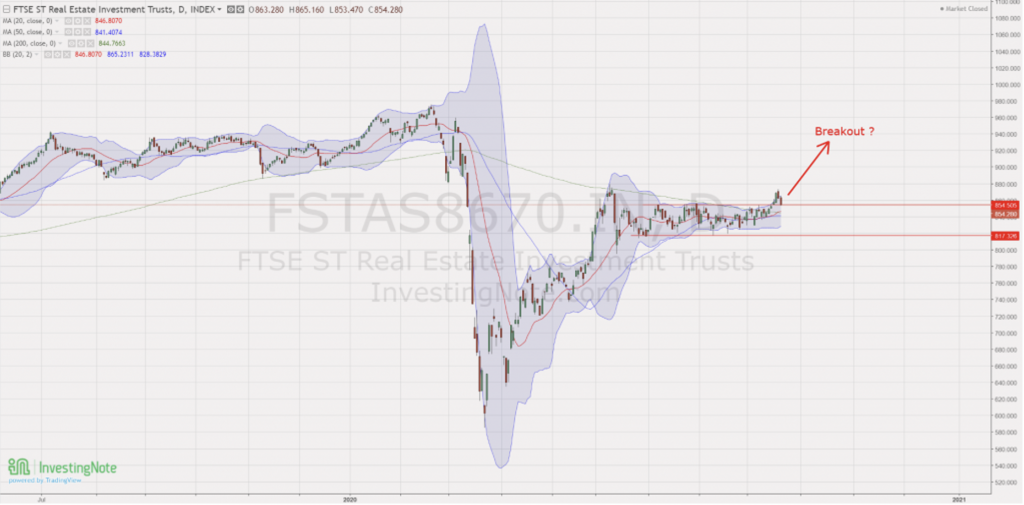

- FTSE ST REIT Index increased slightly from 835.40 to 854.51 (+2.28%) on the month update.

- REIT Index has rebounded circa 45% as of 12 September from the bottom on 23 March 2020.

- Yield spread (reference to ten-year Singapore government bond of 0.882%) has decreased slightly from 5.665% to 5.608%.

- The risk premium is still attractive to accumulate Singapore REITs in stages to lock in the current price and long-term yield after the recovery.

- Technically the REIT index is currently trading on sideways consolidation with low volatility until the breakout. The breakout may happen in the coming earning season, which starts this October. Current macro factors such as the low interest rate environment and the recovery of global economic support the bullish breakout.

Technical analysis

Currently the REIT index is trading on sideways consolidation, sandwiched between a very tight range between 817 support and 854 resistance. There is a Bollinger Band Squeeze with very tight range and low volatility on FTSE ST REIT Index. The index could begin a big move in either direction.

There is a Golden Cross of 20D SMA above 200D SMA and the REIT index has moved above all the three moving averages.

As for now, the short-term direction is sideways and up (if REIT index can stay above all the three moving averages of 20D/50D/200D.

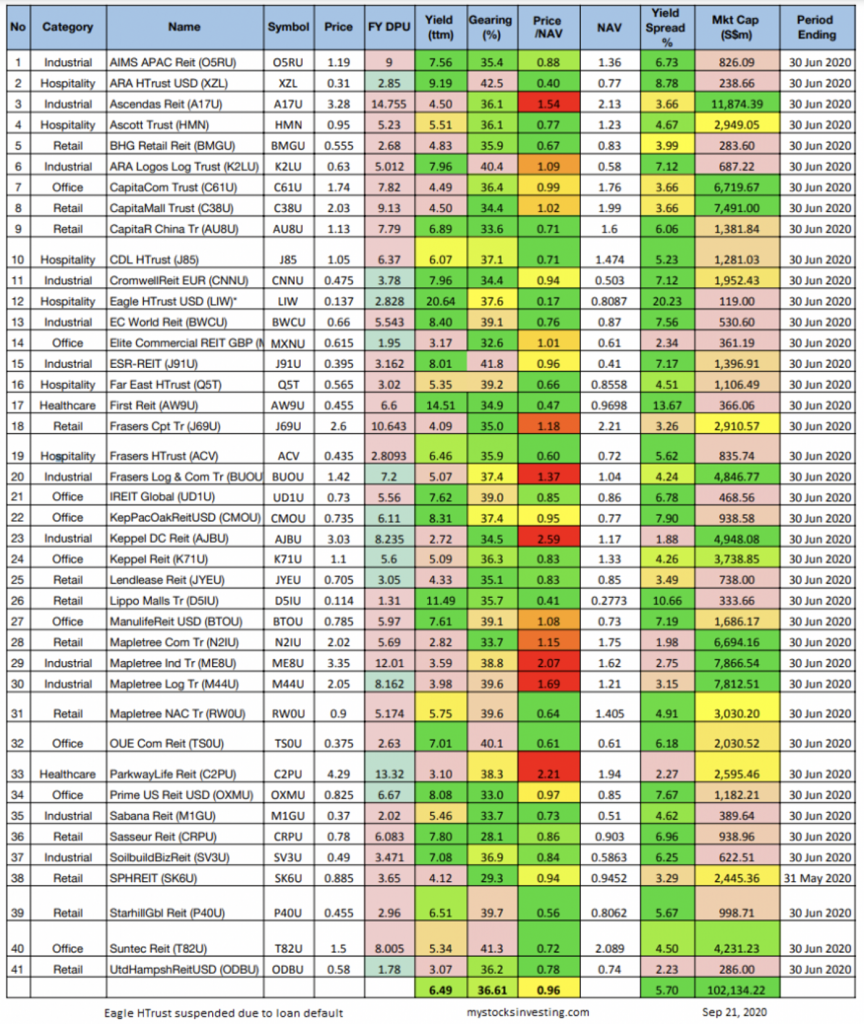

Most overvalued REITs

- Keppel DC REIT (price/NAV = 2.59)

- Mapletree Industrial Trust (price/NAV = 2.07)

- Parkway Life REIT (price/NAV = 2.21)

- Mapletree Logistic Trust (price/NAV = 1.69)

- Ascendas REIT (price/NAV = 1.54).

Most undervalued REITs

- Eagle Hospitality Trust* (price/NAV =0.17)

- ARA Hospitality Trust (price/NAV = 0.40)

- Lippo Malls Indonesia Retail Trust (price/NAV = 0.41)

- Starhill Global REIT (price/NAV = 0.56)

- Far East Hospitality Trust (price/NAV = 0.60)

(*Eagle Hospitality Trust is currently suspended.)

Highest distribution yield (TTM)

- First REIT (14.51%)

- Lippo Malls Indonesia Retail Trust (11.49%)

- EC World REIT (8.40%)

- Keppel Pacific Oak US REIT (8.31%)

- Prime US REIT (8.08%)

(Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to covid-19. Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.)

Highest gearing ratio REITs

- ARA Hospitality Trust (42.5%)

- ESR REIT (41.8%)

- Suntec REIT (41.3%)

- ARA Logos Log Trust (40.4%)

- OUE Commercial REIT (40.1%)

(Singapore REIT has a gearing limit of 50%.)

Top five REITs with biggest market capitalisation

- Ascendas REIT (S$11.87B)

- Mapletree Industrial Trust ($7.87B)

- Mapletree Logistics Trust (S$7.81B)

- CapitaMall Trust (S$7.49B)

- Mapletree Commercial Trust ($6.69B)

Bottom five REITs with smallest market capitalisation

- Eagle Hospitality Trust (S$119M)

- BHG REIT (S$283M)

- ARA Hospitality Trust ($238M)

- United Hamsphire REIT ($286M)

- Elite Commercial REIT ($361M)

(*Eagle Hospitality Trust is currently suspended.)

Fundamental analysis of 41 Singapore REITs

The chart below is the compilation of 41 REITs in Singapore with colour coding for the distribution yield, gearing ratio and price to NAV ratio. This gives investors a quick glance of which REITs are attractive enough to have an in-depth analysis. (Source is here)

• Note 1: The financial ratios are based on past data and there are lagging indicators.

• Note 2: This REIT table takes into account the dividend cuts due to COVID-19 outbreak. Yield is calculated trailing 12 months (TTM), therefore REITs with delayed pay-outs might have lower displayed yields.

• Noted 3: Distribution yield, NAV and gearing ratio would probably be adjusted moving forward.

• Note 4: Some REITs opted for semi-annual reporting.

• Note 5: Monetary Authority of Singapore (MAS) has raised the gearing limit from 45% to 50% on 16 April 2020. The implementation of interest coverage ratio (ICR) > 2.5x has been deferred to 1 January 2022.

• Price/NAV increased from 0.92 to 0.96 (Singapore overall REIT sector is very undervalued now).

• Distribution yield decreased 6.56% to 6.49% (take note that this is lagging number). About 36.61%% of Singapore REITs (16 out of 41) have distribution yield greater than 7%. Do note that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to covid-19.

• Gearing ratio maintains at 36.61%. In general, Singapore REITs sector gearing ratio is healthy. Note: Gearing may be affected (i.e. potential increase) as the valuation of the portfolio would be reduced.