(We asked AI to roast the CRE industry in 500 words. Sadly, annoyingly, scarily… it is pretty good).

Alright, let’s talk about the Institutional Real Estate industry—the only place where people wear Patagonia vests like they’re armour and talk about “dry powder” as if it’s not just money they refuse to deploy until it’s way too late.

First off, let’s address the fun managers—sorry, I mean fund managers. These are the guys who get paid millions to do… what, exactly? Sit on capital for a decade while blaming “market conditions” for not making a single move? I’ve seen chess games progress faster than some of these capital deployment timelines. “We’re taking a wait-and-see approach.” Oh yeah? Waiting for what? The apocalypse?

And let’s talk about their investor updates. Every quarter, LPs get a 40-page report that says absolutely nothing. “We remain cautiously optimistic.” Translation: We have no idea what we’re doing, but we’d really love another round of fees while we figure it out.

Then there’s the classic real estate conference circuit—where fund managers gather to sip overpriced cocktails, repeat the same buzzwords, and somehow convince LPs that their underperforming assets are actually a long-term play. “The fundamentals are still strong.” Yeah, tell that to your negative cash flow.

And don’t get me started on the due diligence process. LPs spend months analyzing every risk factor, every market trend, every tiny detail… and then give a billion dollars to the guy who just gave the best golf outing. “We believe in strong relationships.” Translation: He let me win on the back nine.

But hey, let’s give credit where it’s due—these managers are the real magicians. They can turn management fees into generational wealth while the actual real estate investment struggles to break a 6% IRR. Now that’s impressive.

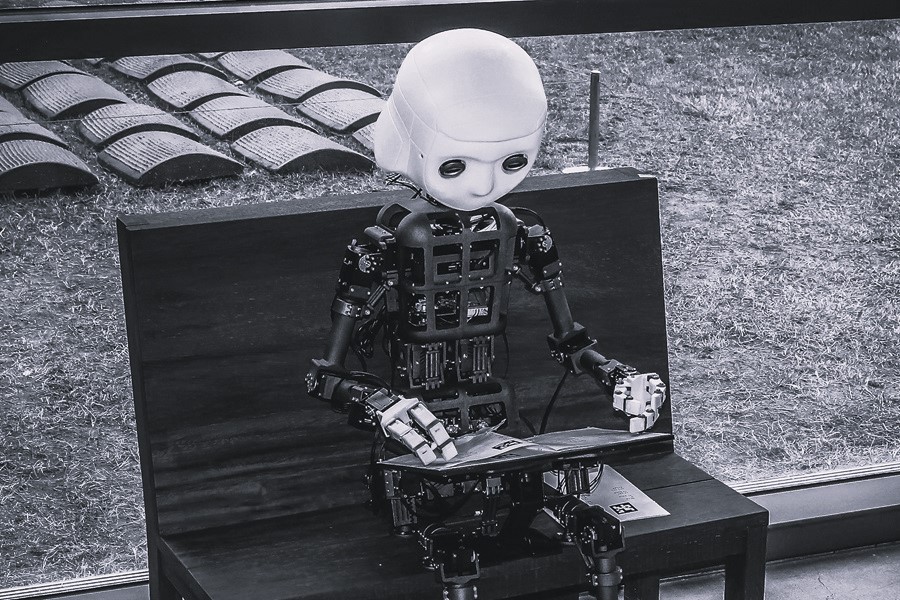

And finally, the big question: Where is all the capital going? Into AI-driven underwriting platforms that just tell you what everyone already knows—real estate is expensive, interest rates suck, and somehow, it’s still the LPs’ fault when things go south.

So here’s to institutional real estate—where the PowerPoints are long, the returns are “adjusted,” and the only real winners are the guys charging 2 and 20.