In the world of commercial real estate office leasing, the sublease market offers a less transparent subset of supply and demand that is difficult to track at best, and frustratingly illogical at worst. Because sublessors are in cost recovery mode, it is challenging to bring parties to the table and walk away with a win-win.

Today’s national sublease story is one of ever-accumulating supply and limited deals, with negative implications for direct rental rates, vacancy trendlines and development pipelines. With this unique absence of comparables to set the market, participants lack the necessary data points to forecast what is next.

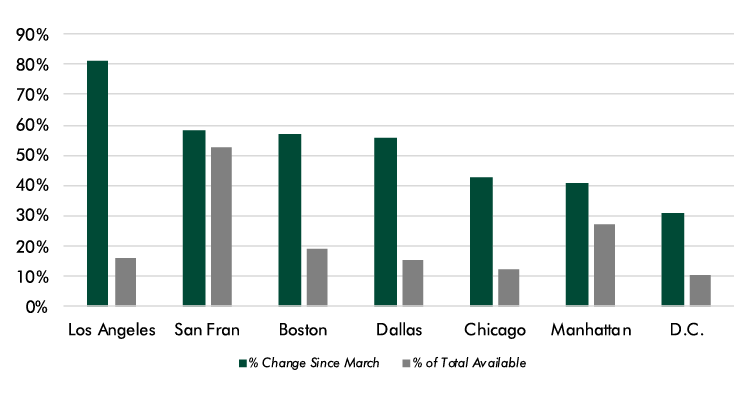

As the covid-19 pandemic led many cities into a March lockdown, CBRE began a comprehensive analysis of sublease availability, with major markets such as Chicago the focal point. Trends found in Chicago, like the pullback of tech companies’ proactive leasing strategy, mirror other large US markets. This study has revealed foundational and often behavioural causes of missing demand for subleases and potential solutions for thawing this national market freeze.

Yes, this time is different

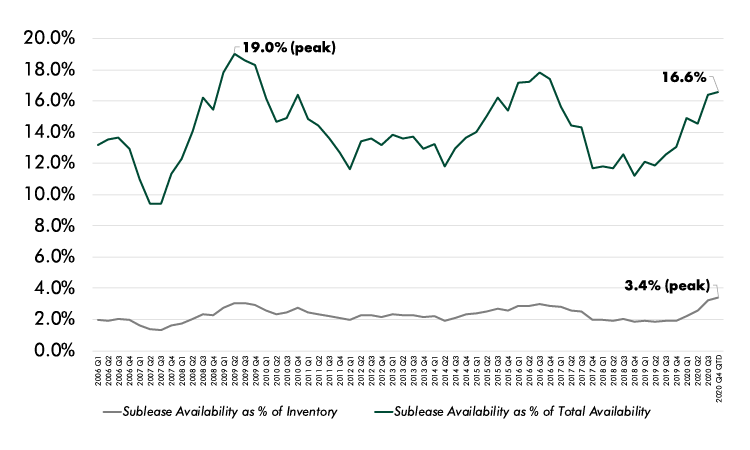

The onset of a downturn comes with a desire to examine past recessions to predict the future. However, present-day assessments may serve us better than extrapolating the experience of the Great Recession. Downtown Chicago sublease listings represent the largest percentage of office inventory in 15 years of data and are nearing the largest percentage of total availability recorded over the same period.

All downturns are not created equal, particularly when their causes range from frozen financial markets to a global pandemic. Current sublease market players would be best served by focusing on owners’ and occupiers’ individual circumstances and points of leverage.

The threat of paralysing loss aversion

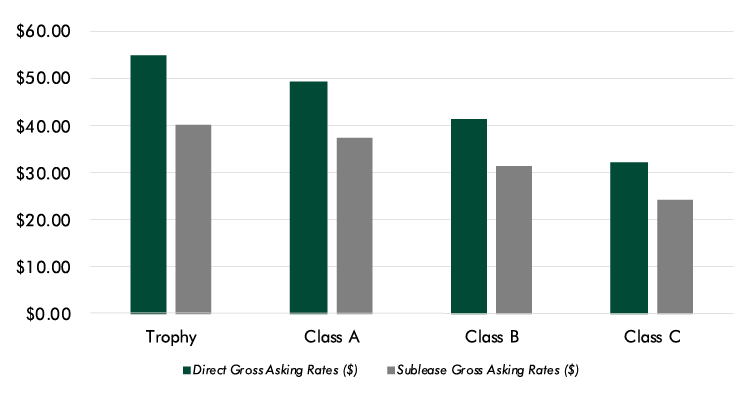

With sublease listings, setting competitive pricing can be obscured by an occupier’s aversion to loss. The opportunity costs of a ‘bird in the hand’ deal at a lower rental rate are easier to ignore when facing pressure to recoup a certain percentage of the lease’s original value. Looking at the delta between sublease and direct asking rates in the Chicago CBD, we found discounts averaging 25%; that is surprisingly modest given the market’s oversupply of subleases and lack of active tenants willing to engage, especially with sublease opportunities.

Pricing a sublease to move requires a holistic evaluation of the market, which mitigates the tendency to overvalue one’s own space relative to comparables. Chicago central business district listings above 10,000 sq. ft have been sitting on the market for an average of 10.5 months, with pricing holding stable in the absence of meaningful demand. That demand may not materialise, though, unless properly incentivised.

You can’t time rock bottom

Occupiers remain on the sidelines of the sublease market for multiple reasons, including uncertain post-covid space needs, bias against subleases (space quality, sublessor solvency) and a fixation on waiting to strike until the market hits bottom. Just like the stock market, perfect timing is not possible and fraught with missed opportunity. You have to be right twice – first to decline the deal on the table today and second to re-enter the market and close when rates are at their lowest. Knowing most people will not feel safe acting until the market has begun to recover, it is a surefire strategy to miss the moment and any potential to snag a sublease at a long-term, favourable rate.

Flipping the script

Chicago offers some optimistic counternarratives with national application. One way this time is different is that there is an overabundance of prime, like-new sublease space. Many current sublessors are high-profile companies with premium offices, and the chance to secure these spaces at a discount comes rarely in the real estate cycle.

Demonstrating market agility, subleases that have closed to date display creativity in deal-making to achieve the sought-after win-win. For example, Old Mission Capital’s recent 38,000 sq. ft lease in Chicago’s Central Loop evolved into a direct deal with sublease terms. The sublessor gained efficiencies by shedding space, ownership found a new long-term tenant and OMC secured discounted terms without the risks of sub-tenancy.

With a right-sized perception of risk/reward and a willingness to entertain unconventional deal structures, owners and occupiers could bring critical liquidity to the sublease market. And with liquidity come much-needed comparables, allowing future conversations to be less guided by cognitive bias and more guided by empirical data.