Climate change and the ESG agenda are changing the way we think about places and their relative attractiveness to real estate occupiers and investors.

Gone are the days when property investors could rely on a quick contaminated land survey, a check on the local zoning plan and a comprehensive insurance policy for their acquisition due diligence. In many parts of the world, environmental considerations have abruptly pushed their way to the front of the agenda, in part through tightening regulations, but also via major climate events. Recent incidents in major cities, from tornados in Nashville to subway flooding in New York City and severe inundations across Europe, have highlighted the fact that the risk to real estate is increasing.

Similarly, social frictions are leading to disruption, with knock-on effects for the economy and, in many cases, real estate. Rioting in 140 US cities following the death of George Floyd in Minneapolis was estimated to have caused in excess of US$1bn in damage, according to the Insurance Information Institute. The Gilets Jaunes protests in Paris in 2018 caused widespread disruption – and led to a significant rise in international visitors cancelling flights to the city. Perceptions of the safety and stability of these cities as business locations are inevitably affected.

For investors in and occupiers of real estate, all this has implications for business disruption and rising costs, which we will discuss below. Also, new accounting rules which are gradually being adopted around the globe require more and more businesses to evaluate their total exposure to climate change. Once environmental risks hit their actual value, firms will look to reduce exposure – including in real estate occupation or investment.

Consequently, environmental, social and governance (ESG) issues have become more prominent in business decision-making. The risks and opportunities associated with all three are unevenly distributed across the planet, which is particularly significant for real estate investments that are, inherently, geographically fixed.

A sector in transition

Investors have long been used to accounting for variations in economies and governance regimes between countries. The focus on climate is more recent and is being looked at across two key dimensions: physical risk and transition risk.

Transition risk arises from the process of adjustment to a low carbon economy, as either market forces or government legislation impact the attractiveness of particular assets – or locations. As governments introduce policies to encourage movement towards carbon neutrality, the geographic pattern of grants, incentives, taxes and regulations becomes ever more complex. This is particularly true given that local rather than national governments have been at the forefront of policy action.

Physical risks arise from the actual or potential impact of changes to the climate or weather in the vicinity of a building. We have seen numerous recent examples of the disruption caused to life and property through floods, fires, droughts and other extreme weather events. Scientific evidence indicates they are happening with greater frequency and causing a higher level of devastation.

The real estate investment landscape is therefore changing due to several distinct but interconnected drivers. First, market and regulatory pressures mean investors are being forced to identify, quantify and disclose the risks they face from climate change. Increased transparency in reporting makes it easier for investors to assess the risks associated with a particular investment or fund – and to price their equity or debt accordingly. This will discourage investors from buying or developing in cities with higher environmental or social risk, unless there is clear evidence that this risk is being meaningfully and effectively addressed.

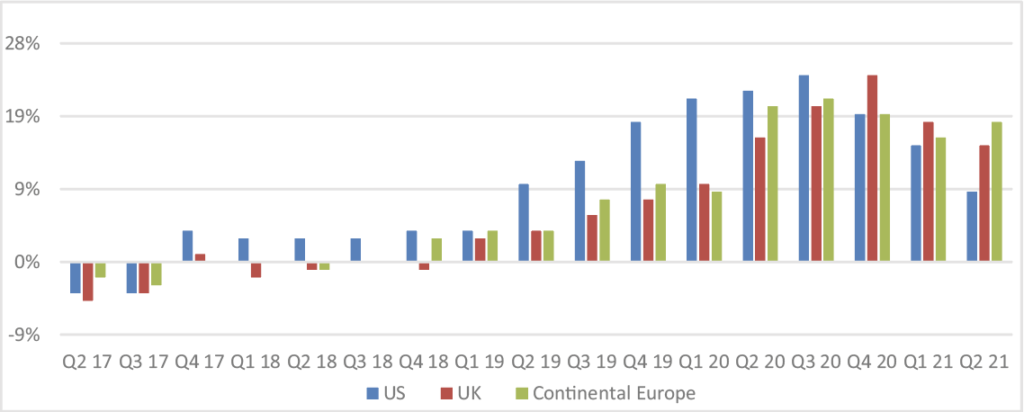

Second, taking on ESG risks will come at a cost. Insurance premiums have been escalating rapidly in recent years, with US markets seeing increases of 30-50% even in unaffected locations. In higher risk areas, costs have gone up by multiples of two or three – and in some cases conventional insurers have pulled out of the market altogether, according to Risk Placement Services. Governments are helping plug the gap in some locations, but pressure will grow to avoid future development or investment in such locations.

Annual property insurance price increases

Finally, occupiers – and their employees – are forming their own view of the risks associated with particular states, cities or micro-locations. Their corporate disaster planning and operational management decision-making will increasingly reflect a more sophisticated, data-driven assessment of the environmental and social risks. Facilities in riskier locations are likely to see lower demand, exacerbated by higher costs. The impact on rents is inevitable.

Flight to experience

As a consequence, we believe both occupiers and investors will be attracted towards locations that are future proofing against ESG risks. Every city has a different risk profile, but no place is risk free, so attention will focus on what is being done to identify, manage and mitigate that risk. This will favour places like New York City, which provides a wide range of guidance alongside specific regulation relating to building design, development, investment and management of extreme climate events.

We expect there to be a ‘flight to experience’, whereby investors and occupiers favour those places that have an historic track record on addressing climate risk. For example, the Netherlands is a major commercial hub for the North Sea region and is renowned for comprehensive flood defences, so could gain from a pivot towards ESG priorities in real estate.

New outlooks

Our new sustainable economy will naturally develop its own centres of excellence, which will present new investment opportunities for the property sector. Green industries are creating thousands of jobs, with universities and cities emerging as hubs for these new sectors. The North East of England has rapidly developed as a centre for offshore wind farms, thanks to a large local maritime engineering industry. A new cable has also been laid under the North Sea to bring in hydroelectric power from Norway. This abundance of clean energy is drawing in other green industries into the region, such as the establishment of a new battery gigafactory near Blythe. Risks in some areas present opportunities in others.

The ESG agenda is changing the way we think about places and their relative attractiveness. Events that were previously assumed to be rare (like natural disasters), factors that were taken for granted (power supply and law and order), or dangers handled by insurance have historically been under-represented or effectively ignored in investment decision-making. We are heading towards a geography reshaped by ESG, where those cities and states that make the most progress on mitigating climate risks and social inequality will prove attractive to talented workers and successful companies. The opportunity is there for upstart cities to rise up the ranking of the global gateway cities.