Globally, we watch millions of hours of content daily. Much of that content emanates from North America’s media industry, taking shape on sound stages across the United States and Canada.

Sound stages have often been overlooked in commercial real estate due to their uniqueness and the relatively small size of the sector. The dynamism of content creation and the expanding reach of institutional capital is rapidly changing that. Over the last decade, sound stages have become more professionalised, leading to a burgeoning asset class.

The media and entertainment industry has been a major force in commercial real estate, especially in chief content hubs such as New York and Los Angeles. Nationally, the industry employs more than 3.3 million people across the performing arts, motion picture and broadcasting sectors. And, in many of the country’s primary markets, it is integral to real estate fundamentals. In Los Angeles, for instance, media companies occupy 18 million sq. ft of office space, and since 2016 these firms have increased their office presence in the region by 7 million sq. ft.

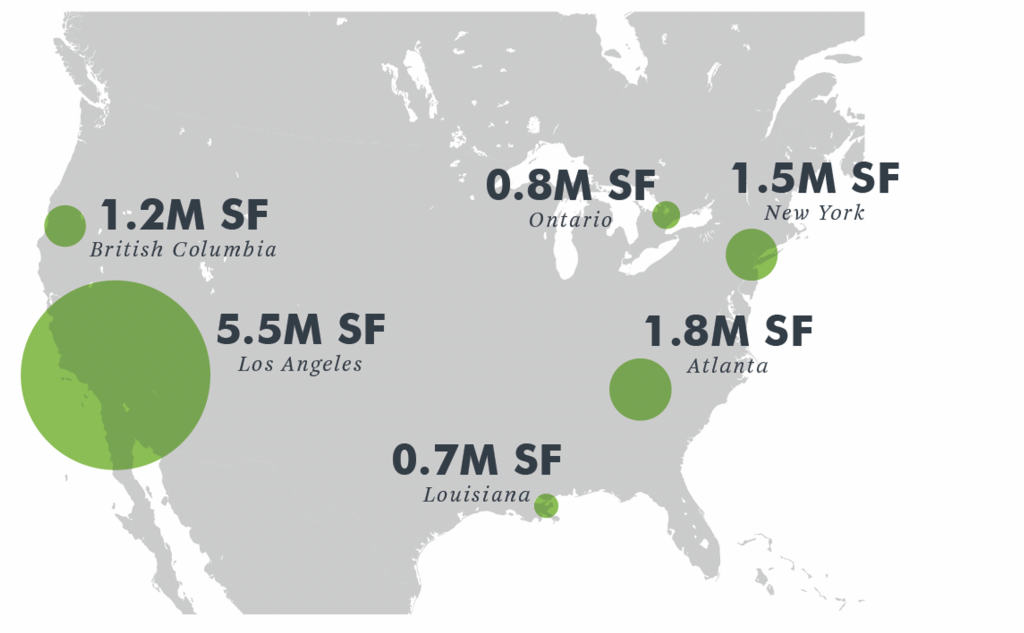

CBRE has identified more than 12 million sq. ft of sound stages in North America, with the greatest concentrations in Los Angeles, Atlanta and New York, showcasing production facilities’ increasing importance as part of the media and entertainment industry’s commercial real estate footprint.

Figure 1: Los Angeles has the highest concentration of filmable production space in Los Angeles

Traditionally, these production spaces have been a commercial real estate afterthought due to their ownership structure, limited inventory, and intensive operating model. In the last decade, complementary tailwinds in the space and capital markets have buoyed institutional interest in the sound stage sector, catalysing a rapid evolution in the asset class.

The advent of streaming has created seemingly insatiable demand for content, with downstream effects for real estate. The top five streaming companies invested a staggering $25bn in new productions in 2019 alone.

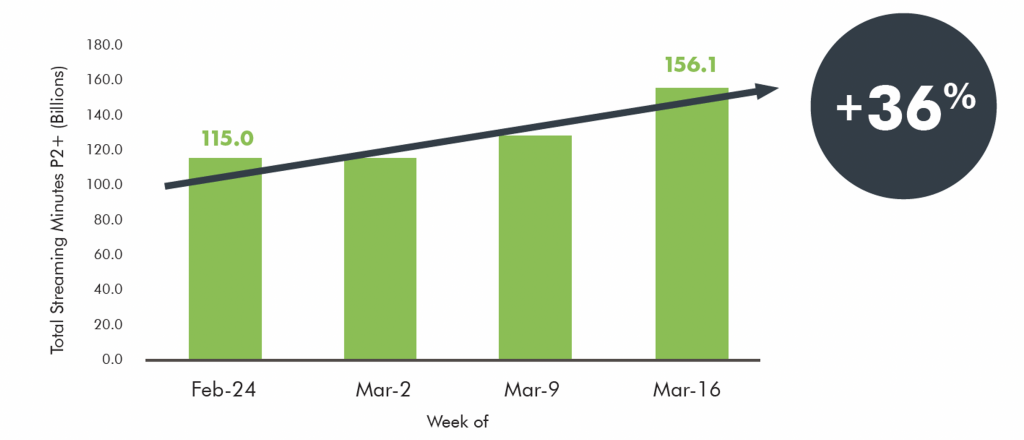

The covid-19 pandemic has accelerated this trend: according to data from Nielsen, the estimated number of minutes streamed by viewers in the first three weeks of March (as social distancing restrictions were implemented nationwide) was 85% higher than the same period the year prior – the equivalent of 400 billion minutes’ worth of content.

The result has been intense competition for any available filming space to support content development as e-commerce companies and logistics operators jostle for the same industrial facilities in the dense urban areas favoured by film and television productions.

Figure 2: COVID-19 has accelerated the growth of streaming platforms

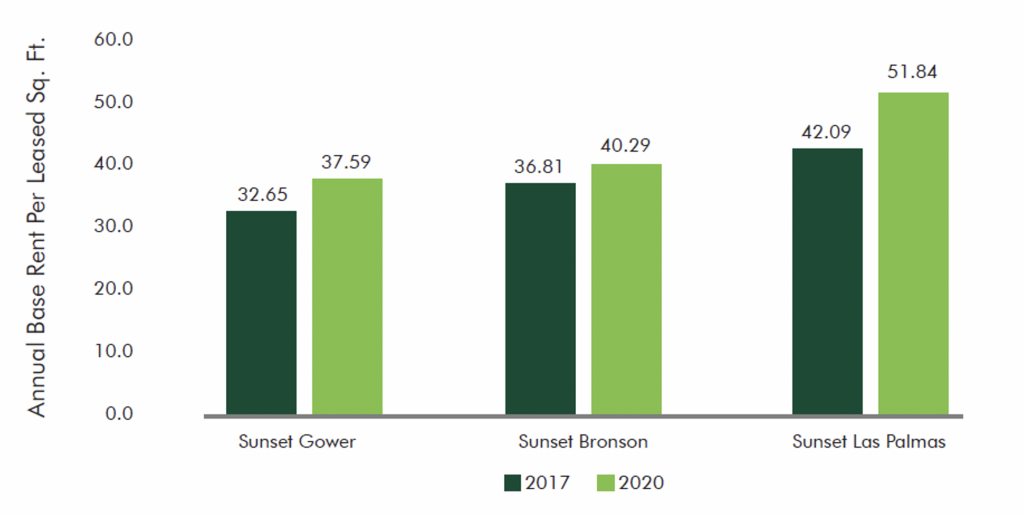

These trends have underscored the compelling economics of production space. In most major filming markets, vacancy has persistently been in the single digits, and production companies are increasingly looking to longer-term leases as a way to guarantee access to space in light of the limited availability. This increased demand has buoyed rental rates. Rents at the 371,000 sq. ft of sound stages owned by Hudson Pacific Properties (a publicly traded REIT), for instance, have risen 20% in three years.

Figure 3: Surging demand for studio space has driven rising rental rates

The large amount of capital entering the sound stage market has also helped to shift the competitive landscape. Over the past decade, well-heeled institutional investors and operators have moved into the market seeking to build portfolios and standardise operations of production space.

In Los Angeles, Hudson Pacific Properties and Hackman Capital have been especially active in large acquisitions. In June, Hudson Pacific announced the blockbuster sale to Blackstone of a 49% stake in three Hollywood studios and five on-lot or adjacent Class A office properties at a valuation of $1.69bn.

Much as we have seen in other emergent commercial real estate asset classes over the last several decades, the influx of capital has driven standardisation across the sector; consequently, sector cap rates have begun to converge with those of other more liquid product types.

The evolution of production space as an asset class is instructive in the broader progression of the commercial real estate industry. Like other product types that have achieved institutionalization through the convergence of strong space market fundamentals and the broad-based interest of capital sources, the path taken by sound stages hints at the expanding nature of commercial real estate and the dynamic future ahead for a growing sector.