperative,’ in IPE Real Estate, May/June, 2017, p. 33 and Interview with Peiser and Wiegelmann, ‘Property in the front line of war against global warming,’ in InvestmentEurope, April, 2019, p. 18.

2 Fears, Darryl, ‘One Million Species Face Extinction, U.N. Report says,’ Washington Post, May 6, 2019, https://www.washingtonpost.com/climate- environment/2019/05/06/one-million-species-face-extinction-un-panel-says-humans-will-suffer-result/?utm_term=.d35688dea30f accessed on May 8, 2019.

3Ali Malkawi, Director, Harvard Center for Green Buildings and Cities, phone interview, May 8, 2019.

4‘Why the Building Sector?’ Architecture 2030, https://architecture2030.org/buildings_problem_why/ accessed on May 10, 2019.5 Brundtland Report, United Nations World Commission on Environment and Development, Chapter 2: Towards Sustainable Development, 1987. https://en.wikisource.org/wiki/Brundtland_Report/Chapter_2._Towards_Sustainable_Development, accessed on May 10, 2019.