With real estate prices at cyclical highs, investors must look to the long term for outperformance. Understanding the evolution of global cities provides the best framework for alpha-generating real estate strategies in the current economic climate.

We have discussed the opportunities created by smart technology such as blockchain before, but it is worth discussing the practices and measurable benefits in the light of McKinsey Global Institute (MGI)’s excellent recent report: Smart Cities: Digital Solutions for a More Livable Future.

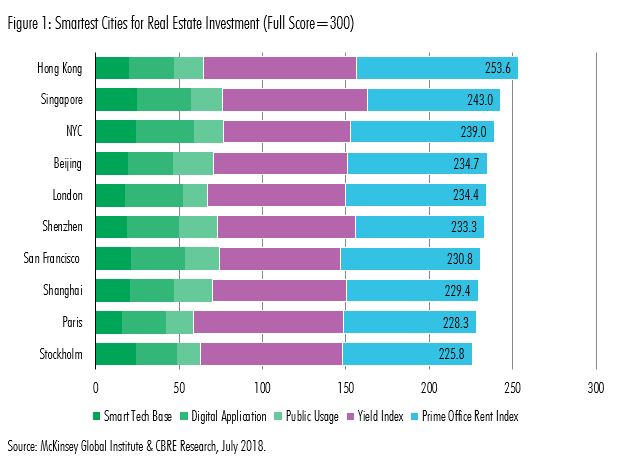

MGI evaluates the potential impact on city life of a range of technologies which are: 1) digital; 2) commercially available or already deployed, and; 3) solving a public problem. Global cities are on the cusp of delivering major improvements in the quality of life, but some are moving faster than others. MGI avoids a definitive overall ranking of cities, but with apologies, we have reworked their data and generated a list of top 10 smartest cities for real estate investment (see Figure 1). This said, investors need to get up close and look in detail at where a city’s smart strengths lie, because it opens the door to a variety of real estate strategies.

Fundamentally, smartness is not merely a perception but about tangible benefits such as economic development and cost savings that achieve better quality of life. Therefore, infrastructure, application and broad-based adoption are all critical pieces for a city to become smart. Megacities like Beijing, New York and London with large population that need massive public transportation, digital solutions and flexible workplaces around the clock simply must get creative at solving problems.

Working with the major areas of gain identified by MGI, here we offer more insights considering the optimal real estate strategy.

- Technology can reduce fatalities by 8–10 percent. Agencies can use data and applications to deploy resources and personnel more effectively in cases of homicide, road traffic, fires, and so on. Optimized location identification, dispatching, real-time mapping and synchronized traffic lights help speed up the process from call center to field operation. Moreover, upgraded security system and predictive policing can lower crime incidents by 30-40 percent even before the occurrence.

- Real estate strategy: In general, gentrification is good for real estate and the best way to make it happen is to heal the community, not dislocating it. Families and businesses have a lot to gain from improved public safety. Chicago is a great example of digital governance. Cities like Rio are making progress to replicate the success.

- Disease burden decreased by 8–15 percent. From being reactive to proactive, healthcare applications can provide early interventions to prevent, treat, and monitor conditions. Tokyo is a leasing example in utilizing cutting-edge health care technologies such as wearable sensors and machine-treatments to ease the medical operations. Strengthened doctor-and-patient engagement through digital technology saves time and lives particularly in areas with doctor shortages.

- Real estate strategy: Invest in cities, mostly in the developing world, that have the most potential for a material improvement in health and life longevity. Health improvements have a major impact on productivity which translate into higher wages. Residential and retail stand to benefit the most.

- Average commute times reduced by 15–20 percent. Traffic and usage data enables route optimization, not only for public transit but private users. Waze, a navigation app in the U.S. can help drivers detect traffic jams and road closures. IoT sensors can effectively monitor delays, maintenance, detect problems before system breakdowns. Applications for digital payments, parking assistance are widely available in cities like Shenzhen and Stockholm.

- Real Estate Strategy: Invest in the suburbs, possibly the inner suburbs, of cities in the developed world. In advanced cities, the biggest cost of commuting is often the time. Fast and efficient commute systems allow people to enjoy larger living spaces without sacrificing accessibility, and thus will drive the suburban real estate market upwardly.

- Greenhouse gas emissions cut by 10–15 percent. Building automation systems (commonly seen in green buildings) can lower emissions for commercial properties, as well as homes by a total of 6 percent. Water consumption and the volume of solid waste can be reduced through usage tracking and public policies too, by 20-30 percent and 10-20 percent respectively.

- Real Estate Strategy. Invest in cities with the most potential for green gains. All the academic evidence points to a green premium at the building level, leading to larger emerge at the city level. Green cities such as Vancouver, Singapore and Helsinki have built brand advantages which help attract capital and talent and may be more resilient to climate change in the longer term.

We noted in our report “Urban Big Data and Real Estate Markets” that cities in many advanced economies have laid a good base for the exploitation of smart technology, but the really rapid gains are seen in the Asian megacities. MGI agrees and provides good guidance on where the best opportunities might be found.