- FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased slightly from 842.13 to 872.79 (+3.64%) compared to the last monthly update. Currently the Singapore REIT index is still trading with a range between 816 and 890.

- Yield spread (in reference to the 10-year Singapore government bond of 1.77% as of 7 November 2021) tightened slightly from 4.21% to 4.10%. This is due to the 10-year Singapore government bond rate increasing from 1.57% to 1.77%. The risk premium is attractive to accumulate Singapore REITs in stages to lock in the current price and to benefit from long-term yield after the recovery. Moving forward, it is expected that DPU will increase due to the recovery of the global economy, as seen in the previous few earning updates. NAV is expected to be adjusted upward due to revaluation of the portfolio.

- Technically the REIT Index is currently on a short term uptrend moving towards the resistance zone at 875-890. With the containment of China Evergrande debt issue and re-opening of the borders, it is expected the stabilisation of the share price of Singapore REIT and the return of the dividend for the next few quarters. Based on the latest earning releases, most of the REITs are growing in DPU and cautiously optimistic moving into 2022.

Technical analysis

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased slightly from 842.13 to 872.79 (+3.64%) compared to the last monthly update. Currently the Singapore REIT index is still trading with a range between 816 and 890.

- As for now, short term direction: up.

- Medium direction: sideways.

- Immediate support at 816, followed by 775.

- Immediate resistance at 890.

- Most overvalued REITs (based on Price/NAV)

- Parkway Life REIT (Price/NAV = 2.02)

- Keppel DC REIT (Price/NAV = 1.93)

- Mapletree Industrial Trust (Price/NAV = 1.53)

- Mapletree Logistics Trust (Price/NAV = 1.52)

- Ascendas REIT (Price/NAV = 1.38)

- Frasers Logistics and Commercial Trust (Price/NAV = 1.34)

- Frasers Logistics and Commercial Trust (Price/NAV = 1.32)

- Most undervalued REITs (based on Price/NAV)

- Lippo Malls Indonesia Retail Trust (Price/NAV = 0.57)

- BHG Retail REIT (Price/NAV = 0.60)

- First REIT (Price/NAV = 0.74)

- Suntec REIT (Price/NAV = 0.75)

- Capitaland China Trust (Price/NAV = 0.76)

- OUE Commercial REIT (Price/NAV = 0.77)

- Highest distribution yield REITs (ttm)

- First REIT (10.73%)

- United Hampshire REIT (8.94%)

- Sabana REIT (8.57%)

- Sasseur REIT (8.27%)

- Elite Commercial REIT (8.01%)

- Keppel Pacific Oak US REIT (7.86%)

- Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- Highest gearing ratio REITs

- ARA Hospitality Trust (48.4%)

- Suntec REIT (44.3%)

- Lippo Malls Retail Trust (42.3%)

- Frasers Hospitality Trust (42.2%)

- Elite Commercial REIT (42.1%)

- Manulife US REIT (42.0%)

- Total Singapore REIT market capitalisation increased by 3.86% to S$109.2bn.

- Increased from S$105.1 Billion in October 2021.

- Biggest market capitalisation REITs:

- Capitaland Integrated Commercial Trust ($13.99B)

- Ascendas REIT ($13.12B)

- Mapletree Logistics Trust ($8.59B)

- Mapletree Industrial Trust ($7.23B)

- Mapletree Commercial Trust ($7.14B)

- No change in Top 5 rankings since August 2021.

- Smallest market capitalisation REITs:

- BHG Retail REIT ($271M)

- ARA Hospitality Trust ($383M)

- First REIT ($418M)

- Lippo Malls Indonesia Retail Trust ($430M)

- United Hampshire REIT ($458M)

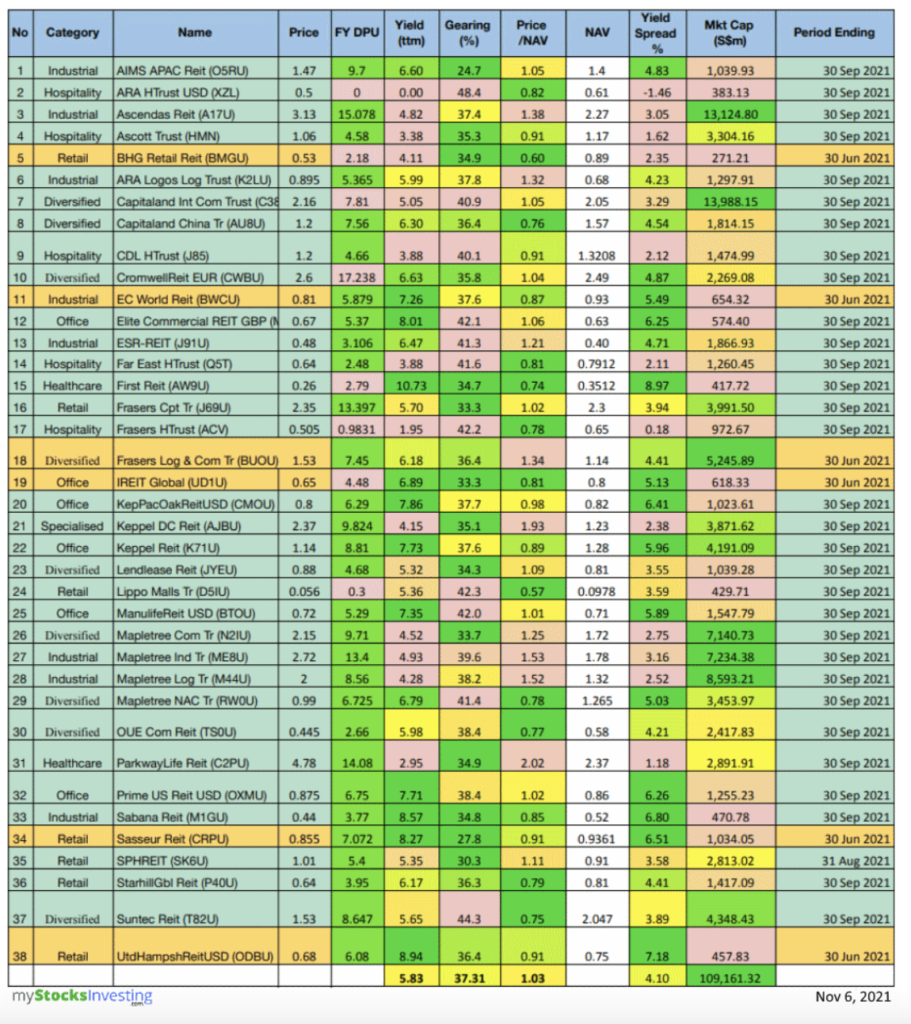

Fundamental analysis of 38 Singapore REITs

The following is the compilation of 38 Singapore REITs with colour coding of the distribution yield, gearing ratio and price to NAV ratio.

- Note 1: The financial ratio is based on past data and there are lagging indicators.

- Note 2: This REIT table takes into account the dividend cuts due to the Covid-19 outbreak. Yield is calculated trailing 12 months (ttm), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower.

- Note 3: REITs highlighted in green (32 REITs) have been updated with the latest Q3 2021 business updates/earnings. REITs highlighted in yellow (6 REITs) are still using Q2 2021 business updates/earnings.

(Source: https://stocks.cafe/kenny/advanced)

- Price/NAV increased to 1.03

- Increased from 1.01 in October 2021.

- Singapore overall REIT sector is at fair value now.

- Take note that NAV is adjusted downward for most REITs due to drop in rental income during the pandemic (property valuation is done using DCF model or comparative model)

- TTM distribution yield increased to 5.83%

- Increased from 5.79% in October 2021.

- 10 of 38 (26.3%) Singapore REITs have distribution yields of above 7%.

- Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to Covid-19 and post circuit-breaker recovery.

- Gearing ratio decreased to 37.31%

- Decreased from 37.41% in October 2021.

- Gearing ratios are updated quarterly. This takes into account the recent Q3 2021 business updates.

- In general, Singapore REITs sector gearing ratio is healthy but increased due to the reduction of the valuation of portfolios and an increase in borrowing due to Covid-19.