As placemaking is rapidly changing the urban landscape, the way we view real estate value needs to adapt to meet evolving community demands,wherepeople create places where they want to actually live, play and work. Increasingly, space in the city is linked to younger generations and the knowledge (gig) economy where shifting lifestyles and open all hours’ irregular work schedules will be the new normal. This interconnection is shaping current and future city office markets which looks beyond the traditional space, financial and lease demands to flexible operating platforms. Owners and investors need to understand the new avenues to create real estate value and seek opportunities to reap commercial rewards far beyond the historical landlord and tenant arrangements.

Whilst space, property and capital markets have been the traditional real estate drivers, the knowledge economy provides an additional layer which is guiding occupier demand. The key elements cover digital connectivity, increased globalisation, environmental concerns and strategic resources alongside post Covid-19 recognition of disaster preparedness. These megatrends are changing the working environment by improving individual’s work experience (productivity) and creating new workplace settings.

As technology redefines the workplace, younger generations are changing the traditional work contract, the nomadic multitask workforce can move seamlessly between organisations, building a freelancing career on entrepreneurship and their interests. Being digital natives, they will take up remote and flexible working practices and increasingly able to work anywhere, causing organisations to reconsider their real estate strategy around more flexible options.

To attract and retain the young knowledge workforce, the modern office setting is becoming more inviting and informal. New workplaces look to breakdown boundaries as to socialise and share knowledge with a focus on occupier experience and wellbeing. Ergonomic desks, meeting and social space offers a creative comfortable work environment where the smart office starts to become your sixth sense, as a personal assistant to support you in your daily activities.

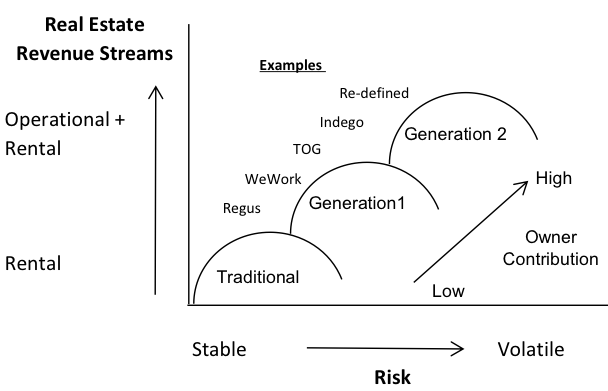

In this environment, property owners need to achieve attractive commercial returns. The convention of providing distance between themselves and tenants with long term ‘let and forget’ full repairing and insuring (FRI) leases are being consigned to history, as the occupiers are looking for smart offices offering flexible terms, customer management and service provisions. The imbalance has created opportunities for intermediates to offer operating models were a serviced office/coworking operator takes a long term conventional lease in a building and then offers flexible smart office space – generation 1 (Regus and WeWork) model. In the Covid-19 era, a generation 2 model is emerging, whereby no longer can the flexible operators accept the risk transfer, with revenue share models coming to the fore. Beyond this, landlords – or should we say customer service providers – are now realising that they themselves can capture this margin and ‘white label’ facilitators are rapidly evolving (Re-defined, Indego etc), see Figure 1.

Figure 1: Property Owners Income Sources:

Smart Flexible Office Space

In various forms, the intermediates offer, may provide attractive returns in buoyant markets, although less so in a depressed markets, where flexible smart leases provide low security of income at the operational and ownership level with increased likelihood of default risk. In short, with flexible smart leases, property owners will hold long term assets with short-term liabilities; essentially they need to become more than rent collectors with a move to a strategic and human focussed property asset management strategy and so achieve maximum returns on the space they let. As has been used in the Hotels market for some time, a cashflow approach with appropriate stress testing needs to be employed to allow a more holistic and representative valuation.

Beyond the physical bricks and mortar structure, property owners need to buy into the future business models and market dynamics of the knowledge workforce, by integrating the physical space with services and technology offering to create an enhanced customer experience. This creates a massive shift in the property owner’s business model where value is created by the offering rather than the location. To determine value, rather than reviewing the building’s covenants and weighted average lease expiry (WALE) profile, futures performance measures will look at on-demand facilities with key indicators covering, footfall, short term occupancy rates, service charges and hospitality revenues.

In moving the income stream sources generated by real estate towards customer services, real estate values would need to reflect the changing risk profile. Initially, this suggests higher yields to embrace the increased uncertainty, with projections based on business valuation principles, which looks at an estimate of the economic value in the form of a going concern. This would place greater emphasis on asset utilisation, efficiency and occupier retention. In simple terms, using a cashflow approach monetising these diverse income streams would generate a higher margin, and a higher yield would be applied.

Driven by shifting demographics and digital connectivity, owners and investors can no longer be the passive supplier of real estate. The hard property asset operational model will be replaced with engagement and flexibility as to create new streams of revenue. The property owner will have no choice but to evolve their offering to meet the rapid changing requirements of the clients. A paradigm shift is occurring, where customer’s on-demand experiences will be the focus for the flexible workplace providers. Words 890

Contact: David Higgins david.higgins@bcu.ac.uk Peter Wood peter.wood@bcu.ac.uk