- FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased from 828.26 to 854.19 (+3.13%) compared with last month’s update. Currently the REIT index is testing the resistance of about 852 of a sideways consolidation range.

- Yield spread (reference to ten-year Singapore government bond of 0.893%) tightened from 4.575% to 4.407% due to a drop in TTM DPU.

- The risk premiums are still attractive to accumulate Singapore REITs in stages to lock in the current price and long-term yield after the recovery.

Technically the REIT Index is still trading on sideways consolidation with low volatility until the breakout. Current macro factors such as low interest rate environment, aggressive M&A for future DPU growth and recovery of global economic support the bullish breakout.

Technical analysis

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased from 828.26 to 854.19 (+3.13%) compared with last month’s update. Currently the REIT index is testing the resistance of about 852 of a sideways consolidation range.

- As for now, the short-term direction is sideways, until breakout of the resistance (starts an up trend) or breakdown of the support (starts a down trend).

- Immediate support at 819.

- Immediate resistance at 852, followed by 874.

Most overvalued REITs

- Keppel DC REIT (price/NAV = 2.35)

- Parkway Life (price/NAV = 1.97)

- Mapletree Industrial Trust (price/NAV = 1.68)

- Mapletree Logistics Trust (price/NAV = 1.60)

- Ascendas REIT (price/NAV = 1.40)

Most undervalued REITs

- Lippo Malls Indonesia Retail Trust (price/NAV = 0.30)

- First REIT (price/NAV = 0.43)

- Starhill Global REIT (price/NAV = 0.63)

- ARA Hospitality Trust (price/NAV = 0.65)

- OUE Commercial REIT (price/NAV = 0.66)

Highest distribution yield (TTM)

- First REIT (13.00%)

- Lippo Malls Indonesia Retail Trust (9.88%)

- KepPacOak US REIT (8.57%)

- ARA LOGOS Logistic Trust (8.46%)

- Cromwell European REIT (7.69%)

(Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to covid-19. Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.)

Highest gearing ratio REITs

- Eagle Hospitality Trust (65.5%)

- ARA US Hospitality Trust (43%)

- Lippo Malls Indonesia Retail Trust (42.5%)

- ESR REIT (41.6%)

- Suntec REIT (41.5%)

(Singapore REIT has a gearing limit of 50%.)

Top five REITs with biggest market capitalisation

- Capitaland Integrated Commercial Trust ($13.98bn)

- Ascendas REIT ($11.19bn)

- Mapletree Logistics Trust ($7.93bn)

- Mapletree Commercial Trust ($6.99bn)

- Mapletree Industrial Trust ($6.68bn)

Bottom five REITs with smallest market capitalisation

- Lippo Malls Indonesia Retail Trust ($243m)

- United Hamsphire REIT ($286m)

- BHG Retail REIT ($289m)

- First REIT ($339m)

- ARA Hospitality Trust ($366m)

Fundamental analysis of 40 Singapore REITs

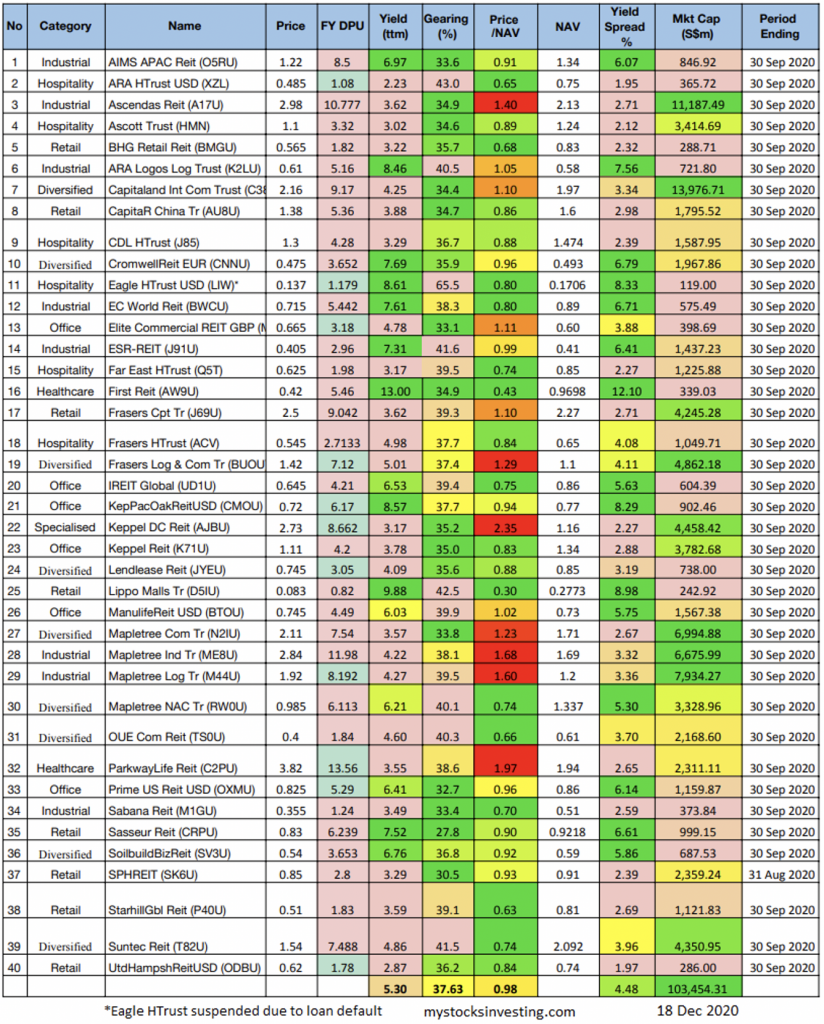

The chart below is the compilation of 40 REITs in Singapore with colour coding for the distribution yield, gearing ratio and price to NAV ratio. This gives investors a quick glance of which REITs are attractive enough to have an in-depth analysis (source here).

Note 1: The financial ratios are based on past data and there are lagging indicators.

Note 2: This REIT table takes into account the dividend cuts due to the covid-19 outbreak. Yield is calculated trailing 12 months (TTM), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower.

Note 3: All REITs in Singapore have already released their Q3 earnings or provided a latest business update.

Note 4: Capital Mall Trust has merged with Capitaland Commercial Trust and became Capitaland Integrated Commercial Trust (C38U). Capitaland Commercial Trust is delisted.

- Price/NAV increased from 0.95 to 0.98 (Singapore overall REIT sector is close to fair value now).

- TTM distribution yield decreased from 5.50% to 5.30% (after Q3 earning release after factoring in the dividend cut impact caused by covid-19). About 22.5% of Singapore REITs (nine out of 40) have distribution yield > 7%. Do note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to covid-19.

- Gearing ratio remains at 37.63%. In general, the Singapore REITs sector gearing ratio is healthy but started to increase in response to the reduction of the valuation of the portfolio and increase in borrowing.