Originally published September 2021.

The case of the London and Paris office markets.

While the global framework of the Paris Accord is gradually being incorporated into national laws in Europe, incentives for property investors to take part in the reduction of greenhouse gas emissions are growing. Non-compliance with the new regulations represents a risk for investors to see their assets stranded either by law or directly by the market. Tools have been emerging these past few years to help investors grasp and anticipate the actions they will have to undertake to comply with the present and upcoming climate regulations, and thus limit the transition and reputational risks. Using the tool developed by the Carbon Risk Real Estate Monitor (CRREM), we translate the regulatory objectives into a financial risk premium that can be adjusted for each market and property type. The climate change-related transition risk results produced using this tool are quantified as a premium in basis points; similar to traditional real estate risks (ie, liquidity, capex, volatility, etc.). The objective is to enable investors to make the right investment decisions.

The EU adopted the 2010 Energy Performance of Buildings Directive (EPBD) aiming to achieve a highly energy efficient and decarbonised building stock by 2050, with indicative milestones set for 2030, 2040 and 2050. By analysing the current state of the building stock by property type and country, and by considering local characteristics that can play a role in the energy reduction and decarbonisation process (such as the profile of the energy grid), CRREM offers the possibility to assess both country-and building-type-specific GHG intensity and energy reduction pathways. For this transition risk premium, we focused on the energy reduction pathways. For Paris offices, for example, the energy reduction pathway aligned to limiting global warming to 2°C equals 44.5% between 2021 and 2040 according to the CREEM tool. Despite different starting points in energy consumption given in kWh/m²/year (214 kWh/m²/year for France against 220 in the UK), the reduction pathway for offices in the United Kingdom is similar. But does this mean that the transition costs, and consequently the transition risk premium, is to be the same for the two largest office markets in Europe, Paris and London? In this article, we will answer this question and quantify a bespoke transition risk premium reflective of the market.

“For Paris and London, to reach an energy reduction of 44.5% by 2040, the retrofit costs are €104/sqm on average”

The energy reduction pathway given by the CRREM tool can be translated into retrofit costs that vary according to key variables for investors: the property type of their asset, the country in which the building is located, the timeframe during which the investor will invest to reduce the energy consumption of the building and the technology available at that time for that purpose. First of all, having set the reduction pathway between 2021 and 2040 according to a specific country and property type, we will use a matrix to determine the retrofit costs for each coming year, in order to reach the dedicated target by the set date. The costs vary across the years as it takes into account upcoming technology advancement. For instance, for Paris and London, to reach an energy reduction of 44.5% by 2040, the retrofit costs are €104/sqm on average according to our matrix.

However, this matrix does not consider the differences of the construction costs among countries. The dataset published by the European Construction Costs (ECC) indicates that construction costs for offices in France are about 8% lower than in London due to the labour markets and other local regulations. To tailor the previous retrofit cost for each market segment, we use as a factor the construction costs specific for each country and property type, with the UK office as the reference. The results give us a cost of the energy reduction for the whole period, that we can divide by the number of years to display an annual figure.

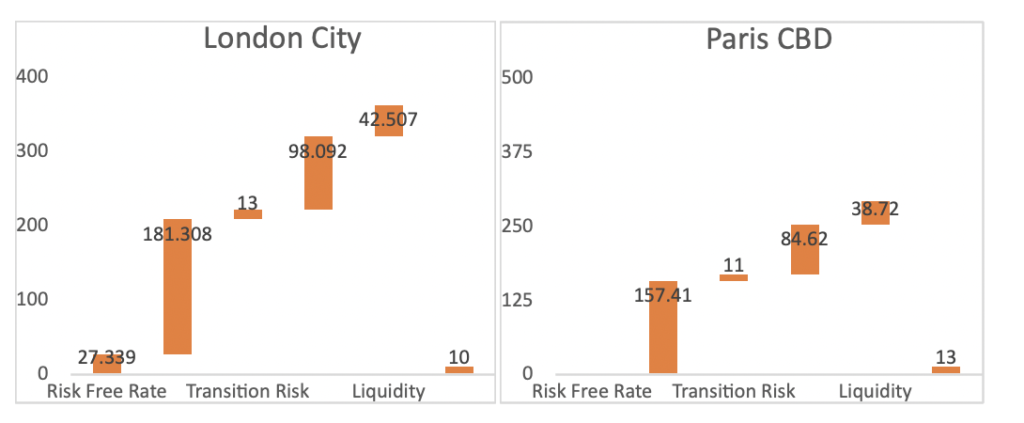

Finally, as €1 invested in offices does not have the same impact on returns as €1 invested in logistics, we related the retrofit cost to the average price per sqm per property type at the country level, using the RCA database. As a result, annual costs of energy reduction are displayed as % of the price per sqm. The percentage converted into basis points can then be added to our risk adjusted return analysis. This analysis consists of quantifying the risk premium associated with each market risk in real estate, ie, the risk-free rate, capex, net depreciation, liquidity and volatility. We call the sum of these premia, to which we can now add the transition premium, the required rate of return, ie, the minimal return that the investor should achieve investing in such a market.

Thus, whereas the energy reduction pathway for offices in France and the United Kingdom are similar according to the CRREM tool, the transition premium will be higher for an office building located in the UK than in France. This is due to the average capital values for real estate as well as the differences in construction costs. Consequently, as shown in Figure 1, the transition risk premium is lower for the Paris CBD office market than in London City, increasing the required rate of return for London City.

Figure 1: Required rate of return (RRR) vs expected rate of return (ERR), including the transition risk premium.

As shown for our two markets of London City and Paris CBD, the level of the climate transition risk premiums at 13 and 11 bps are very modest compared to the other risk premia required to attract investors to both segments. Also, for our entire 106 market universe the premia for capex, net depreciation and liquidity are well above the climate transition risk premium. In our analyses, we are trying to isolate, quantify and place the impact of climate transition risk inside our existing overall risk framework. In the end, climate-related transition risks are manageable and can be priced into transactions and portfolios on this basis.

Thus, the measurement of the transition risk will allow current and potential investors to evaluate the costs of the impact of these upcoming regulations as well as encourage such investors to consider another indicator in comparing commercial real estate markets across Europe. This is a first step to quantify climate change for property investors. The next stage to consider would be price physical risk as climate change is expected to increase natural hazards.