Trump, AVs, data centres, alternative sectors, distress, and more.

As we look ahead to 2025, I’ll give the same caveat I gave last year: nobody can predict the future. If I knew were interest rates were headed, I’d be trading bonds, not writing a Substack newsletter.

That said, looking back on our key themes for 2024, I’m pretty happy with how they landed: of the six, three were spot on (1, 2, and 5) while the other three were directionally correct but with less of a broader impact than we believed they would.

Maybe I should trade bonds.

Without further ado, here are the six key themes and questions I’m watching closely as we kick off 2025:

1. Will Trump’s plans materialize?

As I wrote prior to the election, Trump’s stated plans—if put into effect—would have a devastating impact on the real estate industry. While some in the real estate community have expressed concern about Trump’s proposed tariffs, his trade policy is third down the list of the policies most likely to hit the real estate industry hard.

Instead, Trump’s potential actions toward the Fed and immigration are likely to have far larger, longer-lasting impacts. As I wrote last month, Trump’s threats to curtail the Fed’s independence could have a terrible impact on real estate capital markets:

“The robustness of the US real estate sector is due in no small part to the independence of the Federal Reserve. By acting independently of political goals and whims, the markets trust the Fed to behave predictably when it comes to setting rates. This allows lending to happen and capital markets to function.

“While the US system doesn’t always get it perfectly right, it’s not hard to find examples of politically-driven central banks doing much, much worse. Influenced by Erdogan’s esoteric personal economic views, the Turkish central bank sent inflation to a high of 85% annually in 2022 before slowly cooling things down—by raising interest rates to 50%.

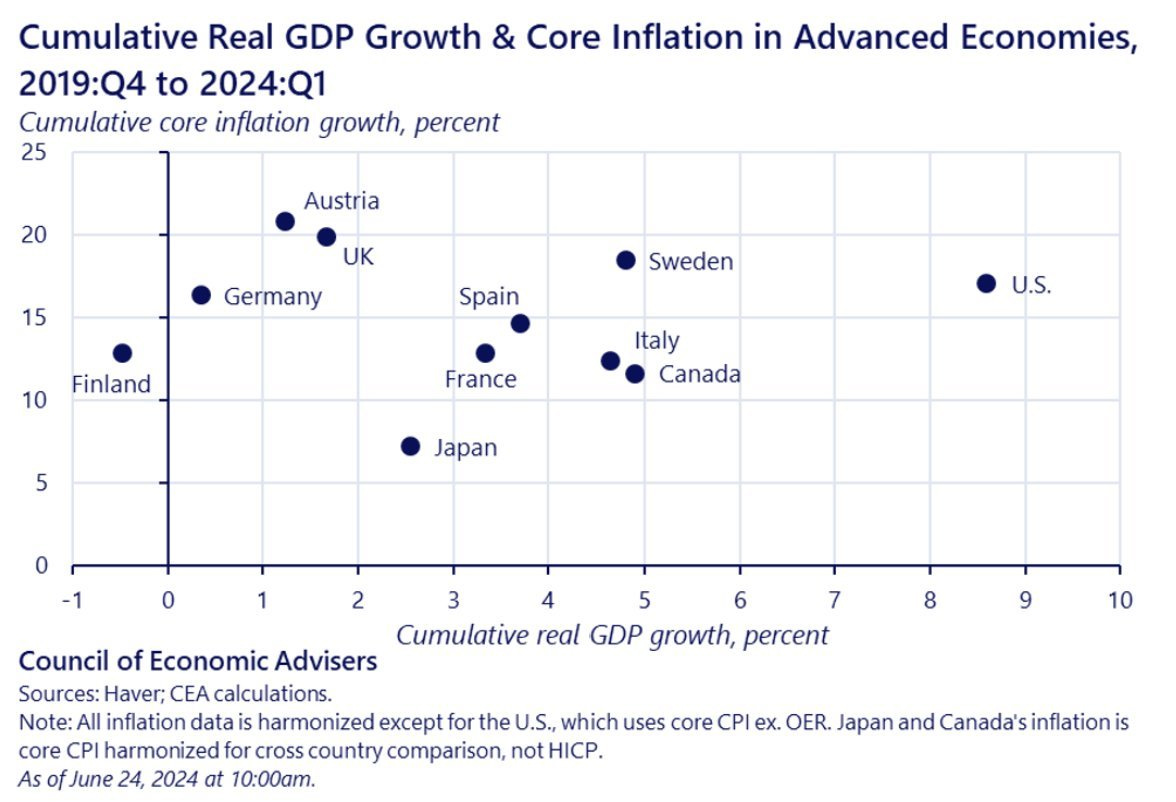

“In the US, the Fed was able to navigate a global wave of inflation far better than most of our peer nations, achieving the elusive “soft landing”—for now. Among developed nations, the US has experienced a period of unparalleled growth relative to the inflation we’ve endured.”

Trump has previously indicated he believes Powell cut rates “too quickly” and would pressure the Fed to keep the monetary pressure on. Politically, this makes sense—if the 2024 election cycle taught us anything, it’s that inflation is politically toxic even if the economy suffers elsewhere. This attitude, combined with inflationary fiscal policies like tariffs, could mean that high rates are here to stay.

More troubling, however, is Trump’s underlying threat to make the Fed bend to political whims. Without confidence that the Fed won’t be politically-driven—regardless of the party in charge—investors and lenders will be less willing to do business and make long-term bets. And once the precedent of independence is broken, it’s very hard to get back.

But tariffs and interest rates aren’t the only threats on the horizon. Putting the ethics of it aside for a moment, the the new administration’s promise to begin a campaign of mass deportation is a threat to the real estate industry on multiple fronts. One, the industry is suffering from a massive construction and skilled trade labor shortage that will only worsen in the coming years. For better or worse, undocumented immigrations have helped fill the gap, and there are no serious plans in motion to train Americans to do these jobs.

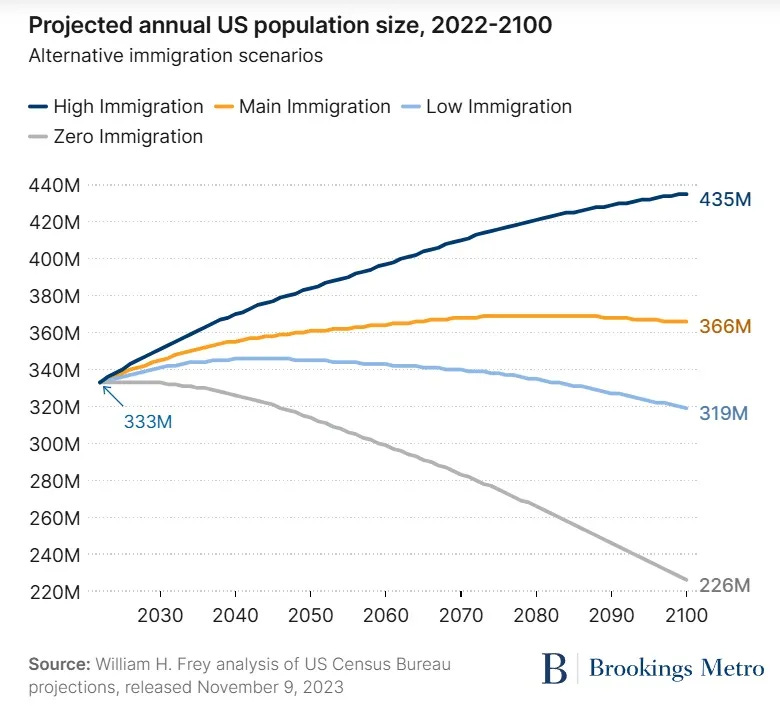

Two, the United States has a total fertility rate of 1.6 children per woman, well below replacement rate of 2.1. Without immigration, the US population would immediately begin shrinking, with senior citizens taking up a rapidly growing fraction of the population with fewer workers to support them. Even if one believes we shouldn’t be replacing native-born Americans with immigrants, nobody has figured out how to convince Americans—or anyone—to have more kids.

So for the real estate industry, even if we were to figure out how to plug the construction labor shortage, it begs the question “for whom we are building?” A shrinking America needs far fewer houses, apartments, research laboratories, warehouses, hotels, and just about everything else other than perhaps senior housing, for a time. Real estate development isn’t really needed in an economy undergoing managed decline.

It remains to be seen, of course, to what degree these policies will actually be implemented. Many business leaders believe that Trump’s immigration rhetoric will sum up to a show of force at the border, some high-profile deportations of criminals, and a lot of bluster. But I’m far less sanguine.

While some of Trump’s cabinet appointments signal moderation, his immigration-related picks show anything but. Border czar Tom Homan, for example, is a hardliner who has promised a maximalist approach. And in light of worsening public attitudes toward immigration, there is unlikely to be a lot of pushback to strict policies against immigration both legal and not.

2. Is there more gloom ahead for multifamily operators?

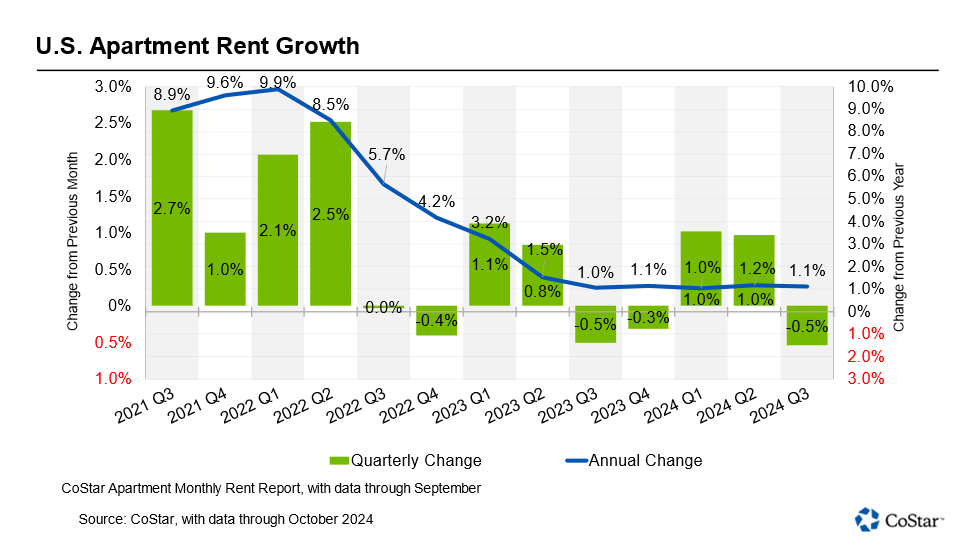

For much of the past year, multifamily owners have dealt with sluggish rents driven by a record number of deliveries. As 2021’s hottest markets see declining rents, owners are eagerly awaiting new supply to peter out—something that should theoretically be on the horizon given 2022’s interest rate increases and rapid slowdown in construction lending.

Unfortunately, 2025 will not be that year.

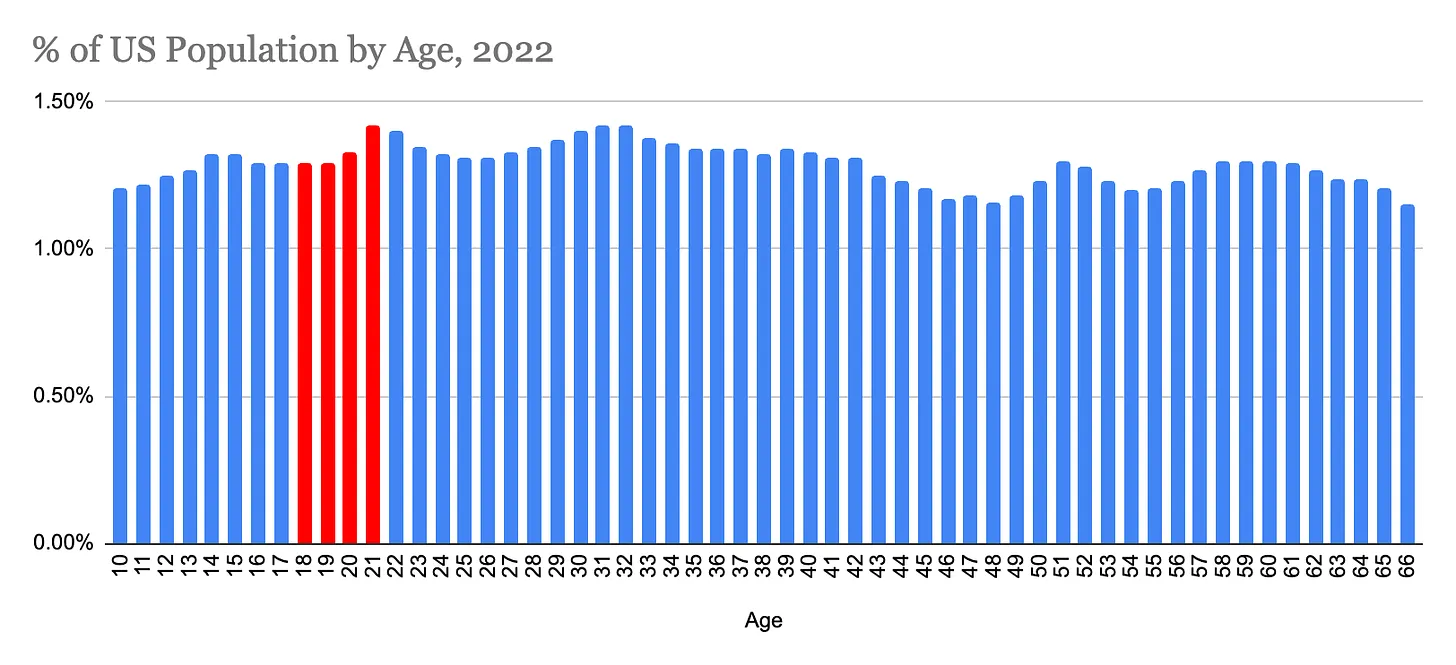

While the coming year will see fewer deliveries (508,000, per Yardi Matrix) than 2024’s record (estimated 518,000), it’s still far above historical norms. The late 2010s, for instance, saw around 350,000 new units per year hit the market. And the current apartment surge is coming at a time when demographics are shifting against the multifamily sector: the age cohorts graduating from college over the next few years are somewhat smaller than those that preceded them.

And this isn’t even taking into account the demand shock that would come from the next administration’s plans to deport 10 to 15 million immigrants. Ignoring that, multifamily owners are in for a rough year. With it, we’re looking at a catastrophic year.

3. How will developers navigate the energy crunch?

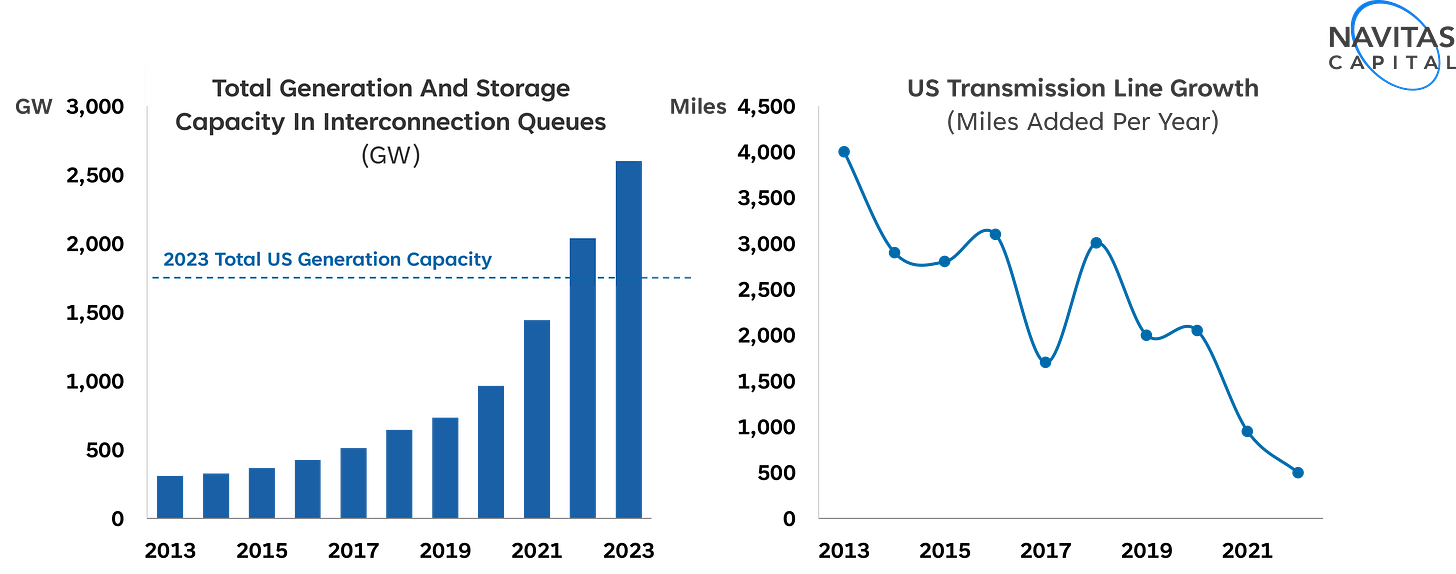

The US is accelerating toward an energy crisis. Rapid AI-driven expansion of energy-hungry data centers, growing popularity of electric vehicles, reshoring manufacturing, and Byzantine permitting rules and environmental reviews tying up critical energy infrastructure are converging to bring chaos to the US power grid—and headaches for anyone who wants to build.

Navitas Capital’s Jenny Song covered this in depth in Thesis Driven back in September, and what she wrote is only more true today. From her letter:

“Because all types of real estate compete with each other in the same [interconnection] queue, we could start to see new home development, for example, compete with new logistics centers for energy capacity and transmission. With delays and long timelines potentially flipping profitable projects to unprofitable ones, site selection will need to incorporate energy as a lens and risk factor.”

Increasingly, real estate developers will not be able to take timely power connectivity for granted. These utility delays are already a reality for developers building in Los Angeles, for instance, where wait times for LADWP hookups stretch to an average of 2.5 years.

Faced with delays and uncertainty, developers and end users alike are taking matters into their own hands. A few months ago, Microsoft signed a high-profile, 20-year deal to reopen the Three Mile Island nuclear power plant in Pennsylvania, pushing beyond tech’s traditional focus on solar, wind, and hydro. And microgrids—small, localized electrical networks that can operate independent of the main power grid—are gaining interest from developers choosing to invest a bit more for certainty and independence from utility backlogs.

It remains to be seen how mainstream these private, off-grid solutions become. In most cases, off-grid power only becomes common when the problem is reliability—as in the developing world—not interconnection timelines. Perhaps the incoming Trump administration will remove regulatory blockers to the construction of new capacity and transmission, as the current situation is a black eye for the wealthiest country in world history.

4. Will AVs begin to impact the real estate market?

We’ve written extensively about the rise of autonomous vehicles, which are increasingly ready for prime time from a safety and reliability standpoint and broadly available in a growing number of American cities. This is a big change from just 18 months ago when serious questions remained about the technology’s viability and near-term potential.

But today, the proof is right there—I can pretty much take an autonomous car anywhere I want in San Francisco, Phoenix, Austin, or the west side of LA. While Waymo’s currently in the lead from a pure autonomy standpoint, there are reasons to believe Tesla could catch up. But from a real estate standpoint, the ultimate ‘winner’ doens’t really matter—the impact on the built world is the same, with serious implications for certain asset types (e.g., parking, exurban housing, hospitality) as well as urban design.

But we have yet to see any impact on AVs on the real estate investment landscape—either scaring investors away from buying parking garages or pushing capital into areas most likely to benefit from rising autonomy. But there is reason to believe that 2025 could be the year that we begin to see the impact, as Trump has touted autonomous vehicles and promised to relax rules for driverless cars. And it surely doesn’t hurt that Elon Musk—a huge AV proponent—has his ear.

The capital markets catching on here seems like one of those things that happens slowly, then all at once. Of course, it doesn’t help that there aren’t many obvious ways to bet on autonomy from a real estate standpoint, other than perhaps buying land near WEDs or investing in likely fleet charging centers—industrial sites near major urban hubs with good electrical hookups.

5. Is the year of foreclosures finally upon us?

Since rates first began rising in mid-2022, genuine real estate distress has mostly been a mirage. Commentators would breathlessly write about the coming “wall of maturities,” a wave of commercial loans coming due that always appeared to be 6 to 12 months out. Lenders, on the other hand, seemed happy to “extend and pretend”—pushing out maturity dates and hoping for a better rate environment next year.

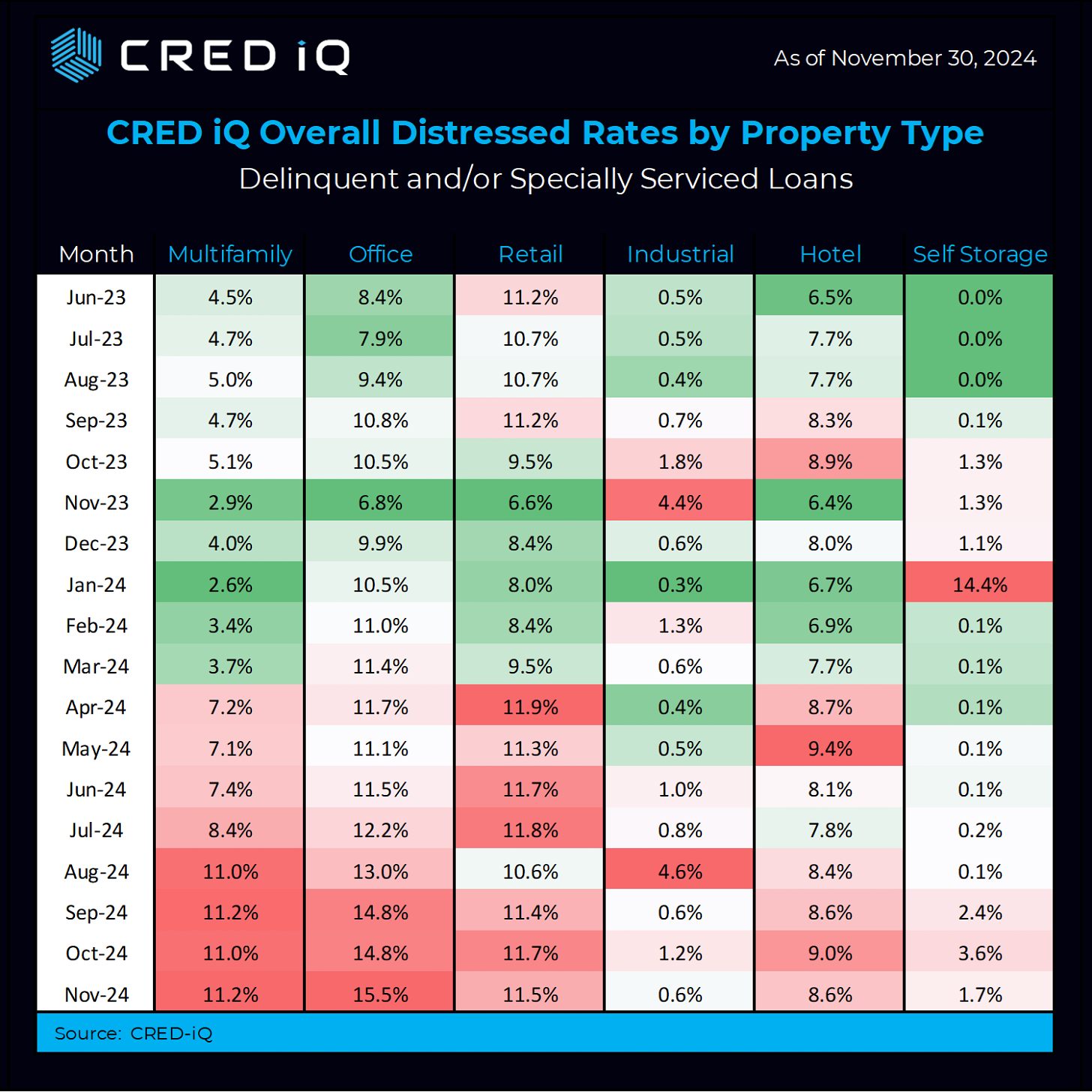

But there’s reason to believe the winds might be shifting. Delinquent or serviced loans began rising steadily across asset classes in the middle of 2024 and now sit at their highest levels since the pandemic.

And since this past summer, “survive ‘til 2025” became “survive through 2025 if not beyond,” a phrase that sits with real estate operators about as well as it rolls off the tongue.

Beyond that, there’s little reason to be optimistic rates are going to come down any time soon. The Fed’s recent cuts have done little to convince the markets that we’re beginning a broader cycle of easing. And how could they? If the parties took any lesson from the 2024 election, it’s that inflation is politically toxic and must be avoided at all costs—even at the expense of unemployment, private investment, and economic growth. And with Trump set to pursue a broadly inflationary agenda—see point (1) above—the Fed will be under tremendous pressure to counter the inflationary impact of tariffs and deportations with continued rate pressure.

With no relief on the horizon, we may finally see some seller capitulations in 2025.

This may come as welcome news to those rumored holders of “dry powder” waiting patiently on the sideline to jump into the market when distress finally hits. But investors should be careful what they wish for; distress triggered by broad macroeconomic pressure rarely comes in tidy packages.

6. How big can alternatives get?

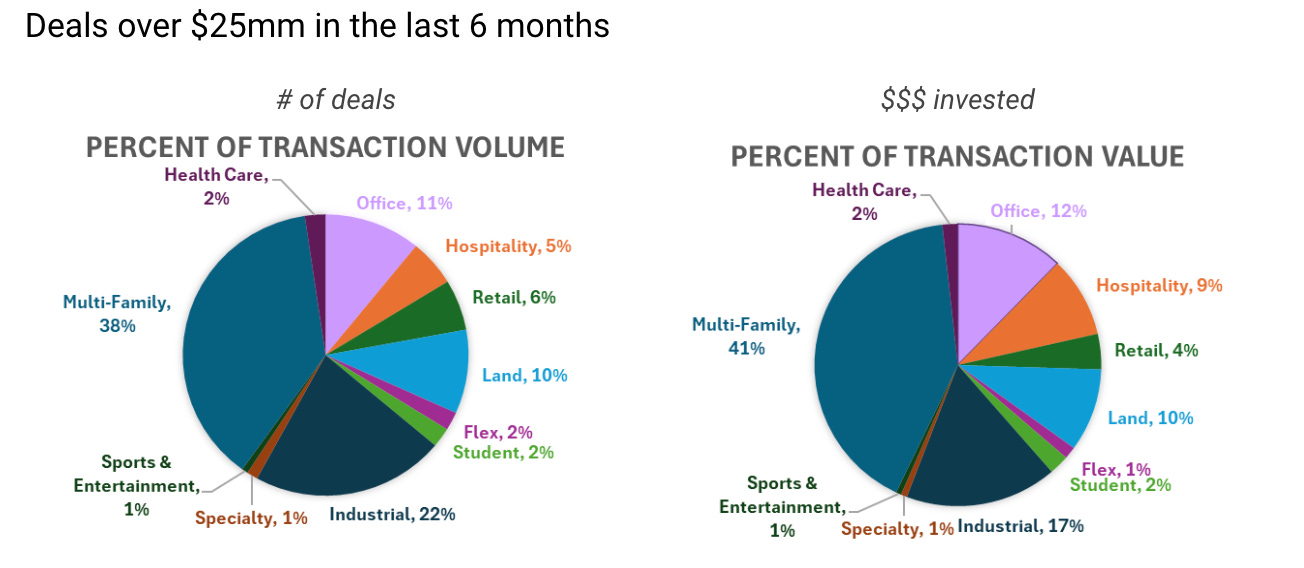

Last month, Thesis Driven writer Paul Stanton highlighted the rise of alternative sectors as a top capital markets trend to watch in 2025. Per Stanton:

“The hunt for yield and risk diversification is pushing investors toward alternative real estate sectors, prompting a wave of capital into asset classes once considered niche. As traditional markets become increasingly dominated by massive asset managers, smaller funds and operators are finding it difficult to compete for core and core-plus properties. This has led to the rise of a new crop of managers, eager to differentiate themselves with higher-yielding and more dynamic strategies.”

These alternative sectors (data centers, life sciences, build-to-rent, industrial outdoor storage, etc.) have been capturing a growing portion of the total invested equity in real estate—currently around 15%. But there’s reason to believe it will go much higher, particularly if distress materializes in any meaningful way in the major food groups and multifamily rents continue to sag.

Many people who don’t regularly speak to institutional real estate groups figure that these large investors simply don’t understand new alternative sectors or are fearful of unproven categories.

But from my experience speaking to institutional managers, nothing could be further from the truth.

These investors are practically begging some GP to figure out a way to roll up enough pipeline / AUM in any of these sectors to justify a $500M+ check. They’d love to back a strategy rolling up small multifamily buildings, outdoor storage, glamping sites, deep water ports, funeral homes, or the most esoteric real estate niche you’ve ever heard of. The problem is that no one has yet demonstrated that they could deploy the size checks they need in these categories. But once this switch gets flipped—as it has in self-storage, BTR, life science, student housing, and a number of other categories over the past ten years—the capital flows. I’d say that structured home equity agreements crossed that chasm just last year.

Right now, the riches are in the niches. I wouldn’t be surprised to see more alternative real estate sectors turn on the jets and attract institutional capital in 2025, driving the percentage of equity capital headed to alternatives well beyond 15%.

This article was originally published in Thesis Driven and is republished here with permission.