Once a month we will bring you an interesting chart with a short commentary. Our aim is to illuminate the corners of financial markets.

This time really is different – US unemployment is ‘off the scale’

The sheer scale of the economic heart attack caused by COVID-19 can be difficult to grasp, especially when the sun is shining and lockdowns are starting to ease.

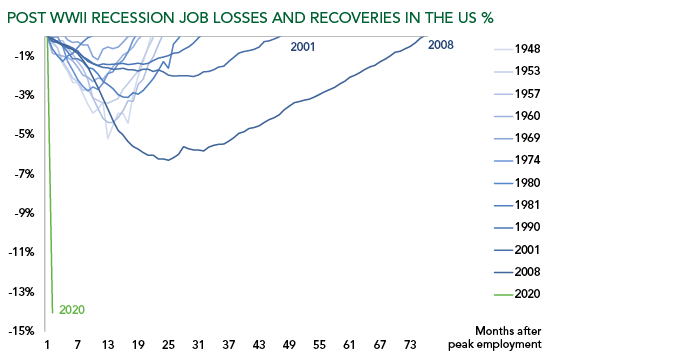

But this month’s chart of job losses and recoveries in US recessions since the Second World War brings home the enormity of the damage.

For years we worried about the record job losses, and then the slow recovery, following the 2008 financial crisis. Now that looks tame compared to the sudden stop caused by the pandemic.

A massive shock requires a massive response. The sudden fall in wages has been plugged by governments with furloughs and other benefits, making this, for now, the recession where no one feels worse off. But this cannot last and governments are already planning to scale back income support.

This makes the shape of the recovery absolutely key to understanding the scale of the economic damage and how much government spending (and borrowing) will be needed in future. But never before have the major economies been deliberately crashed to control a pandemic, and this sudden stop creates genuine uncertainty as to what the recovery will look like.

There is a veritable alphabet of predicted recoveries, from ‘L’ shaped, to ‘U’ and ‘V’. But the truth is no one knows. Forecasts of a V shaped recovery, with business rebounding straight back to previous levels, look unrealistic without the immediate discovery of a vaccine. However, we can expect a rebound in activity as lockdowns are lifted, just not back to pre COVID-19 levels. Social distancing, or even just entirely sensible social caution, will leave many businesses operating well below capacity. This means job losses and leads to less money and spending overall in the whole economy. Unless governments continue to intervene, the economy will shrink, even once we get out of lockdown.

What can governments do to offset this? We already know the answer: keep spending and keep borrowing. This, in our view, will lead to inflation, so we at Ruffer hold inflation-linked bonds and gold to preserve the real value of our investors’ savings.

In the meantime, we are wary of the rapid bounce back in some equity markets. Does this really reflect the reality of post pandemic economies, or is it just the sugar rush of central bank liquidity hitting markets? Shouldn’t the money be going into protecting jobs, or healthcare? Into the real, not the financial, economy?

We think this makes a strong case for a decent dose of caution in investing. Not putting all your eggs in one (equity) basket and instead looking to active asset management to navigate through these uncertainties. This approach has so far enabled Ruffer to steer its clients safely through this crisis, and we believe it will be key to navigating the problems ahead too.

Article originally published by Ruffer.