This article was originally published in December 2020.

The benefits from adding real estate investments to a multi-asset portfolio have been well researched. Real estate has low correlation relative to other asset classes, high Sharpe ratios, greater proportion of total return attributable to current income versus appreciation, and somewhat predictable revenues secured by contractual leases from tenants. These attributes improve the risk-adjusted returns of portfolios that include real estate. We examined another attribute of real estate called antifragility, which is of particular relevance due to unforeseeable ‘black swan’ events such as covid-19. Antifragile investments are those whose performance improves in relation to the size of the external shocks.

Black swans

The term ‘black swans’ emanates from the published work of Nassim Taleb on the subject of mathematical finance, uncertainty and randomness. Traditional financial models assume exogenous shocks are outlier events with low probability of occurrence. Yet it was only 12 years ago that we had the global financial crisis. Black swans are by definition unknowable in likelihood and timing of occurrence. Furthermore, the impact of such shocks is also unknowable in advance. Taleb contends that it is more important to construct portfolios that incorporate ‘antifragility’ rather than seeking to model ‘unknown unknowns’.

Antifragility

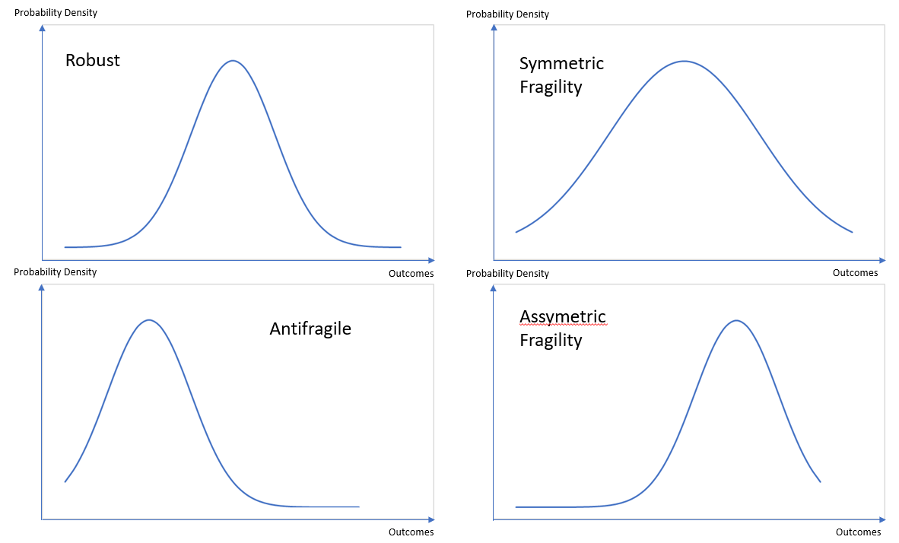

There are essentially four return distribution outcomes as shown below. Robust outcomes are where outlier events are low in probability and have small consequence, either positive or negative. Investment performances are fairly predictable since outcomes are not materially impacted by shocks. Then there are two types of fragile outcomes: symmetric and asymmetric downside scenarios.

Both may give rise to significant negative impacts since the tails are fat. Asymmetric tails to the left means that the investment is more fragile to negative outcomes than to positive upsides. Antifragile investments, on the other hand, are asymmetric to the right. Here the fat tail to the upside means outliers tend to be positive, with large payoffs. In short, robust investments are agnostic to volatility whereas fragility implies investments tend to go badly with volatility. However, antifragile investments benefit from dislocations. In the current environment, we might think of Amazon or Zoom as benefiting from the current outlier event.

Investment convexity

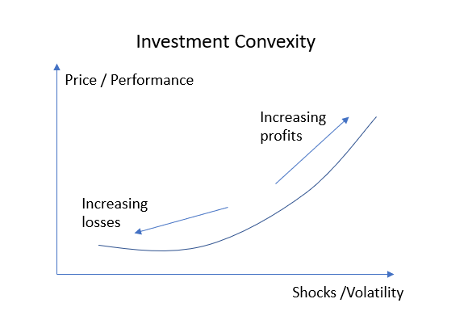

Antifragile investments are also investments that benefit from volatility. Mathematically this is referred to as convexity. Convexity under Taleb’s model is different from convexity that is used for bond investments. For bonds, convexity measures the change in the price of the bond in relation to changes in the level of interest rates. As the diagram illustrates, the higher the volatility in the events under Taleb’s model the greater the payoff with convexity. Conversely, greater volatility results in greater losses for concavity. Again, think of how covid-19 has geometrically launched revenues for Zoom, and on the negative side, how it has hurt WeWork’s highly social co-working model.

Limitation of normalised distribution models

When outcomes are reasonably predictable and where no single outlier outcome can significantly impact the aggregate total Gaussian or normalised probability distributions are a good fit. The normalised distribution clusters outcomes symmetrically around the mean, and the probability of an outcome being two standard deviations away from the mean is under 5%, while three standard deviations (3-sigma events) have a probability of occurrence of just 0.3%.

The problem with black swans, however, is that they do not fit Gaussian ‘normal’ thin-tailed distributions. Black swans can materially distort the aggregate outcome as witnessed from the effects of covid-19 lockdown. Instead of a normalised bell-shaped probability distribution, we have a fat-tailed curve. Moreover, the shape of the curve is no longer symmetrical around the mean but skewed. Essentially, the problem with ‘unknown unknowns’ is that they fall outside the bounds of robust statistics and quantitative models. It is much easier to live in a stylised Gaussian world of non-extreme events.

Since modelling black swans necessarily requires fat-tailed assumptions of risk, which are difficult if not impossible to quantify, investment portfolio performance becomes susceptible i.e. fragile to shocks. The question then is whether there are investments that are antifragile which can be incorporated into multi-asset portfolios.

Asymmetry of real estate – antifragility

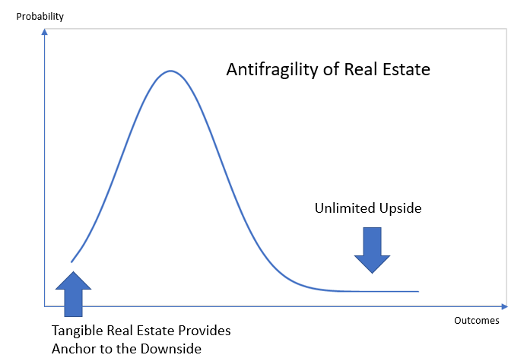

With public equities or corporate bonds for example, black swan events may move the value of certain securities towards zero. The reason is that the underlying businesses can become totally unsustainable. Take for example Lehman Brothers or Bear Stearns during the global financial crisis. These firms were no longer able to remain operational. With covid-19 it remains to be seen which businesses will survive. However, with real estate there is real tangible and long- lived property that underpins the investment. Real property has been a repository of value for many millennia. Real estate provides a non-trivial anchor to the downside which is largely overlooked in traditional financial models. Whereas the upside is technically unlimited, the downside has a floor. This makes the return distribution asymmetric to the right, the best of the four possible outcome distributions.

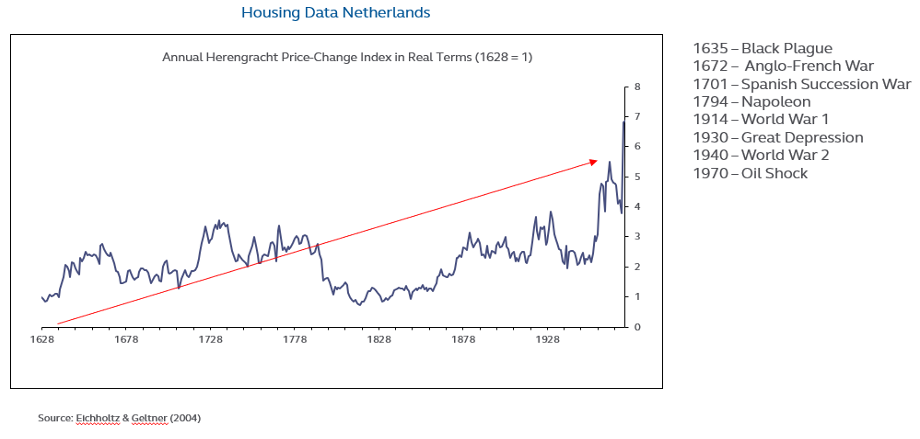

The empirical data on real estate price changes in real terms over a very long time period of nearly 400 years (see the case study on housing prices in the Netherlands below) supports asymmetry to the upside and finite downside. Despite major black swan events such as the Black Death, the Napoleanic wars, both world wars and the Great Depression, real estate showed resiliency to the downside (floors provided by tangible real property value) plus a fat-tailed upside. Note also that this period included the Spanish flu of 1918, which reportedly infected over 500 million people with a death toll between 40 million and 100 million.

Antifragility of real estate – first principles

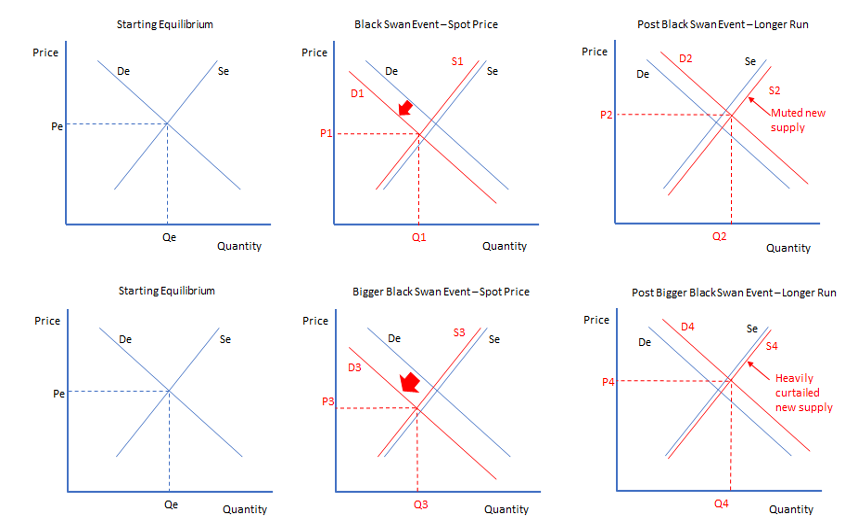

We examine the demand supply equilibria for real estate in the short and long run under conditions of increasing volatility (black swans). Starting with equilibrium between demand and supply, with price = Pe and quantity = Qe, we first examine the impact of a black swan on the spot price. We see that demand falls off materially to D1 due to the shock to aggregate demand. There is a drop-off in supply to S1 which is small relative to the fall in demand.

In real estate, supply decreases due to obsolescence or the withdrawal of marginal properties from the market. However, unlike manufacturing, where production lines can be halted, real estate supply is sticky as it is essentially a fixed asset. At the new spot equilibrium, price falls to P1<Pe. New supply of real estate in the longer run post-black swan events becomes muted as providers of capital for real estate development become significantly risk-averse and policy-makers institute anti-risk-taking measures. As a result, the supply response S2 is relatively small, even as demand recovers and increases with the tailwind of general population growth. Price equilibrium moves to P2>P1 and P2>Pe.

Paradoxically, the more severe the black swan event the stronger the curtailment of new supply in the longer run. In a bigger black swan dislocation, demand falls more dramatically to D3 and price to P3<Pe. As the shock is more severe, price P3<P1 in the short run. The severity of the shock generates a stronger and more lasting reaction in the new supply of properties as providers of capital for development become even more risk-averse and regulations become more draconian against development funding. As demand recovers to D4 it is the endogenous force of heavily curtailed new supply that drives equilibrium to P4>Pe. Note P4>P2, meaning the long-run equilibrium achieves higher pricing the more severe the black swan event.

Institutional real estate performance index

Institutional real estate is the primary investible segment of real estate for pension funds. The National Council of Real Estate Investment Fiduciaries (NCREIF) index is a widely used benchmark that tracks income and appreciation of institutionally owned commercial real estate (CRE). The quarterly data series starting in 1978 includes the performance of over 40,000 office, industrial, retail, multifamily and hotel properties plus other specialised property types such as self-storage and senior housing.

Antifragility of real estate – empirical evidence

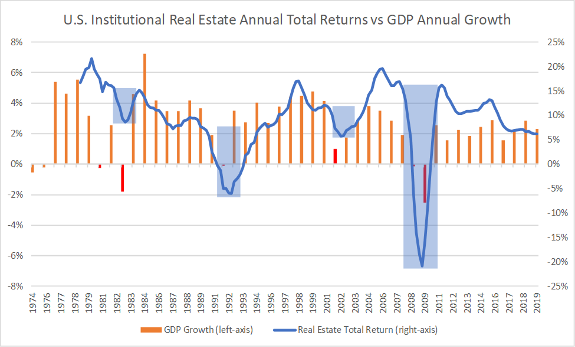

We now seek to examine investment convexity empirically, recalling that antifragility is demonstrated by investment convexity. As a measure for black swan events or market shocks we use real GDP declines. We can see that real estate total returns are impacted by external shocks in the accompanying chart. We use annualised total returns from the NCREIF return index on institutionally owned commercial real estate as a measure for real estate performance. We can see visually that each downturn is followed by a sustained period of strong real estate returns.

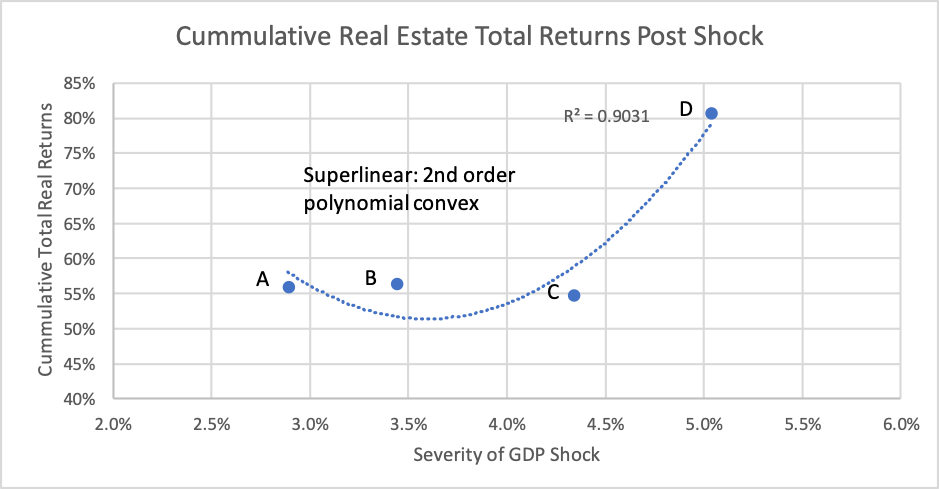

To test for investment convexity, we analysed cumulative real returns from real estate against volatility. We utilised a number of tools, including a goodness-of-fit model, to demonstrate investment convexity as shown in this chart.

Conclusion

Traditional financial models and investment managers prefer to live in a safe world, absent black swan events, but they do occur and they will occur again. Ignoring this truth results in underestimating the risk of most financial assets and overestimating the risk of real estate, on a relative basis. This could be why most investment managers ignore fragility risks when constructing portfolios, as otherwise, real estate would always garner a larger proportion of the portfolio.

Black swan shocks such as covid-19 are ‘unknowable’ in likelihood of occurrence. They are also ‘unknowable’ in impact before the onset of the shock. The ‘unknown unknowns’ describe the real-world environment which does not fit traditional normalised thin-tailed probability distributions. Risks are fat-tailed. Rather than focusing on modelling black swans, the alternative is to consider investments that have antifragility which can benefit from shocks. We showed from first principles and empirical data that real estate investments have antifragility which provides a typically ignored, but added benefit to multi-asset portfolios that have higher allocations to real estate.

Our full paper, Antifragility of Real Estate in a World of Fat-Tailed Risk, can be read here.

Further reading

- Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable (Incerto, 2010)

- Nassim Nicholas Taleb Antifragile: Things That Gain from Disorder (Incerto, 2014)

- Branko Milanovic “The Importance of Taleb’s System: From the Fourth Quadrant to the Skin in the Game” in Global Policy Journal, 29 January 2018 (Durham University)

- Olav Dirkmaat (Professor in Economics at the Business School of Universidad Francisco Marroquín) “Gold Republic, This Is What I Learned from Nassim Taleb”, 25 April 2018

- Farnam Street “Nassim Taleb: A Definition of Antifragile and its Implications” (2014)

- Nassim Nicholas Taleb “Understanding Is a Poor Substitute for Convexity (Antifragility)” on Edge.org, 12 December 2012

- Nassim Nicholas Taleb “Finiteness of Variance is Irrelevant in the Practice of Quantitative Finance”, second version, June 2008

The views expressed herein are solely those of the authors and do not necessarily represent the views of Principal Real Estate Investors or the University of San Diego School of Business or the Burnham-Moores Center for Real Estate. All errors are ours.