Investors must urgently review their portfolios to ensure they are aligned with the major changes taking place – it’s happening faster than you think.

It is widely acknowledged that real estate is set to see widening polarisation in performance, but the speed at which this will occur – and the consequent implications for investment strategy – are much less well recognised. Assuming that the pandemic can be brought under control soon, we are likely to see the condensation of structural changes that might otherwise have taken five or ten years to play out into a mere 18 to 24 months. If the pandemic cannot be contained and the current heightened state of alert drags on well into next year, these changes could be permanently established much sooner.

For example, household online shopping habits will become more ingrained the longer the pandemic continues. Physical shopping will be increasingly unfamiliar, meaning old habits are harder to revive. E-commerce platforms will become more efficient at serving customers after recalibrating their supply chains and fulfilment mechanisms to adapt to higher demand, making the online retail process even more appealing to consumers. More high-street retailers will collapse from poor trading because of the combination of ongoing social distancing measures and weakened consumer sentiment, further damaging the high street.

For landlords and real estate investors, this situation means that the divergence between those assets that will benefit positively from structural change and those likely to lose out is happening right now. The accelerating consumer shift from physical to online retail is already leading to polarisation in performance between the assets, sectors and locations that are positively aligned to this change, such as well-located logistics units, and those that are negatively aligned, such as fashion-based high-street retail. Performance divergence between the winners and losers will be much faster and far more pronounced than many investors expect.

The structural changes in our future are clearly visible to all the real estate participants – developers, investors, landlords, consumers, businesses, employees. Take the office sector. The success of home-working has led company leaders to realise they must focus much more on the attraction and amenity of their office space if they are to entice employees back in order to rebuild social capital and promote collaboration. Reports of the death of the office are (in my view, at least) well overblown, but fundamental change in occupational demand is still likely.

Office employees will work more flexibly in future, with their location dependent upon the task at hand. Physical offices will evolve away from being a place of work towards becoming a place of social interaction, facilitating collaboration, education and innovation and showcasing company brand and ethos to build all-important social capital. Companies that were reluctant to pay rental premiums for the best offices in the best locations will now be more prepared to do so, taking a smaller footprint in the process. Those occupying outdated offices in weaker locations will see that their space does not meet the requirements of a post-pandemic world and will relocate. Depending on the quality of their current exposure, this brightens the outlook for some office investors and darkens it for others.

Changing real estate dynamics will play out across all sectors concurrently, leading to significant and rapid performance divergence. There will be a rush away from assets aligned to the old ways of occupying real estate towards those aligned to the new ways. This is already apparent in record-breaking logistics take-up statistics and rising occupier interest in more flexible office leasing models. In time, as more leases expire and economic activity ticks up, it will be evident across ever more sectors and locations.

Source: Mayfair Capital Investment Management

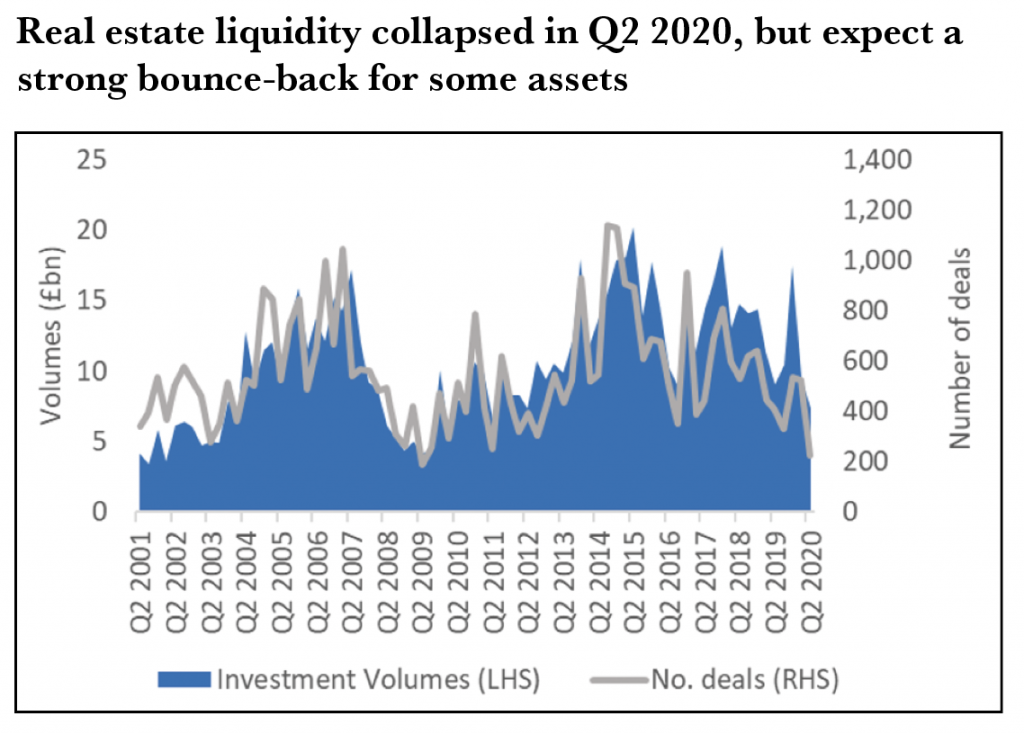

UK investors must expect polarised performance based on how robustly their portfolios are positioned in structural terms. Investment volumes in Q2 were the lowest since the global financial crisis, according to Real Capital Analytics (see chart), as the introduction of material uncertainty clauses in valuations, as directed by the RICS, and lockdown restrictions made property investment and development more difficult. A lack of market liquidity obscures the position, but, given how starkly structural change has shown itself in occupational markets, when liquidity does resume it will quickly become apparent. Investors holding assets positively aligned to change will be sitting pretty. Those holding assets that are negatively aligned to change will face higher capex costs under a best-case scenario or unstoppable value erosion under a worst-case scenario.

Real estate liquidity collapsed in Q2 2020, but expect a strong bounce-back for some assets.

A number of factors ensure that real estate is attractive to investors in the short term. These include: a lack of better-priced alternative options; an ultra-low interest rate environment; lower levels of leverage; and an undersupply of quality floorspace in most locations leading into the pandemic. As a result, real estate liquidity is likely to recover quickly when transactions become easier to complete. The investment market will, though, be more polarised than ever before by asset, location and sector.

Real estate investors must review their existing portfolios without delay to determine if they contain misaligned assets and whether they can be better managed to prevent value loss. Opportunities to double down on assets and locations that will benefit positively from change should be taken, whether that means bringing forward refurbishment plans or enacting new acquisitions. For assets on the wrong side of the structural curve, investors need to undertake an honest reappraisal of pricing with a view to rapid disposal, pursue innovative adaptive reuse options, or commit sufficient capex to secure future income if some hope remains.

Given the potential flood of secondary assets likely to hit the market when more normal trading conditions resume, mispricing may occur. This will be especially true for assets that have repositioning potential, for which long-term demand will endure. It takes bold action to buy against prevailing market sentiment, but those with a solid, thematically based investment strategy who have conviction stand to see strong upside returns.

Investors who have already adapted their portfolios to align with structural change prior to the pandemic should now see their labours bear fruit. Those that have not may soon find that the time to adapt to structural change has gone. As Warren Buffett famously quipped, “Only when the tide goes out do you discover who’s been swimming naked.”