2018 has registered a very healthy start with strong global GDP growth and historically low G7 unemployment rate. The global economy is poised to record the fastest growth (3.1%) in seven years, driven by the turbo charged U.S. economy and continued strength in emerging Asia.

Occupier demand is robust due to rising consumer confidence and tightening job market, while Commercial Real Estate (CRE) investment maintains its momentum as the cost of capital stays low.

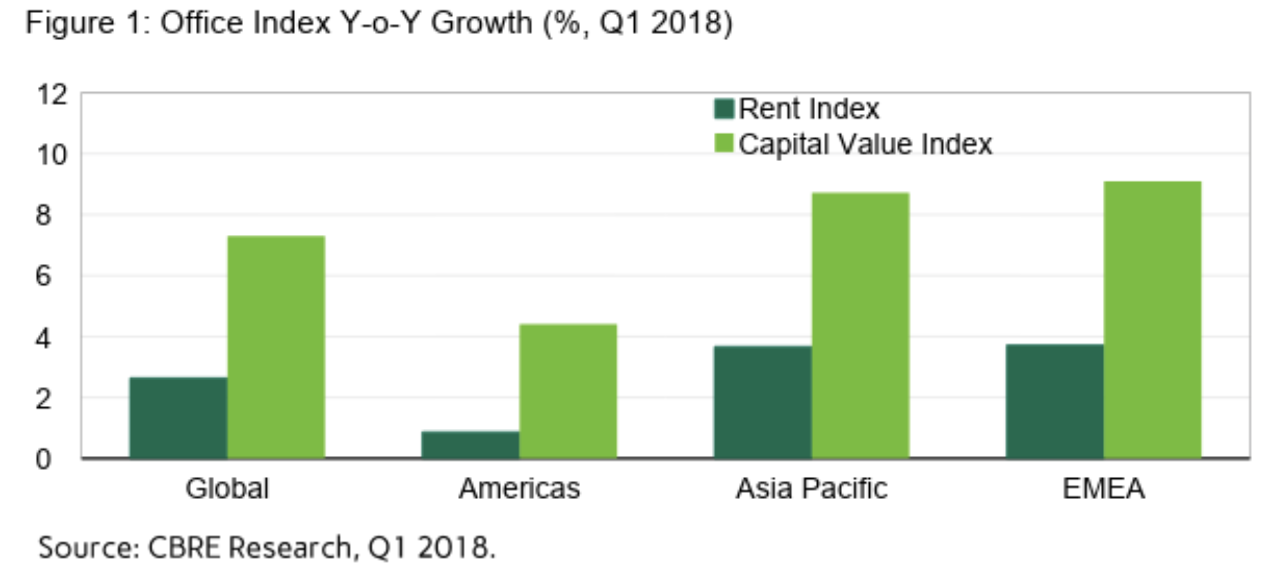

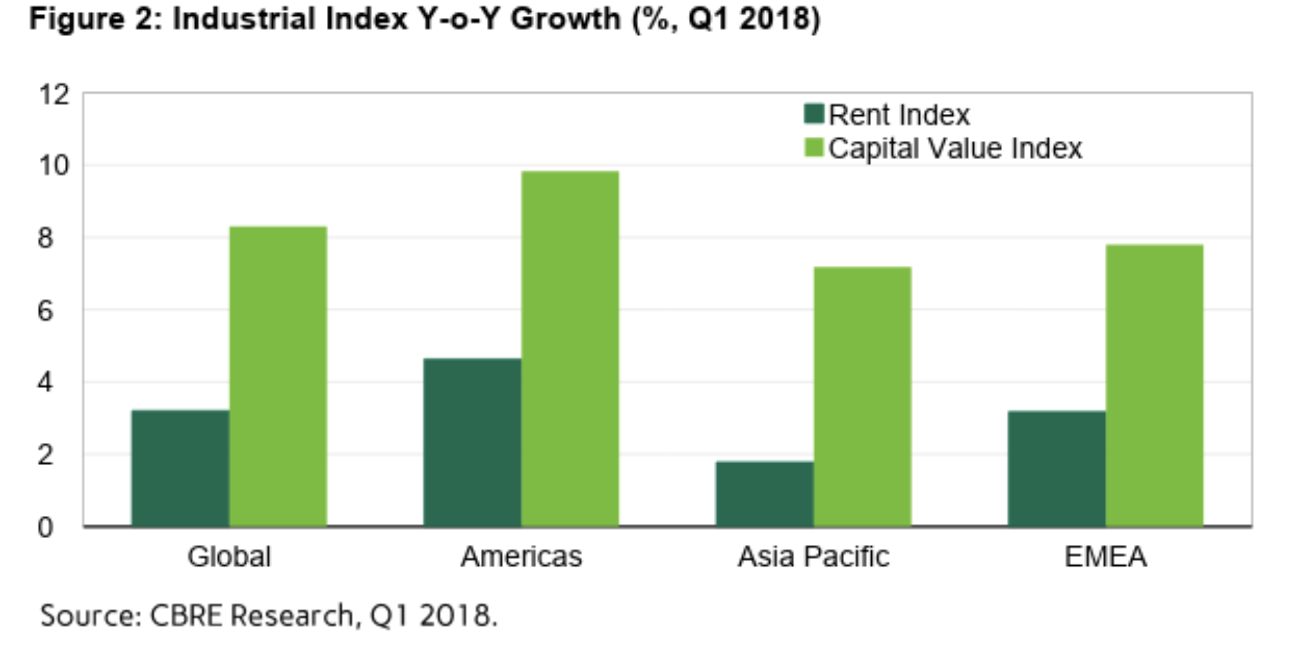

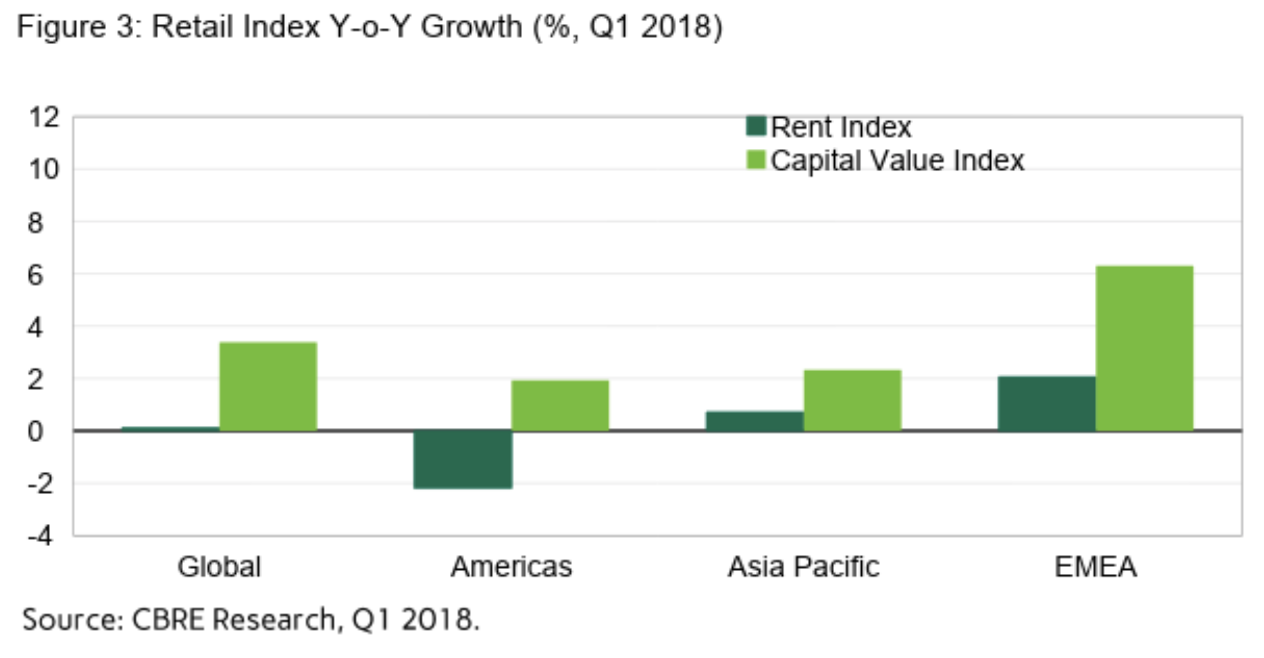

Capital value growth continues to outpace rental values in all regions and sectors. Global rent and capital value indices recorded growth in Q1 2018 across all property types except for retail rent, which dropped 0.75% quarter-over-quarter.

In due course, we think rising interest rates will curb the rate of capital value growth, but for the time being global conditions are very favourable to real estate.

The office sector took the crown in EMEA and APAC for rent and capital value growth. EMEA’s office capital value has outgrown other regions for three consecutive years with an annualized quarterly growth rate of 10.6%. Rental growth was on the upside as well due to strong employment and leasing volume growth.

Despite a strong supply side in Asia, capital value growth has been accelerating since 2016 and rent growth has stabilized above 2%. Improvements in domestic sentiment and capital inflows have driven capital value growth especially in Hong Kong and South Korea. In Q1 2018, APAC also recorded the highest quarter-over-quarter office rent growth since 2014.

Office demand was relatively weaker in the Americas. The number of people who want to work remotely and companies that provide the flexibility to do this are rising. The U.S. companies are also becoming more efficient in the use of space.

Americas industrial overtook EMEA office as the brightest spot in the world of CRE, showing the greatest y-o-y rent growth (4.6%) and capital value growth (9.8%). The sector is benefitting from unprecedented innovation and capitalization throughout the supply chain, in warehouse automation, inventory optimization and digital management. The demand for centralized distribution hubs, fulfilment centers and same-day service locations exceeds supply, particularly for high-quality, modernized and well-located properties. While the pace of industrial rent growth has moderated as new supply increased, capital value growth has accelerated due to robust investor interest.

The APAC and EMEA Industrial sectors are quieter, having surged in the 2013 to 2016 period. Nonetheless, e-commerce is creating further growth. Logistics upgrades to fresh grocery and food delivery are boosting demand for industrial and mixed-use real estate in densely-populated areas.

On the face of it, the boom in e-commerce looks to have caused a mild pull back in Americas retail rents. That is only part of the story. Retail rents experienced tremendous growth between 2010 and 2014 in the Americas. The current “weakness” brings this cycle’s growth into line with other global markets. Moreover, the decline in Americas retail rents is easing sharply. Year-over-year rent decline improved from -5.7% in Q2 2017 to -2.2% in Q1 2018.

In general, though, retail rents are easing, as the sector reinvents itself. Grocery stores are becoming restaurants and restaurants are becoming entertainment and event venues. Opportunities have come with the changes.