The Physical Market Cycle Analysis of 5 Property Types in 54 Metropolitan Statistical Areas (MSAs).

The 2018 economic expansion continued at a moderate pace with a slightly higher GDP growth rate than the past five years. Employment growth continued to increase at an average 200,000+ job increase per month. The Federal Reserve recently put their interest rate hikes on hold, with expectations of a cooling economy, and 10- year treasury rates dropped back below 3%, thus CRE debt costs remain moderate. All favorable trends for real estate. New supply growth is slowing in all property types with higher labor and construction costs.

Office occupancy increased 0.4% in 4Q18, and rents grew 0.3% for the quarter and 2.0% annually. Industrial occupancy was flat in 4Q18, and rents grew 2.4% for the quarter and 5.9% annually.

Apartment occupancy decreased 0.1% in 4Q18, and rents were flat for the quarter, but grew 3.1% annually. Retail occupancy increased 0.1% in 4Q18, and rents grew 0.1% for the quarter and 1.5% annually.

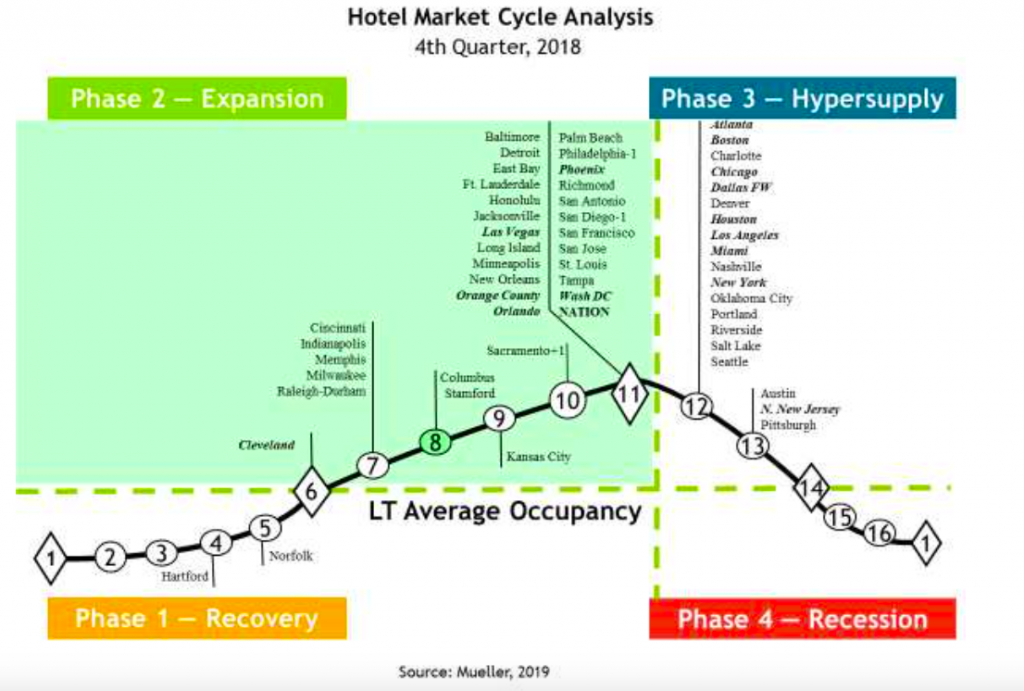

Hotel occupancy declined 0.1% in 4Q18, and room rates were flat for the quarter but grew 3.9% annually.

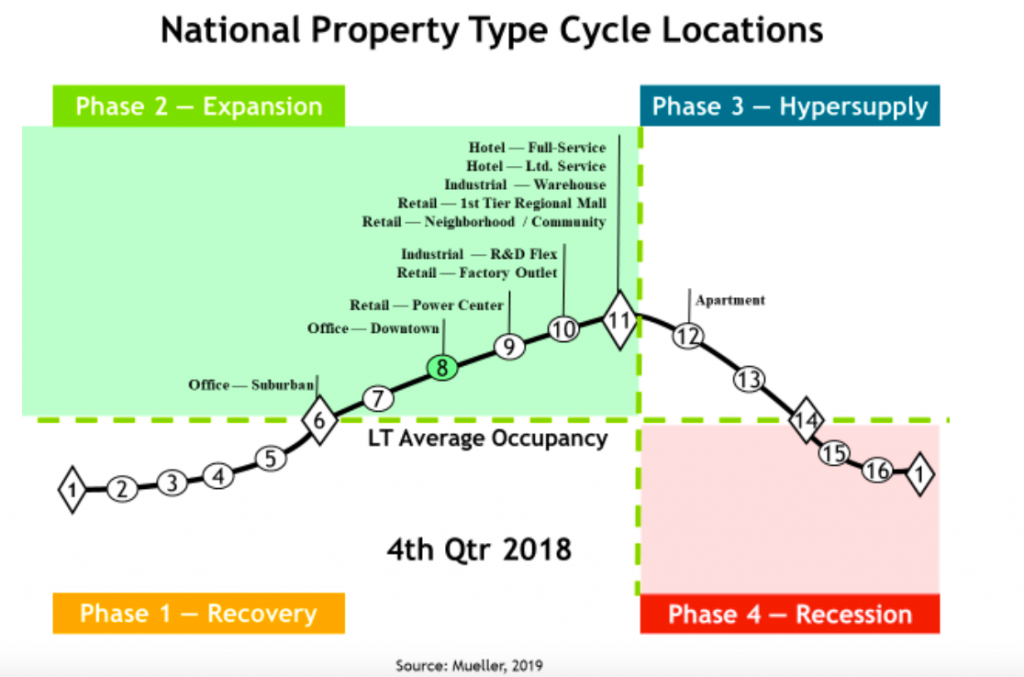

The National Property Type Cycle Locations graph shows relative positions of the sub-property types.

The cycle monitor analyzes occupancy movements in five property types in 54 MSAs. Market cycle analysis should enhance investment-decision capabilities for investors and operators. The five property type cycle charts summarize almost 300 individual models that analyze occupancy levels and rental growth rates to provide the foundation for long-term investment success. Commercial real estate markets are cyclical due to the lagged relationship between demand and supply for physical space. The long-term occupancy average is different for each market and each property type. Long-term occupancy

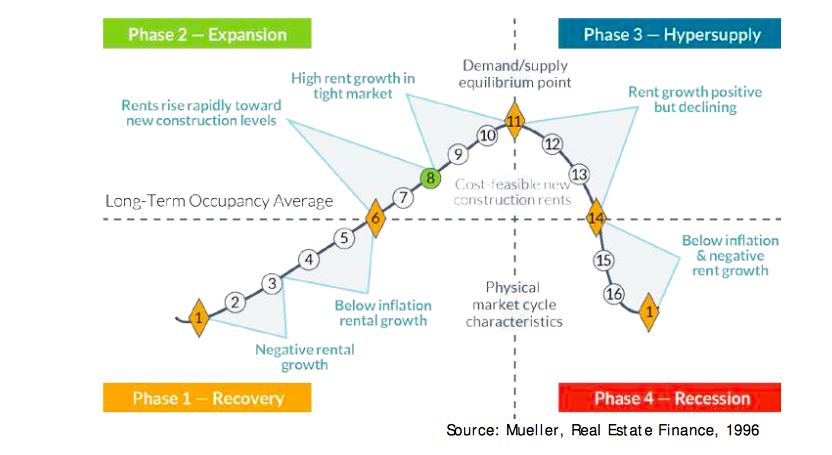

Rental growth rates can be characterized in different parts of the market cycle, as shown below.

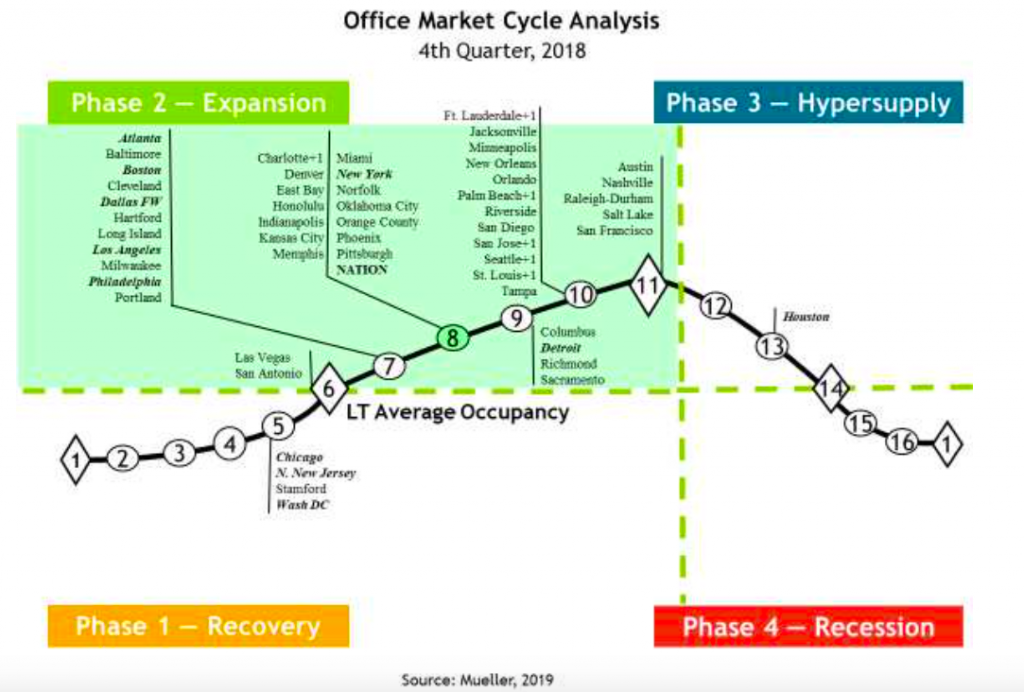

Office

The national office market occupancy level increased 0.4% in 4Q18 and was up 0.6% year-over-year. Office demand continued to improve, as employment growth above 200,000 jobs per month created additional need in this moderately growing economy. New supply at a lower growth rate than demand helped to inch the national occupancy level higher. There were only five markets where occupancy increased enough to advance them one point in the cycle graph. Local “economic base” industries creating different demand growth levels, have spread cities across all points in the expansion phase of the cycle. Average national rents increased 0.3% in 4Q18 and produced a 2.0% increase year-over-year.

Note: The 11-largest office markets make up 50% of the total square footage of office space we monitor. Thus, the 11-largest office markets are in bold italic type to help distinguish how the weighted national average is affected.

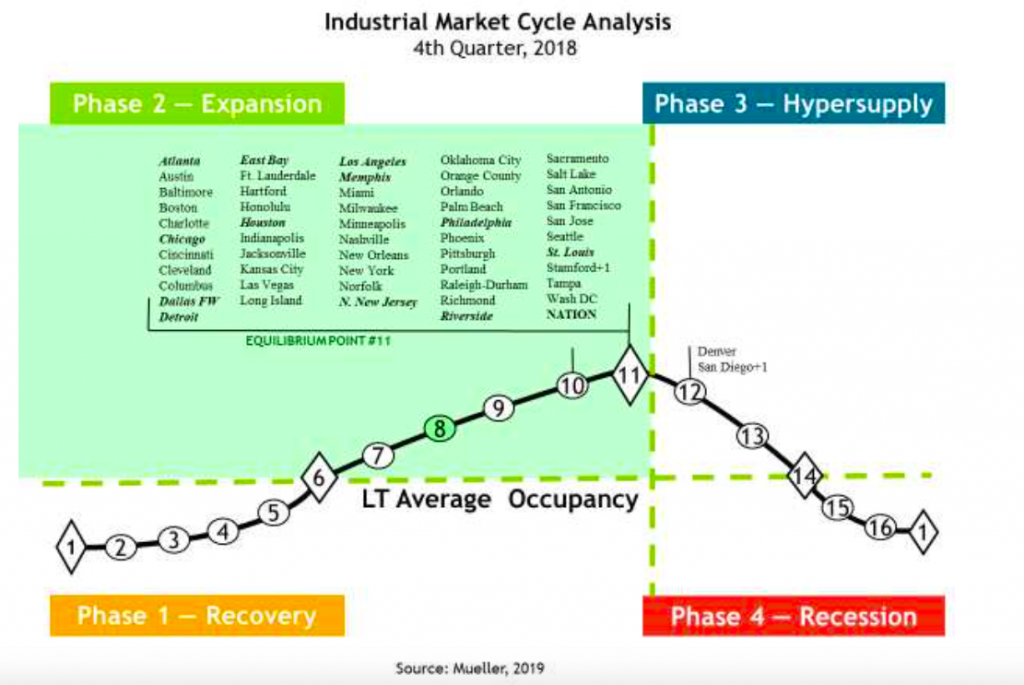

Industrial

Markets that have moved since the previous quarter are now shown with a + or – symbol next to the market name and the number of positions the market has moved is also shown, i.e., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress or move backward in their cycle position when occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if supply growth is stronger (or weaker) than originally estimated.

Industrial occupancies were flat in 4Q18 and increased 0.1% year-over-year as market demand and supply equilibrium continues. Industrial demand is highly competitive, and the national occupancy level is the highest in twenty years. Supply lagged demand by almost 30 million square feet in 2018. Peak equilibrium occupancy was maintained in almost all markets, with only San Diego having an occupancy decline that pushed it into the hyper-supply phase of the cycle. This strong level of occupancy is expected to continue for many years. Industrial national average rents increased 2.4% in 4Q18 and increased 5.9% year-over-year.

Note: The 12-largest industrial markets make up 50% of the total square footage of industrial space we monitor. Thus, the 12- largest industrial markets are in bold italic type to help distinguish how the weighted national average is affected.

Markets that have moved since the previous quarter are now shown with a + or – symbol next to the market name and the number of positions the market has moved is also shown, i.e., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress or move backward in their cycle position when occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if supply growth is stronger (or weaker) than originally estimated.

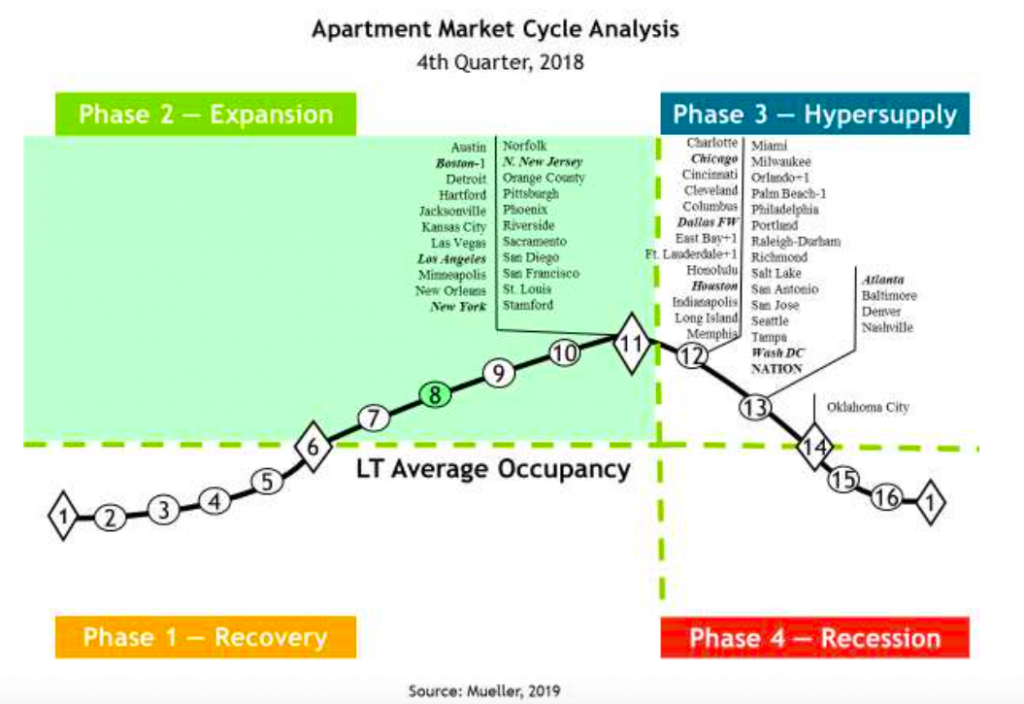

Apartment

The national apartment occupancy average declined -0.1% in 4Q18 and improved 0.4% year-over-year. Demand growth was strong in 2018 as job growth averaged above 200,000 per month, the problem continues to be too much supply growth in many cities. With the Federal Reserve now on hold with future interest rate increases, the cost to finance apartments continues to be attractive, drawing developers to continue to produce more units. We do not expect supply to slow in the near future, lengthening the hypersupply phase. Average national apartment rent growth was flat in 4Q18 but national average rents increased 3.1% year-over-year.

Note: The 10-largest apartment markets make up 50% of the total square footage of multifamily space we monitor. Thus, the 10-largest apartment markets are in bold italic type to help distinguish how the weighted national average is affected.

Markets that have moved since the previous quarter are now shown with a + or – symbol next to the market name and the number of positions the market has moved is also shown, i.e., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress or move backward in their cycle position when occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if supply growth is stronger (or weaker) than originally estimated.

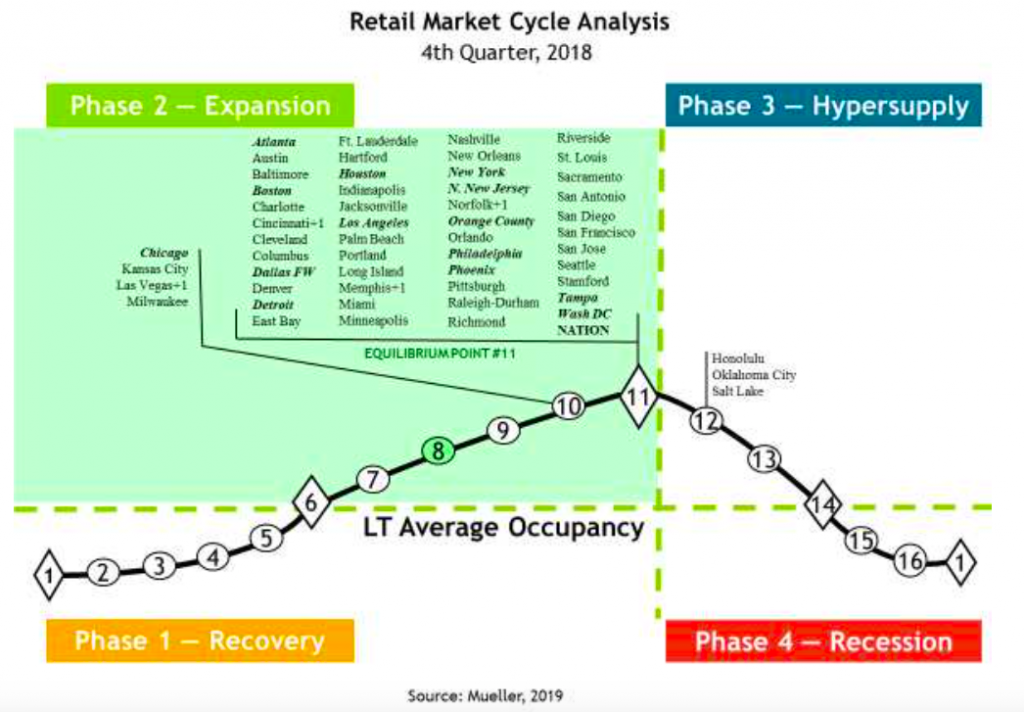

Retail

Retail occupancies increased 0.1% in 4Q18 and were up 0.1% year-over-year. Retail demand continues to grow at a very moderate rate with older formats (department and general merchandise stores mainly) being replaced by experience retail (escape rooms, brew pubs and restaurants). In addition, a great deal of old retail space is being converted to office and apartment use, and a rapid retail space loss coming from conversions to “last mile” industrial warehouse storage use, (if local municipalities will allow the usage change). This means the amount of available retail space is declining, which allows surviving retail space to absorb what new demand comes along. National average retail rents increased 0.1% in 4Q18 and increased 1.5% year-over-year.

Note: The 14-largest retail markets make up 50% of the total square footage of retail space we monitor. Thus, the 14-largest retail markets are in bold italic type to help distinguish how the weighted national average is affected.

Markets that have moved since the previous quarter are now shown with a + or – symbol next to the market name and the number of positions the market has moved is also shown, i.e., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress or move backward in their cycle position when occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if supply growth is stronger (or weaker) than originally estimated.

Hotel

Hotel occupancies were down -0.1% in 4Q18 but were up 0.1% year-over-year. Room demand has grown at double the rate of employment growth over the last decade – a function of both millennials choosing experiences over things and businesses continuing to use travel for face to face interaction with clients and providing employees with offsite recognition events. When break even occupancy is 63% and the national average occupancy hovers at 72% – hotels have great profitability and react by expanding and building more rooms. The oversupply is happening in less than half the markets at this time, but should continue in 2019. The national average hotel room rate increased 0.1% in 4Q18 and increased 3.9% year-over-year.

Note: The 14-largest hotel markets make up 50% of the total square footage of hotel space that we monitor. Thus, the 14- largest hotel markets are in bold italic type to help distinguish how the weighted national average is affected.

Markets that have moved since the previous quarter are now shown with a + or – symbol next to the market name and the number of positions the market has moved is also shown, i.e., +1, +2 or -1, -2. Markets do not always go through smooth forward-cycle movements and can regress or move backward in their cycle position when occupancy levels reverse their usual direction. This can happen when the marginal rate of change in demand increases (or declines) faster than originally estimated or if supply growth is stronger (or weaker) than originally estimated.

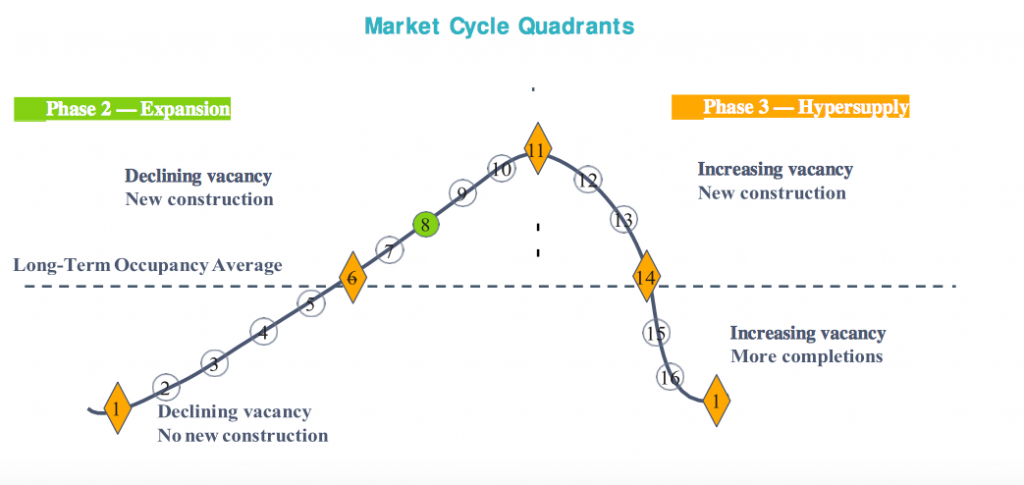

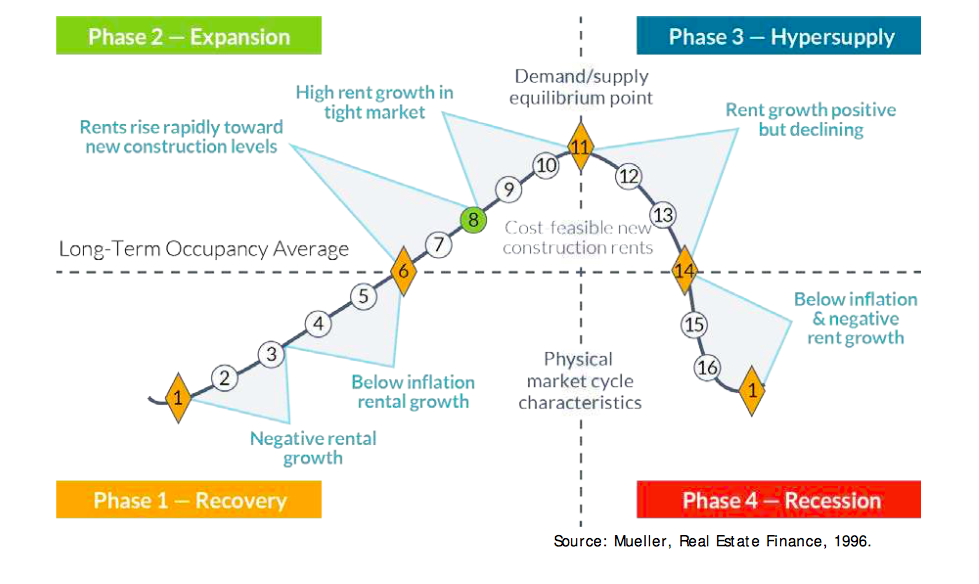

Market Cycle Analysis — Explanation

Supply and demand interaction is important to understand. Starting in Recovery Phase I at the bottom of a cycle (see chart below), the marketplace is in a state of oversupply from either previous new construction or negative demand growth. At this bottom point, occupancy is at its trough. Typically, the market bottom occurs when the excess construction from the previous cycle stops. As the cycle bottom is passed, demand growth begins to slowly absorb the existing oversupply and supply growth is nonexistent or very low. As excess space is absorbed, vacancy rates fall, allowing rental rates in the market to stabilize and even begin to increase. As this recovery phase continues, positive expectations about the market allow landlords to increase rents at a slow pace (typically at or below inflation). Eventually, each local market reaches its long-term occupancy average, whereby rental growth is equal to inflation.

In Expansion Phase II, demand growth continues at increasing levels, creating a need for additional space. As vacancy rates fall below the long-term occupancy average, signaling that supply is tightening in the marketplace, rents begin to rise rapidly until they reach a cost- feasible level that allows new construction to commence. In this period of tight supply, rapid rental growth can be experienced, which some observers call “rent spikes.” (Some developers may also begin speculative construction in anticipation of cost-feasible rents if they are able to obtain financing). Once cost-feasible rents are achieved in the marketplace, demand growth is still ahead of supply growth — a lag in providing new space due to the time to construct. Long expansionary periods are possible and many historical real estate cycles show that the overall up-cycle is a slow, long-term uphill climb. As long as demand growth rates are higher than supply growth rates, vacancy rates will continue to fall. The cycle peak point is where demand and supply are growing at the same rate or equilibrium. Before equilibrium, demand grows faster than supply; after equilibrium, supply grows faster than demand.

Hypersupply Phase III of the real estate cycle commences after the peak / equilibrium point #11 — where demand growth equals supply growth. Most real estate participants do not recognize this peak / equilibrium’s passing, as occupancy rates are at their highest and well above long-term averages, a strong and tight market. During Phase III, supply growth is higher than demand growth (hypersupply), causing vacancy rates to rise back toward the long-term occupancy average. While there is no painful oversupply during this period, new supply completions compete for tenants in the marketplace. As more space is delivered to the market, rental growth slows. Eventually, market participants realize that the market has turned down and commitments to new construction should slow or stop. If new supply grows faster than demand once the long-term occupancy average is passed, the market falls into Phase IV.

Recession Phase IV begins as the market moves past the long-term occupancy average with high supply growth and low or negative demand growth. The extent of the market down-cycle will be determined by the difference (excess) between the market supply growth and demand growth. Massive oversupply, coupled with negative demand growth (that started when the market passed through long-term occupancy average in 1984), sent most U.S. office markets into the largest down-cycle ever experienced. During Phase IV, landlords realize that they will quickly lose market share if their rental rates are not competitive. As a result, they then lower rents to capture tenants, even if only to cover their buildings’ fixed expenses. Market liquidity is also low or nonexistent in this phase, as the

This research currently monitors five property types in 54 major markets. We gather data from numerous sources to evaluate and forecast market movements. The market cycle model we developed looks at the interaction of supply and demand to estimate future vacancy and rental rates. Our individual market models are combined to create a national average model for all U.S. markets. This model examines the current cycle locations for each property type and can be used for asset allocation and acquisition decisions.

Glenn R. Mueller – Professor – University of Denver – Burns School of Real Estate & Construction Management glenn.mueller@du.edu

The market cycle Forecast report is available for a donation of $1,000 per year to University of Denver – Mueller Real Estate Cycle & Sustainability Research Fund.