Powell says “enough” and there are some interesting questions about what happens next, but I can think of at least one camp that’s very, very happy.

- Rates go down, and then what? Good times roll or labor markets get even tighter again?

- One thing is for sure: Uncle Sam can breathe a bit easier

- The Fed’s unrealized losses are happy too

The undisputed beneficiary of rate cuts

The good Chairman Powell signaled that rate cuts are finally on the way.

Why? Presumably because inflation has settled somewhere in the 2-3% range, and that’s good enough for now, given the “back to normal” labor market, which includes rising unemployment, and slow growth.

So rates go down, and then?

It’s unclear what exactly will happen when rates do start to come down, and there’s a decent argument that it won’t be as good for equities as people seem to assume (at least not without some other tradeoffs).

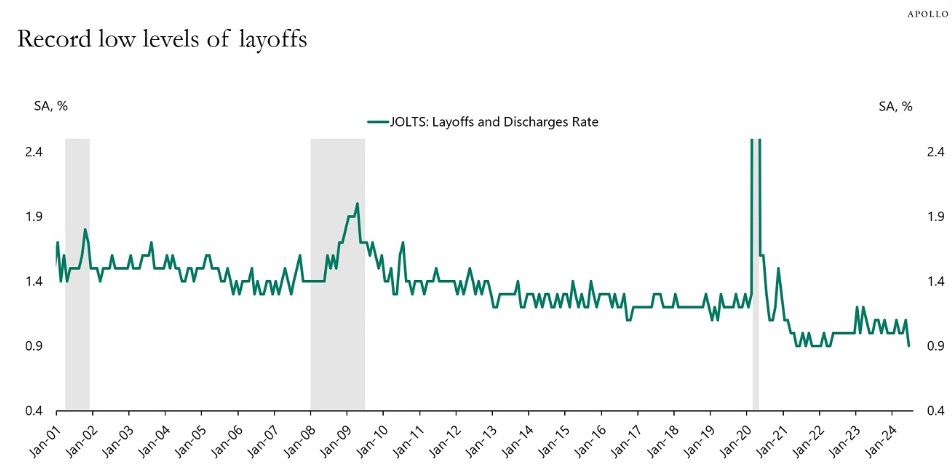

Likewise, while unemployment might be rising, it’s not because people are getting fired:

Firings are still incredibly low.

It’s a weird kind of unemployment that is mostly driven by people trying to break into the workforce—which still matters—but bigger picture, labor force participation is still incredibly high. The labor supply is still secularly tight (because we’re aging).

So, if rate cuts did “heat up” the labor market again, who exactly would firms hire to do the work? What juice is left to squeeze? And what would happen to wage growth (which has been driving inflation for the better part of three years) if the bidding war for workers started again?

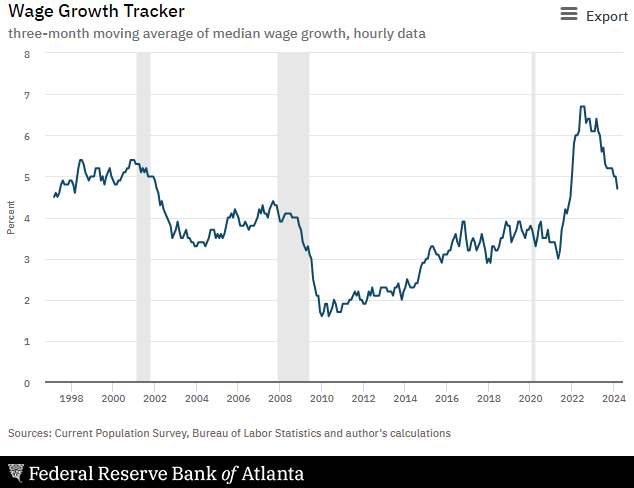

Wage growth is still above the prepandemic trend, which will make it awfully hard to bring inflation all the way back down to 2%.

At just under 5%, wage growth is still a full percentage point higher than it was before.

With ever increasing demand for healthcare workers especially, 2-3% inflation seems like the new normal.

But anyways, none of this is really the point. And the truth is that it’s awfully hard to predict such a ridiculously complicated chain of events that would provide much, if any, certainty to the question “what happens when rates are cut?”

“What happens?” who can say? What I can say, however, is that there is one very clear beneficiary from rate cuts. The biggest beneficiary of them all, even.

So, who is the one undisputed biggest beneficiary of rate cuts? No, it’s not the Finance Bros, although they’re probably feeling a little relieved.

The biggest beneficiary of rate cuts is Uncle Sam (and, in some ways, the Fed itself).

Let the charts do the talking:

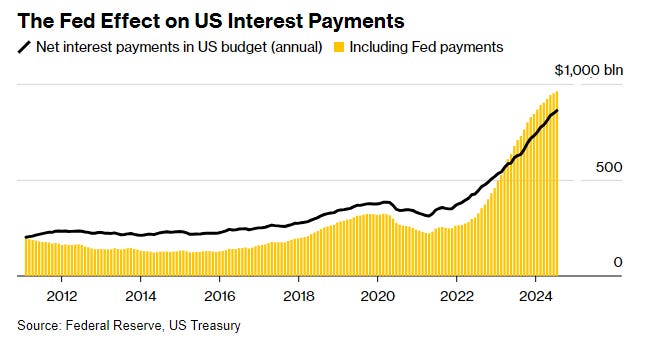

Uncle Sam’s skyrocketing borrowing costs

Uncle Sam’s borrowing costs have skyrocketed under its high rate regime:

Net-interest payments on the federal debt are close to a trillion dollar per year.

Uncle Sam’s interest payments are now 4X larger than what they were just 4 years ago.

It’s been one of the weird quirks of “tightening” that while higher borrowing costs are supposed to dissuade borrowers—and thereby “kill demand” and therefore prices—the policy presumes that borrowers are price sensitive. The quirky part is that the biggest borrower by a longshot, Uncle Sam, however, is completely undeterred by higher prices (in the short run, at least).

Uncle Sam just keeps on borrowing, and if the interest costs are higher, Uncle Sam just borrows more, because it’s already spending way more than it makes. So how does it cover the extra interest expenses? Uncle Sam borrows even more (and downward down the debt spiral we go).

Remember that the next time anyone on Capitol Hill tries to lecture “Wall St.” about profligacy and greed.

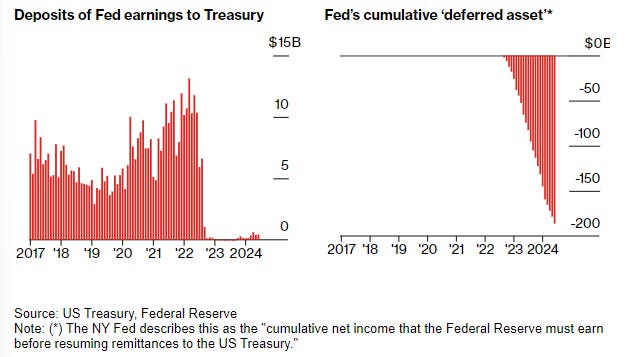

The Fed’s unrealized losses or PIK loans to Treasury

The other thing to remember is that while the Fed’s interest rate-rug pull caused some banks to fail—stupid, reckless banks that loaded up on low-yielding treasuries, which wouldn’t generate enough cash to cover the suddenly higher costs of deposits—no one got rug-pulled worse than the Fed itself.

You see, the leading purveyor of the stupid, reckless thing, i.e. loading up on long-term, low-yield assets, is the Fed.

And when the Fed moved rates higher, its cost of deposits (i.e. the interest it pays on reserves) skyrocketed too. Just like SVB, the Fed found itself paying more in interest than it was earning.2 If you pay more than you make, generally that’s bad.

So the Fed is losing money, but to whom? Where does the IOU go? It goes to Treasury, of course.

The Fed used to make money on its lending back when rates were so low. It would sent those earnings to Uncle Sam.

Now it just tells Treasury to “put it on the tab” in the form of a “deferred asset” (to the tune of ~$200B in total, at latest count).

The Fed’s IOUs to Treasury are now growing ~$2B/week.

Not only is Uncle Sam paying through the nose for its own debt, but the Fed’s own borrowing habits have turned from profit-maker into a loss-maker, and Uncle Sam is carrying that load too.

That is what Random Walk means when it says that Uncle Sam, more than anyone, benefits from rate cuts.

Well, the good news for the Uncle Sam is that lowering rates will help Uncle Sam with its interest bill, and help the Fed with the massive “unrealized losses” on its own balance sheet. Naturally, it’s gonna take a little more than 50 bps of cuts to turn that around completely, but it will certainly help a little.

This article was originally published in The Random Walk and is republished here with permission.