An exercise in drawing parallels.

The first cryptocurrency ETFs have recently been launched. This article briefly examines the concept of parallel markets (in particular that of a liquid proxy for an illiquid asset) and asks whether there are lessons to be learned for cryptocurrency markets from the development of the liquid real estate market.

In academic Finance theory, ‘parallel markets’ are typically defined as unofficial markets for assets (equities, currencies, etc) which work at the same time, or parallel to, the official market. Examples would be exchange rates in countries where various form of XR restrictions and capital controls exist, debt markets where borrowers seek loans, but do not meet traditional lending criteria and, of course, the dark web.

The concept of parallel markets is also applied specifically in real estate markets where we talk about the Parallel Asset Pricing Model, which is the alternative pricing of the listed sector, relative to their underlying assets. Thus we talk about REITs being at a premium or discount to their underlying value, and at an implied yield above or below the valuer’s equivalent yield on the portfolio. We also talk about potential arbitrage opportunities between the two markets based on relative pricing. The purpose of a parallel market can therefore be either as a (liquid) substitute for exposure to an illiquid or expensive underlying asset, or as an unregulated way of gaining access to a market which would otherwise not be available.

“Suspend for a moment all thoughts about lack of income, transparency and the possibility of market manipulation and collapse”

As we are all aware, cryptocurrencies are volatile, lacking in transparency and broadly unregulated. However, and this exposes a generational division, they are wildly popular with what I will call younger professionals, who are seeking to gain an exposure, but do not have the hefty initial capital outlay required (sound a familiar story yet?). As a result, the first Crypto ETFs have just been launched. (Suspend for a moment all thoughts about lack of income, transparency and the possibility of market manipulation and collapse.) There are only two questions that we are concerned with here. First, do they mirror the price of the underlying cryptocurrency and, second, are there any lessons to be learned about its potential development from the real estate market?

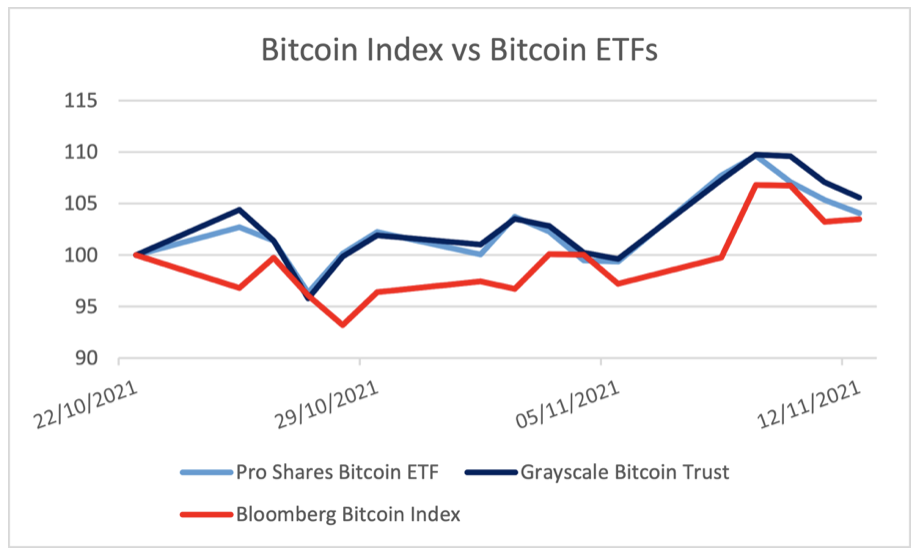

So, to answer the first question – pretty well yes. Figure 1 below shows how two of these ETFs have performed relative to the Bloomberg Bitcoin Index which we will take as a proxy for the market. In the three weeks that they have been trading, the broad price movements have been similar, although day to day movements have not always been close. This is not uncommon with the ETF structure.

Second, in terms of lessons to be learned, real estate already has a well-established listed sector which provides sector specific exposure, is highly regulated, transparent and well used. The development of ETFs to provide easy access to the underlying asset appears to be the latest move in making cryptocurrencies accessible to investors. This has been a successful template for real estate in terms of the REIT sector. However, until there is evidence of underlying supply and demand for these crypto assets, satisfactory regulation to protect investors and transparency, the volatility (+10% to -5% in three weeks) is likely to remain. That said, the next step would appear to be the development of specialist ETFs for the different cryptocurrencies, mirroring the transition of the real estate sector from generalist to specialist over the past five years.