The FTSE ST Real Estate Investment Trusts (FTSE ST REITs Index) continued its bullish rally, raising from 832.03 to 842.91 (+1.31%) as compared to my last post on Singapore REIT Fundamental Comparison Table on Feb 4, 2019.

Chart 1: FTSE ST REIT Index (FSTAS8670)

The REITs index retraced and successfully tested the 820 resistance-turned-support to continue the uptrend. In addition, this bullish uptrend is supported by a strong volume. Based on the current chart pattern and trend analysis, the trend for Singapore REITs is up! There is a chance for the Singapore REITs index to test the immediate resistance at about 875 (the previous high in 2018) based on current market sentiment and bullish momentum. This represents another 4% upside potential from the current level before the REITs index can reach a new high. All eyes will be on whether the Singapore REITs can break the all time high of around 890 back in May 2016.

Fundamental Analysis of 39 Singapore REITs

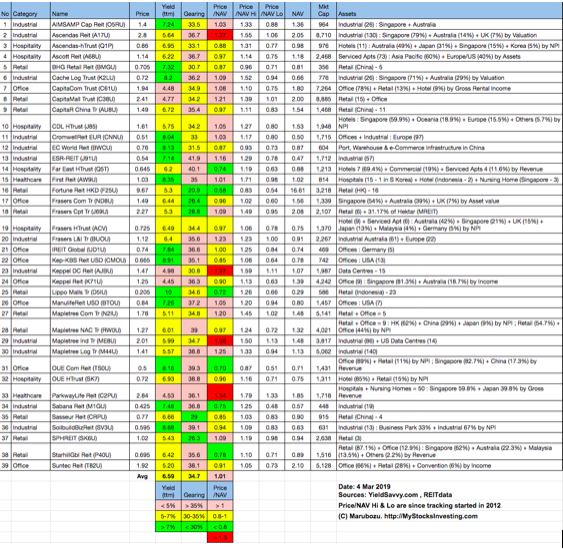

The following table is the compilation of 39 REITs in Singapore with

Table 2: Singapore REITs Fundamental Comparison Table Mar-2019

Summary of Singapore REITs Table (Mar 2019) compared to Feb 2019 Singapore REITs Table

- Price/NAV maintained at 1.01 (Singapore Overall REITs sector is at fair value now).

- Distribution Yield decreased from 6.72% to 6.59% (take note that this is lagging number). About 35.9% of Singapore REITs (14 out of 39) have Distribution Yield > 7%.

- Gearing Ratio decreased slightly from 35% to 34.7%. 21 out of 39 have Gearing Ratio more than 35%. In general, Singapore REITs sector gearing ratio is healthy. Note: The limit of gearing ratio for REITs listed in Singapore Stock Exchange is 45%.

- The most overvalued REITs is Parkway Life (Price/NAV = 1.54), followed by Keppel DC REIT (Price/NAV = 1.37), Mapletree Industrial Trust (Price/NAV = 1.36) and Ascendas REITs (Price/NAV = 1.37).

- The most undervalued (based on NAV) is Fortune REITs (Price/NAV = 0.58), followed by OUE Comm REIT (Price/NAV = 0.70), Lippo Mall Indonesia Retail Trust (Price/NAV = 0.72), Far East Hospitality Trust (Price/NAV = 0.74) and Sabana REIT (Price/NAV = 0.75).

- The Highest Distribution Yield (TTM) is Lippo Mall Indonesia Retail Trust (10.00%), followed by Keppel KBS US REITs (8.91%), SoilBuild BizREIT (8.88%), First REIT (8.35%), Cache Logistic Trust (8.20%), OUE Comm REIT (8.16%), EC World REIT (8.13%) and Cromwell European REIT (8.04%).

- The Highest Gearing Ratio are ESR REITs (41.9%), Far East HTrust (40.1%) and OUE Comm REIT (39.3%) and Mapletree NAC Trust (39%)

Summary

Fundamentally, the Singapore REITs as a whole are at fair valuenow. The yield spread between big cap and small cap REITs remains wide. This indicates there are many value picks left in medium and small cap REITs. As for the big cap REITs, there is still room for further upside potential as the distribution yield is still comparatively attractive to other asset classes. For reference, the 10-year risk free yield rate for the latest Singapore Saving Bonds is 2.16%.

The yield spread (with reference to 10-year Singapore government bond (2.24%)) has tightened from 4.53% to 4.35%. The DPU yield for a number of small and mid-cap REITs is still very attractive (>8%) at the moment. However, it is expected that the next move will be on small and medium size REITs due to higher risk premium.

Technically, the REITs index is trading in a bullish uptrend but it is expected to have a short term pause before moving higher. Immediate support at 820 followed by 800. If the Singapore REITs index can stay above 800-820 support zone for the next few months, it is a highly possible that the bullish trend may continue to break new highs. Bear in mind that Singapore REITs have one of the highest dividend yield compared to other stocks in Singapore and also other stock markets in the region.