City centres and suburbs have been subject to both centripetal and centrifugal forces in modern times. During the first four decades after World War II, rapidly growing middle-class incomes in the Western world translated into expanding city suburbs. This trend peaked in the early 1990s. Suburbia, with its carefully manicured single-family homes, was seen as the place to be. Who would’ve wanted to invest in decaying inner cities with no-go zones like the ones portrayed in the Michael Jackson videos of the time? While this phenomenon was most prominent in the US, many European cities – such as London, Frankfurt and Zurich – also experienced similar shifts, albeit to a lesser degree.

Over the past three decades, however, this trend has reversed sharply. Rapid globalisation fuelled the development of urban centres, which came hand in hand with declining crime rates in inner cities. And the diverse mix of people moving into these urban centres has broadened the range of cultural influences. Today, a multi-ethnic choice of restaurants can introduce us to flavours from all over the world, and dance clubs and movie theatres bring us globalised entertainment options.

This recent trend towards greater urbanisation is apparent in Asia, Europe and the Americas. Inner-city property owners from New York to Ho Chi Minh City have been reaping the dividends – real-estate prices have been on an upwards march over the past 30 years, interrupted only temporarily by shocks such as the Asian financial crisis, 9/11 and then the global financial crisis. High-rise condos have been popping up like mushrooms, and abandoned warehouses and factories are being repurposed for residential and recreational uses. Grade A buildings have reshaped the skylines of cities around the world, including London. The trend picked up in the 2010s due to millennials’ strong propensity to shop, live and work in inner cities. The high-density, multi-family residential buildings that had been common in continental Europe for decades started gaining popularity in the US and the UK and are beginning to appear in Asia as well.

The stage was set for further urban dominance over suburbia when the coronavirus pandemic struck. Cities around the world were thrown into lockdown for weeks; Hong Kong is already on its third lockdown, while the US is struggling to contain the first wave of the pandemic. Nine months after the initial outbreak, overseas travel is still nearly impossible on a broad scale. Although a host of uncertainties remain, we need to start thinking about what lasting changes the pandemic could bring to residential housing markets. Will people now be tempted to move to the suburbs, and will working from home become the new normal?

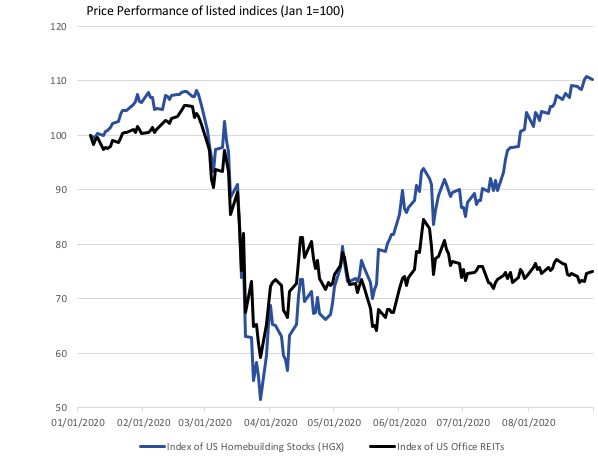

Financial markets in the US seem to have already answered this question. The stock prices of homebuilders operating mainly in the suburbs have been surging, while the prices of REITs investing in commercial business districts are hovering near their March 2020 lows. The Philadelphia Housing Sector Index (HGX) has outperformed the FTSE EPRA Nareit office REIT index by a whopping 33% since the start of the year (see Figure 1). This indicates a sharp uptick in demand for property in the suburbs versus inner cities. Based on a review of price indicators for city condo and rental properties across the US, we can confirm this trend only for New York and San Francisco so far, where asking rents for centrally located apartments have fallen by 5–7%.

For now we are not seeing similar developments outside the US. In Switzerland, the most central and urbanised market you can find is Zurich’s city centre. Here, a large, multi-family complex called Bellaria came on the market in mid-August 2020, and demand for its centrally located apartments, some of which offer lake views, has been nearly insatiable. All but 12% of the 172 apartments were snapped up in the first week. Of course, this is only anecdotal evidence and we could probably find just as much evidence for the counterargument.

When all is said and done, there is no doubt that a new trend is emerging: renewed interest in the suburbs. But will it be only temporary, or will the appeal of suburbia be structural, as home working is adopted on a larger scale? Nobody knows for sure, although data from a small number of gateway cities with high-density residential districts, such as New York and San Francisco, suggest a secular trend.

We mustn’t underestimate the power of events that can alter people’s behaviour. After all, city centres and suburbs have already seen waves in both directions over the past 70 years.

Figure 1. Outperformance of US homebuilder index versus office REITs