A new golden age looms.

Retail has been at the epicentre of cyclical and structural change. Prior to Covid 19, the sector was grappling with rapid ecommerce growth and changing consumer habits. The pandemic compounded those challenges, resulting in severe impacts on occupancy, rental collection and market sentiment. Look closer though, and pockets of resilience do exist. Many occupiers have not only survived but thrived over the past two years. With the pandemic becoming endemic, a golden age beckons for future-proofed physical retail formats, assets and locations, and informed investors who position their strategies accordingly.

Immediate impacts were pronounced

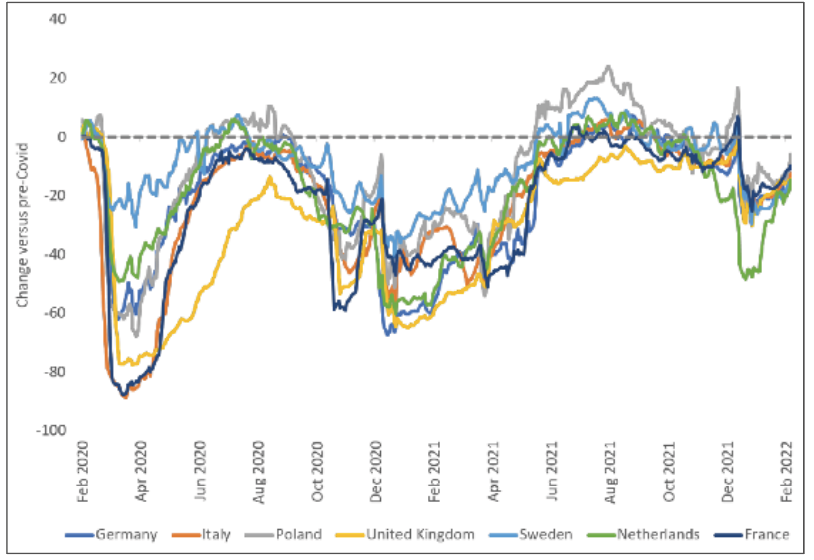

The pandemic had an immediate and dramatic impact on physical retail. Non-essential retailers were forced to close and high-street footfall collapsed (figure 1). Ecommerce penetration rates increased significantly. Retail capital values fell markedly in most European countries. Even with restrictions easing, lingering virus concerns, social-distancing requirements and homeworking mandates continue to depress footfall. Market sentiment remains weak.

Figure 1: Retail & recreation mobility: Footfall has yet to recover

The future is bright

As with other sectors, the pandemic merely hastened structural changes to shopping patterns. These would have eventually occurred over a longer period, prolonging the pain for occupiers and investors. The necessary pain has largely now been realised. Capital values have corrected, rents have rebased on formats previously misaligned to the future and retailers who would have closed anyway are gone. Freed from these constraints, retail is well positioned for a revival supported by three powerful forces: consumer demand, occupier demand and dynamic supply.

Strong consumer demand

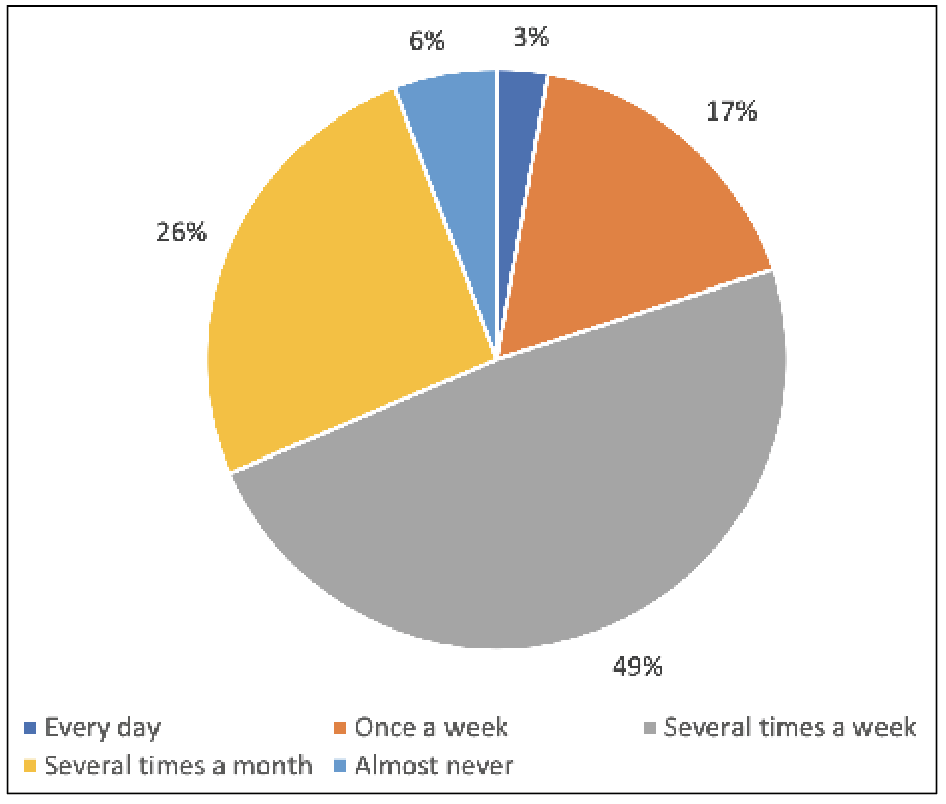

Shopping habits have been permanently reshaped and greater ecommerce penetration is here to stay. However, the pandemic has demonstrated the many benefits of physical retail when it comes to experiences, instant/accurate fulfilment and discount prices. It has also emphasised the pitfalls of online shopping, such as fulfilment times, product issues and the returns process. Consumer appetite for physical retail adapted to the future nature of shopping is significant and most consumers expect to shop in person multiple times per week post-pandemic (figure 2).

Figure 2. Physical retail attraction: likely frequency of in-person shopping post-pandemic

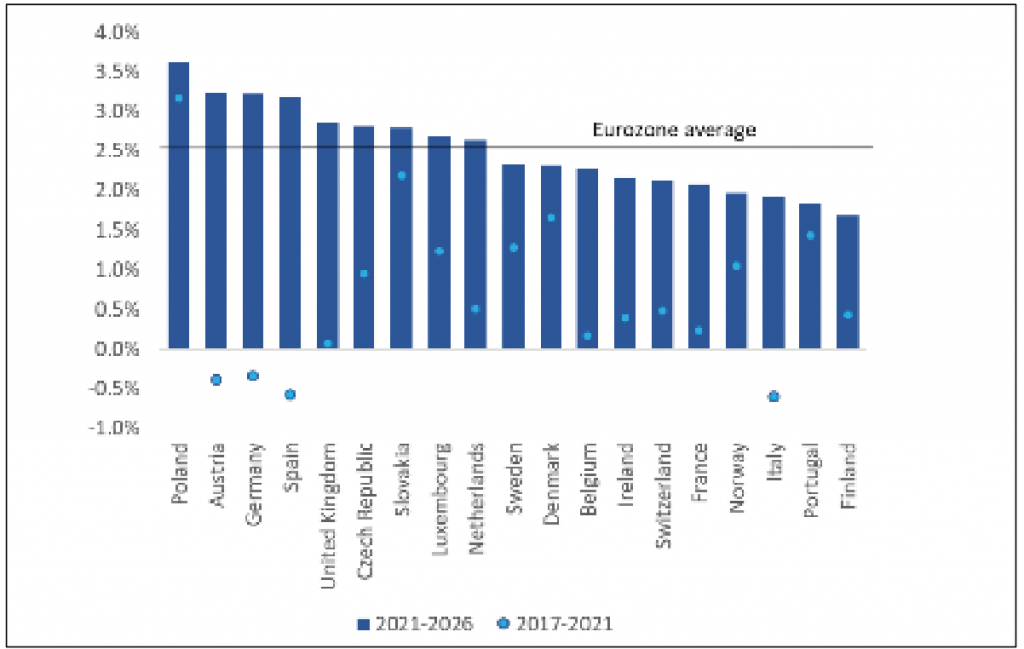

In addition to a strong desire to spend in person, consumers will also have unprecedented ability. Government support schemes mean European households have amassed €820bn excess savings during the pandemic (Oxford Economics/ Haver Analytics, Q4 2021). Revenge-spend potential is huge. Consumer spending growth over the next five years in all European countries is forecast to significantly exceed the rates seen over the past five, averaging 2.5% per annum (figure 3, Oxford Economics, Q1 2022). Most of this will be spent in person. Despite enduring ecommerce growth, physical retail has a prosperous future.

Figure 3: European retail sales: Consumer spending growth to be pronounced

Acquisitive occupiers

Occupier demand still exceeds supply. Retailers who have traded well during the pandemic, such as discounters and those with a dual online/physical offer, along with experience-based operators, are all expanding. There are new retail entrants too, particularly among ecommerce platforms who need physical space to augment their online offering and offset slowing market share growth.

Higher vacancy will provide these retailers with a once-in-a-generation opportunity to acquire new sites in desirable locations, previously unobtainable due to a lack of availability or prohibitive rental costs. One example is IKEA taking a prime site in London’s Oxford Street. Expanding occupiers are the first signs of a revival.

Dynamic supply

European retail floorspace is oversupplied in aggregate, but there is a shortage of future-proofed stock in the right locations. Occupier demand is polarising onto specific assets/locations at the expense of secondary assets/locations unsuited to modern retail. These assets will need repurposing for other use. The characteristics of occupiers, assets and locations which will see stable and growing demand from physical retailers is now clear. These include freestanding supermarkets/supermarket-anchored locations, affordable retail warehouse parks and modern prime high streets in growing cities. Investors who own or can acquire such stock will capture positive occupier-demand migration.

A golden age looms

Retail is at an inflexion point. It has endured traumatic change, retailers have closed and values have corrected. Looking forward though, European shoppers have the desire and means to spend. Future-aligned occupiers are confidently expanding. There is a shortage of suitable assets in the right locations capable of fulfilling modern occupier demand, meaning investors who own or can buy/create this stock will win. The stage is set for a sustained retail revival as it enters a new era attuned to customer desires in the ecommerce infused, post-pandemic world.

Fortune favours the bold

It takes courage to invest in retail within this environment. For savvy investors though, market negativity equals unique opportunity. Over-allocated investors are seeking to bring down retail weightings quickly and uninformed investors concerned by the future will result in mispricing. Assets situated in resilient locations which are or could be made to align with growing occupier demand will be available below their true value. Investing capital now into resilient assets/locations will result in an increased share of the looming revenge-spend splurge. The market will turn quickly when this becomes more readily apparent, meaning the best performance will accrue to first-mover investors. Fortune favours the bold after all.