A look at the mathematician and his tables.

In over 35 years of public speaking, I have made audiences grimace, laugh and, I hope, develop their understanding of the world of property. Yet, this summer, I mentioned an antiquarian book that I had just acquired and the audience reaction can only be said to be excitable. What tome could garner such a reaction? Believe it or not, it was a simple set of valuation tables albeit, admittedly, a very old set of tables by a historically renowned author, Sir Isaac Newton.

Property valuation tables

Before I talk specifically about the book that Sir Isaac Newton wrote, perhaps I should explain what valuation tables do. In short, the tables will tell you at any given rate of interest either the future value or present value of any known sum of money. This is nothing to do with inflation (indeed, in Newton’s day there was no perception of inflation – it existed, but it wasn’t readily observable), but it is all to do with interest rates.

If banks gave interest at 2%, then we can all calculate that the account with £100 today will have £102 in

one year’s time. What valuation tables do (using the compound interest) is calculate the accumulation over much longer periods. For example, how much will £100 accumulate to in 25 years? Go to the tables and look for the number at the intersection of 2% and 25 years, and it gives you a multiplier of 1.6406. Multiply this times £100 and it gives an answer of £164.06 as the amount in the bank account at 2% interest in 25 years’ time. So, that is a future value calculation.

If, however, you are due to be paid a sum in the future (say a rent in 25 years’ time), you can see that (using the reverse of the example above) at 2%, every £164.06 receivable has a present value of £100 today. More importantly, if you go to 25 years at 2% in the tables, it gives a present value multiplier of 0.609531 which, when multiplied by the future value of £164.06, gives £100. This is a present value calculation. The tables have a whole host of similar calculations related to simple interest, life interests, annual payments and life annuities that allowed anyone to undertake the relevant calculations that we would do today by calculator or spreadsheet by the simple multiplication of two numbers. Newton’s tables are a very early (if not the earliest) example of such tables.

Sir Isaac Newton’s tables

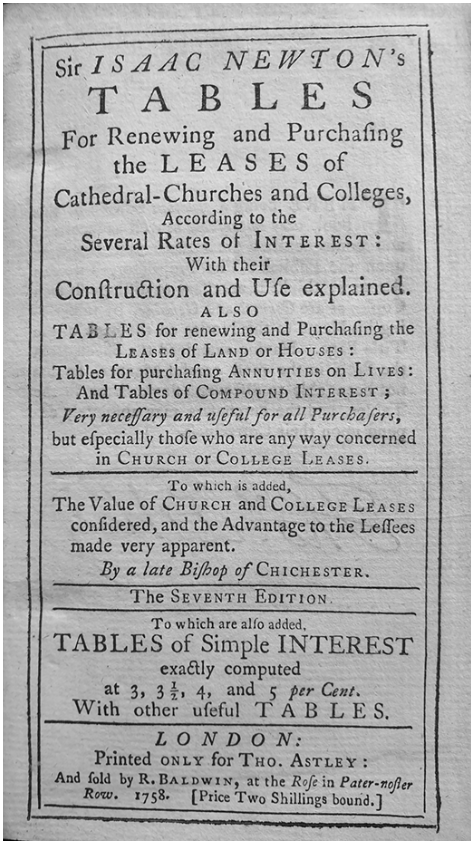

I must admit that I was aware of the existence of Newton’s Valuation Tables (with its catchy, easy-to-remember title, as noted in the picture on the right) from a visit to the old physical library of the Royal Institution of Chartered Surveyors (RICS) in London back in the very early 1980s. I was looking at the differences of the various eponymous property valuation tables readily used at that time, ranging from the ubiquitous Parry’s Tables – which was and continues to be the mathematical bible of British-trained valuation surveyors – to the lesser used and more mathematically accurate(?) annual and quarter in-advance tables of Bowcock and Rose. The librarian at Great George Street was both perplexed and enthralled that anyone could wish to research such a turgid topic and she rushed to a backroom, returning five minutes later wearing white gloves and clasping a first edition of Sir Isaac Newton’s Tables for Renewing and Purchasing of Leases of Cathedrals, Churches and Colleges. From that moment on, I was smitten. Not with the librarian who helped me so much, but with the thought of the great man creating such detailed mathematical tables without the use of a calculator, a computer or, to the best of my knowledge, an abacus. I know that he was recognised as the preeminent mathematician of his generation, but I am in awe of the sheer diligence and dedication to undertake thousands of calculations by hand so that professionals could value all the various interests in property.

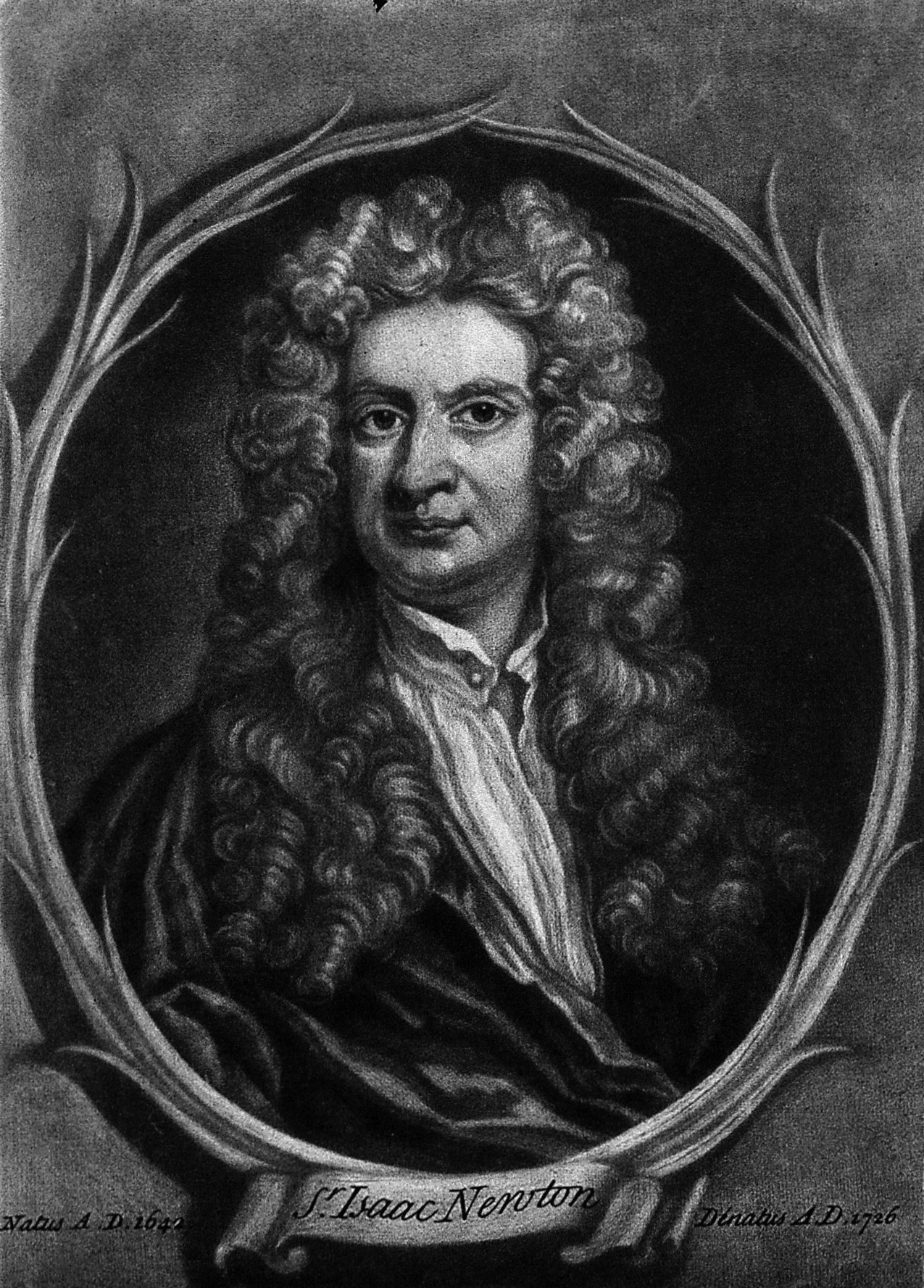

The life of Sir Isaac Newton

A full biography of Sir Isaac Newton is outside the ambit of this article but, unsurprisingly, there are numerous works that discuss the achievements of this great man. The very short history is that he was born in 1642 and died in 1727, a very long life for someone of that time. Obviously, he is remembered mainly for his work on identifying gravity, and his contribution to mathematics and physics is immense. He graduated from Cambridge in 1665 and for the following two years (while in lockdown due to the plague – we can all relate to that today) developed the principles of calculus, later to be published in his seminal text Principia Mathematica, while studying astronomy in his ‘spare’ time.

Like many of his peers during the Renaissance years, he didn’t specialise in any one topic. He was a mathematician, a physicist, an astronomer, an alchemist, an engineer, a local politician and, bringing all this together, both a member of the Royal Society and the Master of the Royal Mint. But it was his devoutness as a Christian that gave rise to the Valuation Tables. The value of churches and (religious) colleges, which was the equivalent of our commercial property market today, was widely misunderstood and, it is said, the combination of his numerical prowess with his desire to help the church establishment that led him to create the tables, initially for internal use within various dioceses, but then published in 1722 as a first edition.

The edition that I now own is the 7th edition, published in 1758 which, since the third edition, includes St Isaac’s name in the title for marketing, but which had been expanded and changed substantially by the new authors George Mabbut and Thomas Manningham. Indeed, many scholars now suggest that Isaac Newton had little to do with the published versions, but I still like to believe that he was initially involved with his work with the church and is not just someone who recommended the original work during his lifetime.

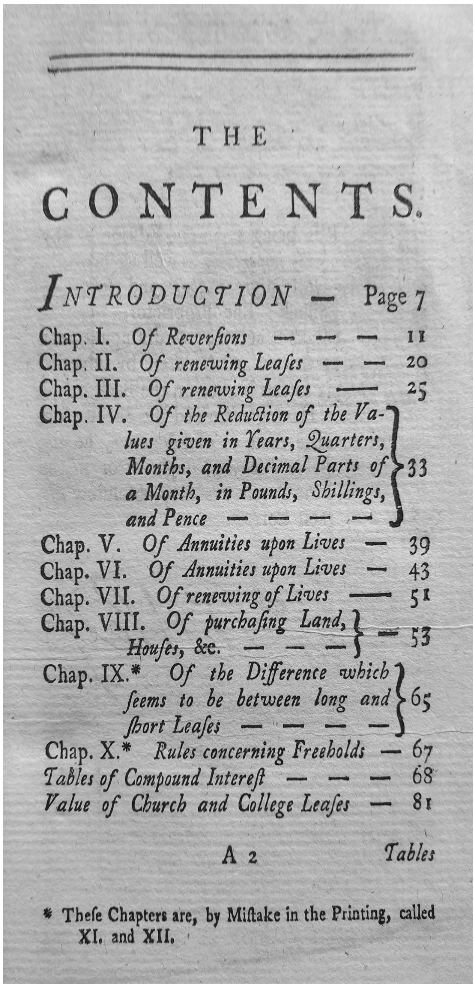

What the book contains

As noted above, the book contains numerous tables with multipliers for different scenarios of capital investment today or the present value of lease payments in the future. But, in addition to the number-crunching, each chapter explains in detail the role and application of each set of tables. What is interesting is that the English is actually very readable. That might be the result of my fascination with Shakespeare when I was a teenager, which meant that I spent a whole summer reading all his works in Old English, but I think it is more because our language hasn’t changed as much as many would surmise. It is easy to follow and understand.

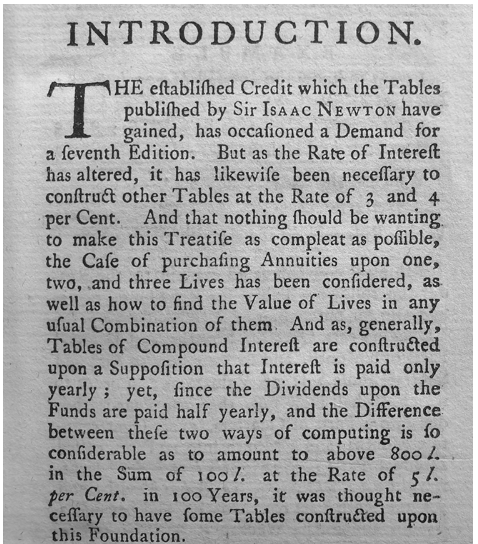

The Introduction is a wonderful snapshot of the application and evolution of the tables. The seventh edition talks about the need to include higher interest rates as national rates of interest had increased substantially during the interim publication dates (another feeling of déjà vu) and that receipt dates of some incomes were now half-yearly and not annual.

I do love this book. It is a retrospective celebration of all the issues and problems, and solutions(!), that drew me into the world of understanding property investments when I was just 18. Even with the ambiguity of authorship, this is a touchstone with our ancestors and shows that nothing really changes. What I do today is what Sir Isaac Newton and his peers did over 300 years ago, and I celebrate that connection with my profession.