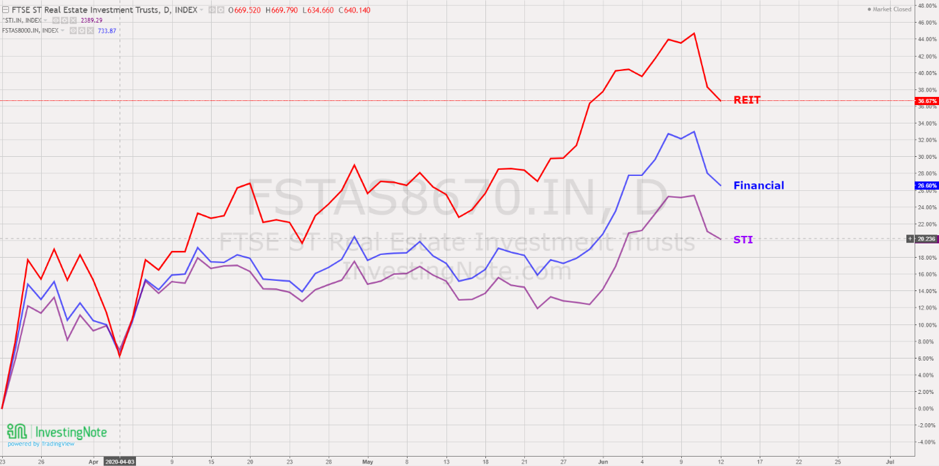

* FTSE ST REIT Index up 745.45 to 823.64 (+10.49%) on the month update.

* Index has rebounded c41% as of June 12 closed after hitting the recent high of 878 (c.50% rebound from the bottom).

* Yield spread (reference to 10-year Singapore government bond of 0.981%) has tightened from 6.97% to 5,47%.

* The risk premium is still attractive to accumulate Singapore REITs in stages to lock in the current price and long-term yield after the recovery.

* Technically the REIT Index is currently on uptrend and have further upside if the 200D SMA resistance is overcome.

* REIT sector outperforms the financial sector and Singapore Straits Times Index (STI) since the bottom on Mar 23, 2020.

Technical Analysis

If the REIT index can clear the 200D SMA resistance, the REIT index will enter into a full Bull territory and have a chance to break new high. Current bullish momentum is very strong.

Short term direction: Up.

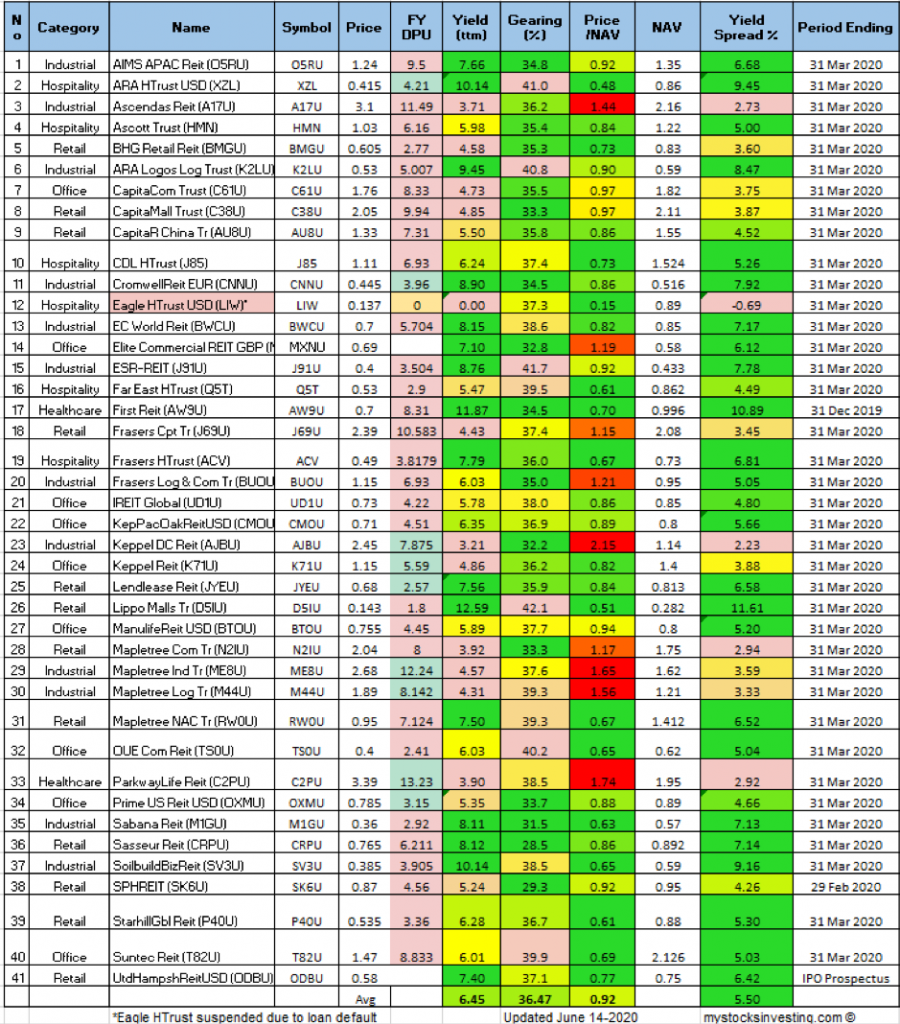

Most Overvalued REITs

- Keppel DC REIT (Price/NAV = 2.15)

- Parkway Life (Price/NAV = 1.74)

- Mapletree Industrial Trust (Price/NAV = 1.65)

- Mapletree Logistic Trust (Price/NAV = 1.56)

- Ascendas REIT (Price/NAV = 1.44).

Most Undervalued REITs

- Eagle Hospitality Trust* (Price/NAV =0.15),

- Lippo Malls Indonesia Retail Trust (Price/NAV = 0.51)

- ARA Hospitality Trust (Price/NAV = 0.48)

- Far East HT (Price/NAV = 0.61)

- Starhill Global (Price/NAV = 0.61)

The Highest Distribution Yield (TTM)

- Lippo Malls Indonesia Retail Trust (12.59%)

- First REIT (11.87%)

- ARA Hospitality Trust (10.14%)

- Soilbuild Business Trust (10.14%)

- ARA Logos Logistic Trust (9.45%).

[Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19. Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.]

The Highest Gearing Ratio REITs

- Lippo Malls Trust (42.1%)

- ESR REIT (41.7%)

- ARA Hospitality Trust (41.0%)

- ARA Logos Log Trust (40.8%) (previously Cache Log Trust)

- OUE Commercial REIT (40.2%)

Top 5 REITs with biggest market capitalisation

- Ascendas REIT ($11.2B)

- Mapletree Logistics Trust ($7.2B)

- CapitaMall Trust ($7.6B)

- Mapletree Commercial Trust ($6.8B)

- Capitaland Commercial Trust ($6.8B)

The bottom 3 REITs with smallest market capitalisation

- Eagle Hospitality Trust ($119M)

- ARA Hospitality Trust ($235.4M)

- Elite Commercial REIT ($234M)

[*Eagle Hospitality Trust is currently suspended]

Fundamental Analysis of 40 Singapore REITs

The chart below is the compilation of 41 REITs in Singapore with colour coding for the Distribution Yield, Gearing Ratio and Price to NAV Ratio. This gives investors a quick glance of which REITs are attractive enough to have an in-depth analysis. [ DPU Yield for Elite Commercial REIT, United Hampshire REIT are projections based on the IPO prospectus.]

- Note 1: The Financial

Ratio are based on past data and there are lagging indicators. - Note 2: This REIT table takes into account the dividend cuts due to

COVID-19 outbreak. Yield is calculated trailing twelve months (ttm ), therefore REITs with delayed payouts might have lower displayed yields.

- Noted 3: Distribution Yield, NAV, Gearing Ratio would probably be adjusted moving forward.

- Note 4: Some REITs opted for semi-annual reporting.

- Note 5: Monetary Authority of Singapore (MAS) has raised the Gearing Limit from 45% to 50% on April 16, 2020. The implementation of Interest Coverage Ratio (ICR) > 2.5x has been deferred to Jan 1, 2022.

- Price/NAV increased from 0.84 to 0.92 (Singapore Overall REIT sector is very undervalued now).

- Distribution Yield decreased from 7.68% to 6.45% (take note that this is lagging number). About 39% of Singapore REITs (16 out of 41) have Distribution Yield > 7%. Do note that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- Gearing Ratio maintains at 36.47%. In general, Singapore REITs sector gearing ratio is healthy. Note: Gearing may be affected (ie. potential increase) as the valuation of the portfolio would be reduced.