Identifying long-term patterns in markets is easy, acting on them is something else

‘The wheel is come full circle,’ commented Shakespeare’s Edgar on the carnage that surrounded him at the end of King Lear. The notion of a wheel of fortune is one that has pervaded since antiquity. There are good times and bad times. There are bull markets and bear markets. There is boom and bust, something Chancellor Gordon Brown said he was going to eliminate.

Whether it’s the seasons of the year, the moons, or the inevitable ageing process and the cycle of life – what Shakespeare called “the Seven Ages of Man” – it’s clear that there are recurring patterns to the world around us. There are even recurring patterns in the length of women’s hemlines. Anyone who has been involved in business for any significant amount of time will know that markets never go up for ever, but are subject to the same cyclical movements.

Commodities are very prone to cycles, so called secular bull markets or super-cycles. In 1947, Edward R. Dewey and Edwin F. Dakin published a book called Cycles – The Science of Predictions. It’s now out of print, but Dewey and Dakin noticed a 54-year index cycle in wholesale prices – in other words commodity prices – going back to 1790. Based on this they made projections for the future. They called it the 54-year “Rhythm”.

Their forecasts were pretty accurate. The 1980s and 90s were a clear secular commodities bear market. The 2000s a clear secular bull. The 2010s another secular bear. The 2020s? A bit of everything.

Thinking in basic terms can be an effective way of investing: are we in a bull market or a bear market? How long does this bull/bear market have to run? Find a bull market and go long. That’s all you need to do really as an investor. There’s no point picking brilliant stocks, if the sector they are in is in a bear market.

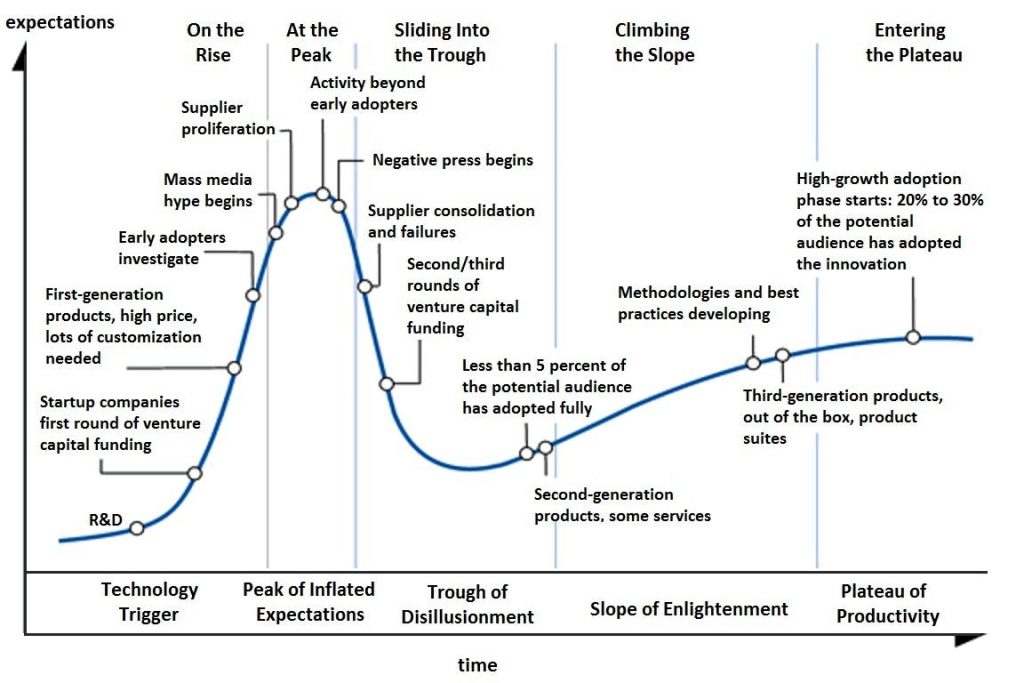

Mining companies themselves, go through clear cycles – perhaps phases is a better word – from exploration and discovery, through development and mine building, to actual production. New technology goes through a clear cycle as it evolves, which research firm Gartner dubbed the hype cycle.

Look at what happened with Dotcom and the internet: from invention to excitement and bubble to collapse to mainstream adoption. Felix Dennis in his book How To Be Rich talked about “riding the wave”: getting into a new growth area early and then surfing to riches.

Thinking in terms of cycles can help you to frame the bigger picture. It can give you an idea of where you are in the grand scheme of things. We like reading about cycles because they bring a veneer of certainty, clarity, security and comfort, where there is, in fact, often none. But most of us have a slightly superstitious streak, which means we can be vulnerable to cycles narratives, too easily persuaded by them and too easily wedded to them.

I remember around the time of the Global Financial Crisis in 2008, many became obsessed with the idea of Kondratiev winter. In his 1925 book The Major Economic Cycles, Russian economist Nikolai Kondratiev had identified a long-term cycle lasting approximately 50 years. As I say, cycles can make for good copy and Kondratiev made his name pedalling them. We had had spring, summer and autumn. Now we were headed into winter. The notion was confirmed by the collapse in financial markets happening in real time around us. The narrative took hold, and many buckled down with gold, tins and guns, ready for a great depression, only to miss out on one of the most epic bull markets in history.

Back in 2005 economist Fred Harrison wrote about an 18-year cycle in UK property in his cult classic Boom Bust: House Prices, Banking and the Depression of 2010.In 2005 many had already turned bearish on property with good fundamental reasoning. But Harrison said the bull market had longer to run and the top was coming in 2008. He was right. There were still two more years of bull market. The peak actually came in the third quarter of 2007.

The problem is the trough was so short lived. A couple of years maybe. We got the Global Financial Crisis but I don’t remember the “Depression of 2010”.

There was a buying window during that 2009 to 2011 period, but prices, especially in London, did not fall by anything as much as many were hoping. Interest rates were slashed and there were few forced sellers. Without the rate cuts, house prices would have come down by a lot more. By the turn of the decade it was off to the races again. If you sold in 2007, but were too wedded to the cycle theory, you would have been waiting for lower prices and never got back in again.

Harrison, by the way, is forecasting the next peak in UK real estate in 2025. He may prove right, but recent data coupled with rising rates suggest the market has already peaked. Is this another false top, such as we saw in 2005? We shall see.

Another popular cycle is the four-year “presidential cycle” in US stocks. A few years ago GMO’s Jeremy Grantham, one of its main proponents, declared that it doesn’t work any more because the US Federal Reserve has broken it. But here we are in 2023, in the third year of a presidential cycle, and the S&P500 is acting it out to the letter, rising to new highs when few expected it.

The idea is that economic sacrifices are made during the first two years of a president’s term (while it’s still OK to be unpopular). This results in the “four-year cycle low” in the stockmarket. Then, in the final two years of the term, the focus shifts towards stimulus, to boost the economy ahead of the next election. That 3rd year boom is just what we are seeing now.

Cycles are all very well in theory. They make a great topic for discussion, but trading them in real time is a different prospect altogether. It’s too easy for an academic to look back at history, find a pattern and declare it a cycle. When real life doesn’t fit the model, you’ll hear something like: “Well, the war upset the cycle”, or “they printed loads of money, so the cycle didn’t work out”. Markets are not fixed and predictable in the same way as the days and weeks of the year.

I like writing about cycles. I like reading about them. I think they help guide you through life. But when the word “cycles” comes up in investing, I breathe out and try and erect a defensive mental wall. Heaven forbid I should get too wedded to them.

Real life and academia are not the same.

Interested in buying gold to protect yourself in these uncertain times? My current recommended bullion dealer in the UK is The Pure Gold Company, whether you are taking delivery or storing online. Premiums are low, quality of service is high. They deliver to the UK, US, Canada and Europe, or you can store your gold with them.

This article was originally published in The Flying Frisby and is republished here with permission.