Recapitalisation – why now?

A recapitalisation cycle is underway across the Australian commercial property sector. The drivers, in common with markets in other developed countries are financial and physical. What differentiates Australia is the structure of the financial and commercial property sectors, creating opportunities and imposing limitations.

Three long-term trends – a four-decade secular decline in interest rates; thirty years of sub-5% inflation; twenty years of stable value relativities between core real estate sectors (office, retail, industrial) – all appear to have decisively terminated. The shifts in interest rates and relative valuations that have accompanied the recovery from the COVID-19 pandemic challenge these three “certainties”.

The key financial driver is rising interest rates and a reassessment of capital costs, both debt and equity. At the same time a wide divergence in valuations has emerged between private and public commercial assets (such as REITs). In comparison with European and North American markets, in Australia commercial real estate debt (CRED) duration tends to be short. Residential mortgages are typically linked to floating rate instruments. So rising interest rates have an immediate impact.

The physical drivers of the recapitalisation cycle are changes to office working, travel and shopping habits as well as longer-term demographic shifts. This is driving a re-rating across real estate sub-sectors – the core office, retail and industrial markets, as well as a range of other non-core sub-sectors – hospitality, residential build-to-rent, data centres for example.

Even if policy interest rates are now at, or close to, cyclical peaks, effective interest rates paid by many borrowers will rise as loans mature. Asset values therefore are likely to remain under pressure. Alternative scenarios are explored in a recent research paper: Mind the Gap from Madigan Market Insights.

How will recapitalisation play out?

Traditionally Australia’s Big Four commercial banks have dominated the market, still accounting for around 70% of the domestic CRED market. This contrasts with total bank lending below around 50% (US) and 40% (UK). While the Australian banking sector is competitive, the major banks operate under identical domestic regulatory constraints and Basel III and IV rules. Indeed, competition between the banks, it might be argued, increases the correlation in their reactions to market shocks and asset exposures.

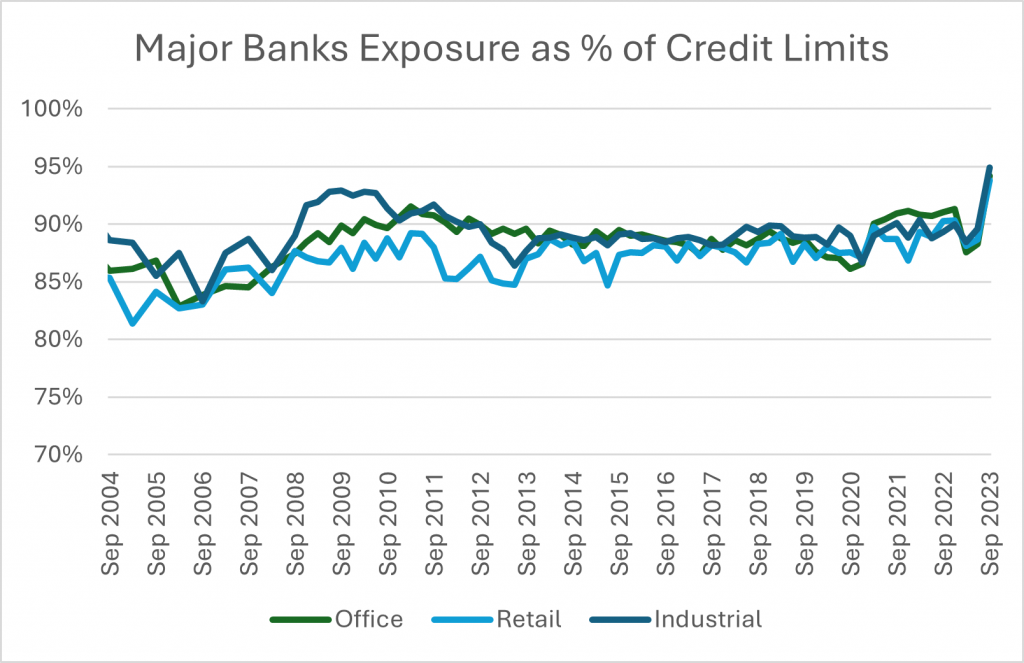

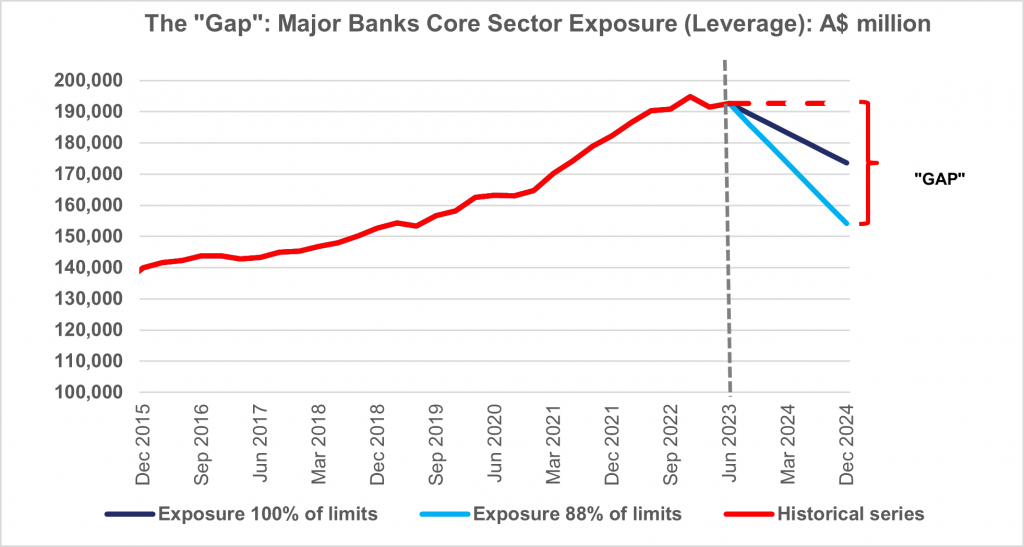

An immediate response to downward pressure on values and the tightening interest rate cycle has been a spike in bank lending as some landlords and investors have moved to reposition for an extended cycle of credit constraint. As a result, the formal banking sector is edging up toward credit limits – a constraint that will only get tighter as the appraisal valuation cycle matures through 2024.

The other blade of the scissors is rising pressure on ICRs (Interest Cover Ratios) as loans, often locked in during the low interest rate post-GFC, pre-COVID cycle are rolled over and re-priced.

Running the numbers

Consider the core, office, retail, industrial sector only. Assume an average (debt/assets) leverage ratio of 35% (a common leverage ratio for core real estate assets in Australia) and a 20% decline in asset values (broadly consistent with a 35% discount to NTA as currently reflected in the REIT sector). At the current exposure limit of 88.8% for the four major banks the estimated “gap” arising from a 20% decline in asset value is A$38.5 billion and for all defined banks, at the current 89.1% of exposure limits, the “gap” is A$53.5 billion for the core commercial real estate sectors in Australia (office, retail and industrial) over the next two years, equivalent to 14.4% of current bank debt exposure. If the exposure is allowed to rise to 100% of the limit, the “gap” falls to A$19.1 billion or 9.9% of current lending (major banks) and A$26.5 billion (all banks).

However, the binding constraint on debt finance may not be leverage ratios. The interest cost on large business fixed rate loans has risen by 293 basis points, from 2.16% (March 2022) to 5.09% (September 2023). This has been on the back of a sharp rise in the cash rate (currently 4.35%) set by the Reserve Bank of Australia.

An ICR of 3.7x is consistent with a property yield of 6%, loan interest rate of 5.0% and 35% leverage. If lending rates rise by say, 300 basis points to 8%, this translates into an ICR of 2.3x.

If the assumed ICR covenant is 2.6x, a capital gap of A$20.6 billion emerges for the core property sector (office, retail and industrial) for the four major banks, or A$28.7 billion for all registered banks.

Gaps get filled…

Illustrating the challenges ahead, investors and financiers will need to distinguish short-term adjustments (such as public REITs trading at discounts to NTA) from possible long-term shifts (such as the re-rating of the office, retail and industrial sectors). Supportive debt capital providers can facilitate portfolio restructuring, support time-flexible negotiating strategies and enable market participants to capture emerging optionality as assets are re-rated and re-positioned.

Recapitalisation of the commercial real estate sector will require access to flexible debt and hybrid instruments as well as equity. The elevated levels of uncertainty, likely to persist over the next two years, call for short-term finance solutions to deal with current situations with a view to implement longer-term choices over time. Debt has a leading role in the adjustment process.

Despite volatile financial and real estate markets, recent global investor appetite for investment grade real estate remains robust – target allocations to real estate across a broad sample of institutional investors are stable in 2023 at multi-year highs in the EU and US, while targets have been raised and holdings are below target levels in the APAC region.

Under the impact of diverse short-term and long-term drivers, we anticipate 2024 and 2025 will be dominated by a recapitalisation of the real estate sector, with demand for real estate exposure in the APAC region to persist.