The Mayor of London, Sadiq Khan, is reported to be considering bringing in rent controls.

It is not clear that he has power to do that, or how it would work. Rent control might improve the lot of suffering existing tenants, at least for a while. But the lesson from cities like Berlin, where such controls exist, is that it would do so at the expense of the less well-connected and the less well-off who won’t necessarily look like a reliable tenant when 20 people are fighting for a new flat.

Controls also do nothing to address the underlying shortage of homes. Done badly, they can even discourage investment in new and existing housing.

More fundamentally, how did we let things deteriorate to the level where just holding rents steady is the best that tenants could hope for?

The Mayor of London has plenty of power to push rents down, if he wants to. What’s more, he can do that while generating a fairer, more walkable and prettier city, and making many existing homeowners better off.

Plenty of other cities around the world have seen rents fall as low interest rates have meant cheap money to fund housebuilding. Tokyo has partly built its way out of a housing shortage. There is no reason why we couldn’t do the same – except a failure to adopt popular reforms.

London has plenty of room for more homes. Most of the capital has one-fifth as much housing as the most beautiful parts of the centre – the parts that tourists flock to see. Swathes of London are covered with low-rise two-storey semi-detached houses. They were fine for the working class families who bought them in the 1930s.

But our current system has made them scarce and unaffordable. The planning system introduced in 1947 was never intended to encourage attractive piecemeal densification. In 1947, no one foresaw the need.

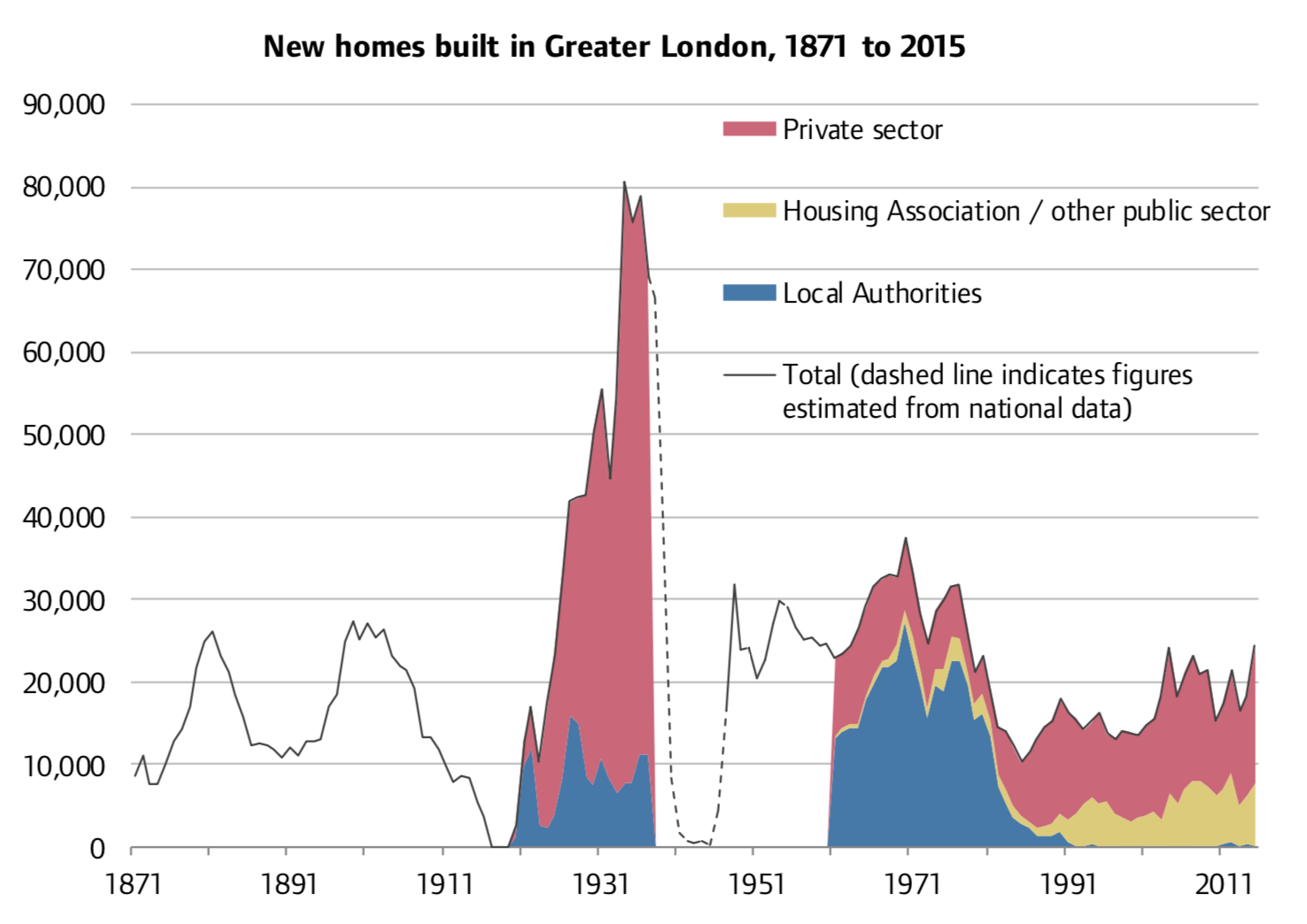

London has never got back to the net rate at which it built homes before the Second World War. With modern methods, we could build far faster than back then.

Source: GLA

At today’s prices, the Edwardians or the Victorians would have been building hundreds of thousands of prettier buildings with more homes. The Edwardians had architects who specialised in designing five or six floor buildings as infill on narrow plots. You can spot them in city centres across the country.

Every architect will tell you how they could do far more with many existing plots, given the chance. A suburban plot often has space for five times as much housing, if only we built at densities that you see in Edinburgh’s New Town, Bath and inner London today: Edwardian mansion blocks or Georgian terraces.

What could Mr Khan do? The Mayor has the power to tell boroughs to approve applications from a majority of residents on a street, coupled with a design code of their choosing, for permission for everyone on the street to extend or even replace existing housing. He can do that while setting rules to protect the neighbours and people on other streets, together with height limits of say, five or six storeys.

We think the Government will do that eventually. Mr Khan could steal a march on them by doing it first.

If people have the ambition, they can double or treble the value of their existing house, just by getting the permission to replace it with more homes. Even houses on nearby streets will see a bump in value, as people realise they could do the same thing on their street.

The permissions don’t have to be used, of course. People can just sit on them, or team up with two or three neighbours to sell to a small builder. The design code will ensure that the end result is a much better street. The beautiful Georgian streets of Pimlico weren’t built in a day.

That policy could add, over time, five million more homes in London alone. The flood of new homes will bring rents down. It would make high quality housing far more affordable for millions of tenants, and give those who want it a path to homeownership.

More homes near jobs would also raise wages in places left behind, with more workers than jobs. It’s unfair to pretend to ‘rebalance’ the economy by keeping the young and the poor away from opportunity.

Let’s end unfair evictions. Let’s end unfair rent rises. Let’s end tenants being stuck in appalling conditions because they can’t afford anything better. Let’s do all that with local support while boosting the economy, rebalancing wages across the country and making fairer and more beautiful cities. The Mayor of London could start that right now. Why doesn’t he?

Originally published on CAPX.