Once a month we will bring you an interesting chart with a short commentary. Our aim is to illuminate the corners of financial markets.

TINA turning?

Rising returns on cash may cause investors to withdraw from riskier assets such as equities and corporate bonds

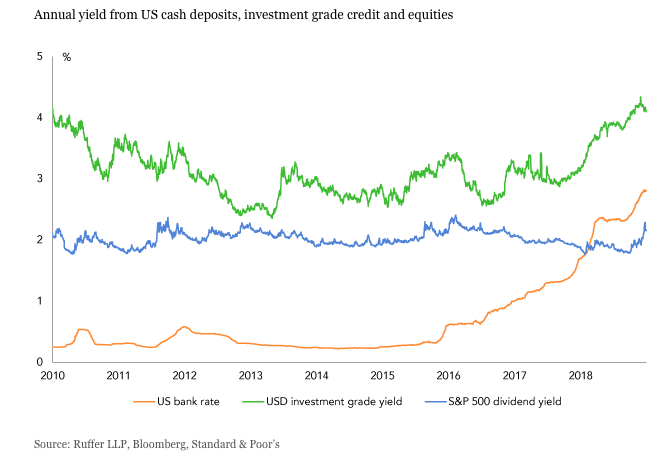

Ever since the authorities cut interest rates around the globe to zero (or near zero) in the aftermath of the credit crisis there has been a strong incentive for savers to hold risky assets. With cash in the bank effectively yielding nothing, savers seeking any income were forced to buy riskier assets, predominantly equities and corporate bonds. This became known as the TINA trade – as in ‘there is no alternative’ for investors seeking any sort of income from their savings.

Unsurprisingly this increase in demand from normally cautious savers has pushed up equity prices and lowered corporate bond yields. For example, pre-crisis the yield for investment grade US corporate bonds was normally in the 5-6% range, rather than the 2-4% level seen in recent years.

Now however, as the chart shows, there is an alternative. In the US at least, interest rates have risen steadily and offer a ‘risk free’ income of almost 3%. This is now not so far behind the income yield available from corporate bonds, with all their credit and liquidity risks.

Since 2009 the amount of money held by ordinary investors in US corporate credit mutual funds and exchange-traded funds (ETFs) has exploded from about $500 billion to almost $2.5 trillion*. At the same time, as we highlighted last month, the quality of this debt has deteriorated materially. Savers have flocked to these corporate bond funds and ETFs in such size because of the lack of any alternative source of income. These flows could easily reverse now that cash offers a decent alternative.

It is not just corporate bonds that are at risk from the allure of higher interest rates on cash. Last year just leaving cash safely sitting in the bank gave a higher yield than holding US equities. As if to confirm this savers have started to vote with their feet. As US rates have risen, private investors, along with mutual funds and institutions turned net sellers of equities in 2018. Only record levels of share buy backs from corporates, often funded with yet more debt, supported US equities last year.

Of course, such a return on cash in the bank is only available in the US with interest rates remaining rock-bottom elsewhere. But investment is a global industry and the US by far the biggest market, so any shifts in savings there will be felt around the world. The fact that cash is now an alternative option for savers is one of the reasons why at Ruffer we currently hold only a cautious 35% allocation to equities in our portfolio and have invested in protections against disruptive moves in credit markets.

Article originally published by Ruffer.