Originally published July 2022.

The public sector is the largest UK landowner and space occupier, with local authorities owning and managing the majority of the real estate assets to meet services to the community. As central funding of these services reduces and the knowledge economy is changing the way we live, local governments are looking at more efficient and effective ways of managing their real estate operations and creating investment value to bridge the gap between funding shortfalls and the demand for public services.

The challenge for many local governments is to support the numerous community space requirements within a fit-for-purpose real estate framework that may have only one or two investment-grade income generating properties. In part, this can be achieved by a proactive approach to provide local destinations, blending traditional operations with features of the emerging knowledge economy. This would require active specialist property management, covering asset and business operational expertise, which can be provided by leading property consultants at a significant cost.

In detailing this, many local authorities are focused on cost savings and so an in-house property management team may not have the time, knowledge and tools to effectively manage and improve the performance of their property portfolio, especially the investment assets that could benefit from hands-on customer-focused space management.

“… councils are buying into future business models and market dynamics of the occupier as much as – if not more than – into the bricks and mortar”

Added to this at a corporate level, several local authorities are investing in commercial properties as a way to generate long-term stable income streams, although past practices to date have highlighted narrow portfolio diversification, management challenges, fee leakage and limited awareness of the knowledge economy on future real estate returns. As RICS (2019) noted “… councils are buying into future business models and market dynamics of the occupier as much as – if not more than – into the bricks and mortar.”

Importantly, for an attractive investment property portfolio, locational spread, mix of tenants and property types are essential. This is a challenge for individual local authorities to achieve portfolio density and so limit the impact of unsystematic (specific) risks, whilst focusing on the needs of active management on the operation of their own extensive community-dominated property portfolios.

A Sovereign Public Sector Property Fund can address this, offering a central government-backed collective portfolio strategy providing performance diversification with a business operational platform that enhances the performance of the occupied space, property and the surrounding community. Real estate assets in a Sovereign Public Sector Property Fund are in local authority locations and so can be attractive as a destination for the community, offer employment opportunities, and contribute both to direct and indirect council taxes.

Management of a Sovereign Public Sector Property Fund is critical. Like Sovereign Wealth Funds, good governance can be achieved by detailed policies and an independent board with a clear set of aims and objectives to cover social, economic and financial considerations. In covering the financial aspects, specific real estate objectives can add value to the local community, offering quality places that meet the placemaking concept to improve the local environment. Establishing a blueprint of best practice can detail the role of management with investment and ethical (including ESG) guidelines alongside accountability and transparency.

Those local authorities providing real estate assets that meet Sovereign Public Sector Property Fund criteria can receive units based on market value. Like a trust structure, net income revenue generated across the diversified property portfolio will be regularly distributed to the local authorities. As part of the management structure, an independently chaired investment-steering committee will offer local authority representatives opportunities to be part of the Sovereign Public Sector Property Fund decision-making process. In addition, like an unlisted property fund, units can be traded between local authorities, plus the Sovereign Public Sector Property Fund can offer a redemption scheme based on appraisal values with defined buy and sell premiums.

In providing defined business units, the Sovereign Public Sector Property Fund has the opportunity to generate income within a space-management team which compliments the traditional fund and asset management operation. Furthermore, refurbishments and new development projects can offer valuable opportunities for capital growth in part supported initially by central government and private debt-funding arrangements.

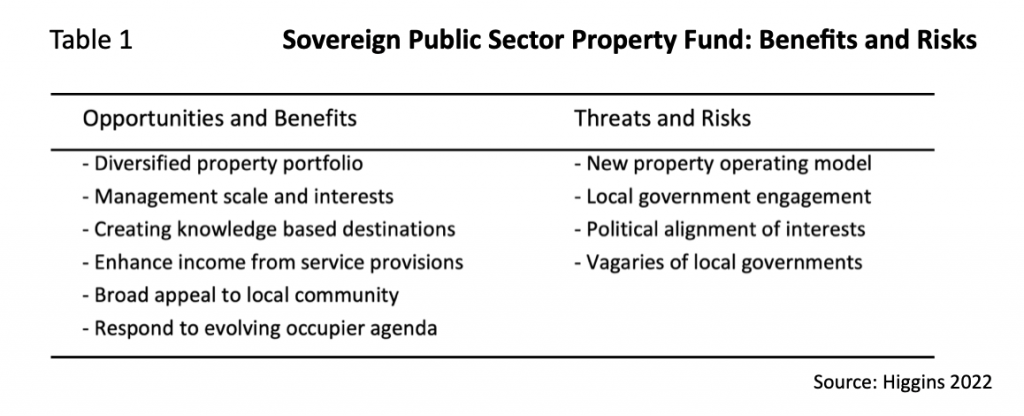

As Table 1 details the challenges and opportunities, a Sovereign Public Sector Property Fund can offer participating local authorities superior long-term stable investment returns, alongside providing destinations and opportunities to bring forward investment in under-utilised prime local authority real estate assets. This can lead to employment openings and support to the surrounding communities.

In providing a Sovereign Public Sector Property Fund concept, there is a requirement for further research, integrating placemaking and the knowledge economy, stakeholder consultation and financial modelling. This can lead to a more in-depth understanding of this innovative real estate ownership vehicle. The challenge is to capture this real estate investment opportunity in an undervalued fragmented local authority sector which services an important part of the UK economy.

Dr David Higgins is Professor of Real Estate at Birmingham City University. For more details, please see the working paper ‘Sovereign Public Sector Property Fund: Building a Conceptual Framework’. For a copy, please contact the author: david.higgins@bcu.ac.uk