Harvesting the low-hanging fruit.

“We do not inherit the earth from our ancestors, we borrow it from our children.” (Haida proverb)

Despite lofty sustainable development goals established by the UN in 2015 and supposedly to be achieved by 2030, much of the world continued to suffer from the The Boiling‘ Frog Syndrome‘ until early 2020.

Faced not only with an unprecedented global health crisis, but also with widespread wildfires, flooding and droughts ranging from North America, large parts of Europe to China and Australia, many more people suddenly noticed that previously localised issues increasingly have a global dimension and cannot be dealt with on a local basis only.

That’s an important realisation, especially from a sub-Saharan African (SSA) perspective.

Why?

Whereas infectious diseases like Ebola or issues such as soil erosion and droughts were mostly observed on the evening news in developed countries, there is now an increasing commonality of issues between developed countries and frontier/emerging markets which increases the likelihood of these issues being addressed.

Drought-resistant crops and soil-enhancing fertiliser production are examples of challenges to be tackled by farmers in sub-Saharan and Western European markets alike. Decarbonising energy production is another layer of commonality. Recent success stories, like the speed covid vaccines have been developed, as well as the emergence of RTS,S as the first Malaria vaccine, especially for African children, show the possibilities.

Before considering practical investing implications for sub-Saharan African markets, it’s helpful to think about a suitable framework to evaluate markets, industries and ultimately opportunities.

While there are various schools of thought, I personally believe the BlackRock distinction between sustainable solutions and ESG integration is among the most practical framework out there used by investors. While sustainable solutions, driven by investors, target behaviour, distinguishes between Avoid Strategies and Advance Strategies, ESG integration is geared towards achieving enhanced returns by incorporating ESG information, derived for instance from climate models.

From an SSA perspective this framework, if applied without cutting corners (aka green-washing) will guide investment decisions in the following way:

Avoid strategy: This may be the hardest one, since it requires investors to walk away from economically viable solutions which, until recently, often provided significant cost advantages. Examples include coal-fired power stations vs renewable energy sources, in particular solar power.

Advance strategy: This is a ‘rich field to plough’ in SSA, since it targets specific social and environmental outcomes.

ESG integration: The idea behind this is the use of environmental, social and governance data to supplement decision making and achieve enhanced risk-adjusted returns, disregarding the character of the underlying strategy, sustainable or not. Apart from targeted outcome-oriented impact funds, which fall mostly into the advance strategy bucket, ESG integration entails the biggest potential, since it reduces the possibility of conflict and therefore smoothes internal organisational acceptance. From a SSA investor perspective it has another major advantage: it avoids the lingering suspicion that investing in SSA is essentially charity or, at best, development aid (outside certain industries like mining or O&G).

So, where do we find that low-hanging fruit?

Shelter: ie, adequate housing, particularly in often overlooked rural areas with core industries like mining or agriculture is the number one issue. One of the examples is the EMPAKO affordable housing transaction we are currently supporting in South Africa’s rural NW mining region. Apart from providing 140 thousand quality homes and associated infrastructure, the project entails substantive community components involving schools, clinics and tribal offices. In addition, the installation of more than 350,000 solar geysers as part of this five-year development programme will achieve estimated annual CO2 savings of 142,000 tons.

Education: Hard assets, like schools/ vocational training centres, on-campus student and teacher housing are gaining momentum. ‘Soft assets’, like teacher qualifications, adequate compensation and EdTech platforms to reach children in remote villages are key success elements.

Affordable and stable energy access: This is one of the biggest current impediments to job creation which will largely need to occur in manufacturing and the knowledge economy. However, in terms of the transformative impact, more mundane elements, like the ability for children to switch on the light to finish their homework after dark should not be underestimated either.

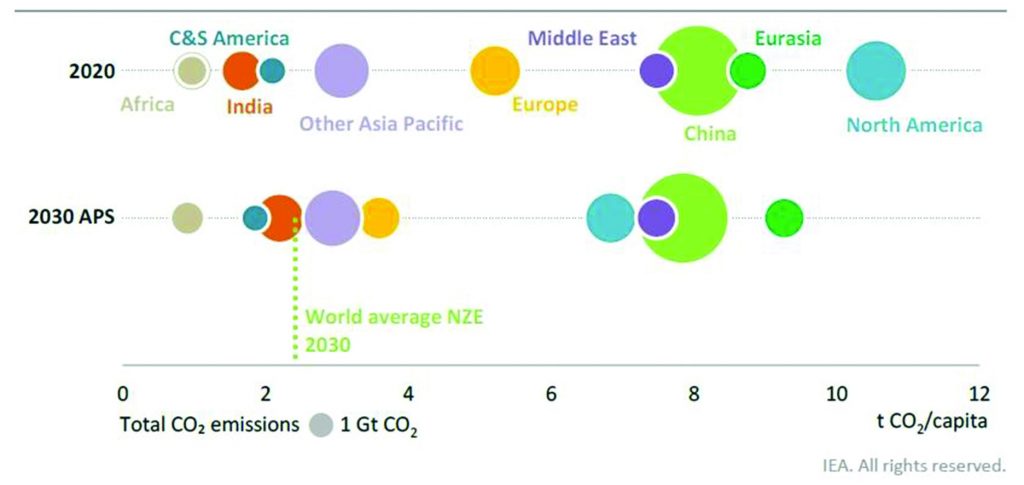

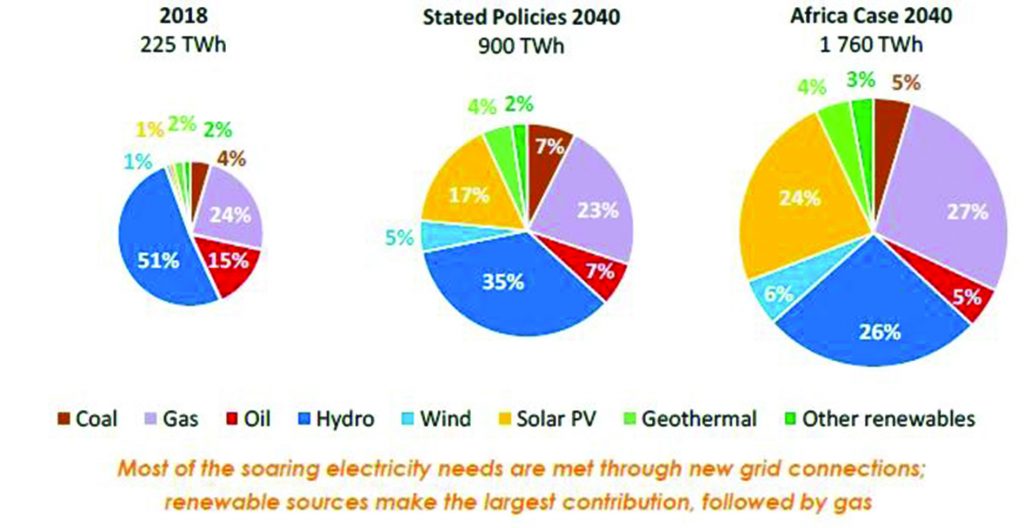

The following combined graph illustrates the significant decarbonisation opportunity in expanding sustainable energy access and production infrastructure in SSA. Apart from production, enhanced grid-interconnectivity (eg, Southern African Power Pool across SADC) and reduced transmission losses (eg, transformer upgrades, theft reduction) will be key efficiency enhancements.

CO2 emissions per capita by region in 2020 and the announced UN SDG pledges scenario in 2030

SSA (excluding South Africa, whose largely coal dependent energy mix is poised for a significant future green-energy shift) electricity supply by type, source and scenario, 2018 – 2040

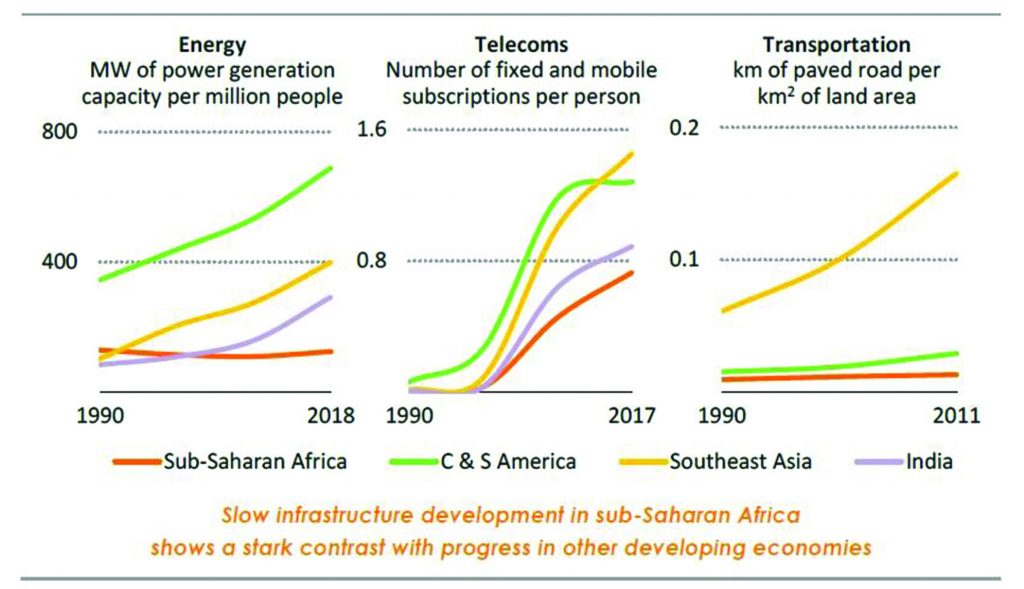

Infrastructure, in particular scalable digital infrastructure, will achieve the biggest productivity gains. In addition to capacity expansions, efficient operation of existing transportation infrastructure assets like ports will be equally important. This is evidenced in comparatively long processing times at major ports across the SSA region. The recently announced JV between the UKs CDC and DP World shows underline that importance.

Comparison of infrastructure developments across selected emerging markets

rom an investor’s perspective, it is important to keep an eye on inter-regional differences. Mobile subscription penetration stats shown above are good, albeit somewhat misleading. While they increased across the region, there are particular markets with entrenched oligopolistic structures keeping mobile (data) access prohibitively expensive for large parts of the population. Enhancing competition like in the case of our Malawi Nyasa Mobile project, which aims to significantly reduce consumer prices (currently 5x Western European levels), while significantly reducing the carbon footprint due to solar-powered mobile towers, is an example of the investment opportunities available.

The SSA sustainable investing opportunity clearly presents itself and capital allocators in developed markets, but also African capital pools, like pension funds, should revisit their strategies. Discontinuing the use of an EMEA strategy designation by carving out a dedicated Africa investment strategy with a respective intra-regional differentiation would be an important first step and eye opener for the investor community.

“It always seems impossible until it’s done.” (Nelson Mandela)