How long can it last?

Visiting logistics facilities is a big part of my working life. Not my favourite part – memories of teenage nights spent toiling away in a Shropshire butter factory may have something to do with that – but a necessary one in this booming sector.

Demand for logistics has never been greater. Whether it be mid-year annual returns hitting 23% in the United States or Birmingham becoming one of Europe’s top 10 traded markets, wherever you are, this sector is on fire. Rents are rising, yields are falling and logistics values are hitting record highs in almost every market we cover.

This is nothing new. According to our estimates, logistics has been the top performing sector globally for nine of the past 10 years. However, after such a long bull run, we see nervousness creeping into parts of the market. Investors are understandably asking just how long things can proceed at this pace.

“There are few good reasons to suggest this bull market is coming to an end”

Right now, there are few good reasons to suggest this

bull market is coming to an end. Investment momentum shows no signs of slowing, while near record low vacancy across Europe and the United States suggests rent will continue to move higher. On this basis, our latest forecasts show logistics topping the global hierarchy until the end of 2024.

Great news for those holding logistics, but not sufficient for a universal buy call. With yields at record lows and trending lower, expectation of higher rents seems implicit within current pricing. Indeed, strong and sustained rent growth is likely to be a key component of most acquisitions being underwritten today.

Why wouldn’t you make this assumption? Ecommerce growth looks to be a one-way bet and while no one exactly knows the future path of online sales, it seems pretty clear that we’re still a long way away from the peak. Recent increases in logistics operator costs may curb some of

the demand, however, many of these factors are likely

to prove temporary and are unlikely to be a major drag

on performance.

We do, however, need to keep a close eye on supply. With prime values in Europe doubling since the start of 2015, there is a clear incentive for developers to build. And indeed they are. Ten years ago, European construction was running at about 2% of stock, a figure that has trebled over recent years.

So far much of this supply has been constructed on a build-to-suit basis, but given the level of investor appetite, there’s a high chance we’ll see more speculative development coming to the market – particularly in those locations with fewer barriers to entry.

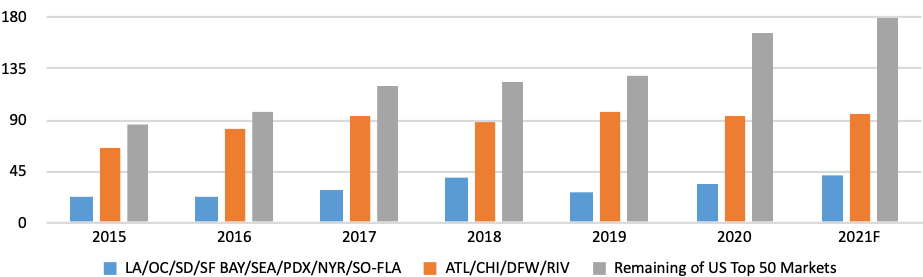

This story is repeated in the United States. Again the market is currently highly constrained, but with vacancy at or near record lows in many larger US markets, we see future logistics capacity growth being pushed into less constrained regional hubs, such as Salt Lake City and Las Vegas, as well as into southern New Jersey and Pennsylvania in the northeast.

The chart below highlights the shift, beginning in 2020, away from coastal markets and the national logistics hubs. These expansion corridors may ease rent growth in less densely populated areas, where facilities can more easily be substituted within a region.

Overall, we remain firmly in support of the logistics sector in the US and APAC. Australia and Korea continue to offer a healthy yield premium over other parts of the globe. And, while future returns in the US are unlikely to match the expected highs of this year, with annual rent growth forecast to be close to 5% until the middle of the decade, the sector looks well set for continued strong performance.

“The next few years should be strong and indeed we may be underestimating future rent growth”

We see a less compelling investment case in Europe. With lower consumption growth than both the US and APAC, and prime a yield almost in line with offices, we forecast European logistics performing in line with the market average over the coming decade. The next few years should be strong and indeed we may be underestimating future rent growth, but with supply increasing and entry yields sinking into the mid-threes, core investors could struggle to meet return requirements.

Our headline view on the European market is certainly not true in all locations – cities such as Paris and Milan continue to command overweight calls – but on the whole we are more cautious.

I’ve written in the past about Last Mile and Last Hour locations, and we continue to expect excess rent growth in these urban locations in Europe. However, accessing these opportunities is not easy. There is development – including the conversion of redundant retail space as an option – but on the whole many investors will find it difficult to build at scale in this part of the market.

In all regions, we still favour an active management approach – taking on development and letting risk. This may seem counter-intuitive given the concerns over new supply, but with today’s low vacancy there remains a window. In core locations this approach may offer only a limited return premium, and we often see better risk-adjusted opportunities in less established but fast-growing markets, such as Fukuoka (Japan), Busan (Korea) and the second-tier Polish cities.

Despite our increased caution towards the European logistics market, we’re a long way from having a generalised underweight call. We see areas of opportunity and over the longer term we remain convinced logistics will form an increasingly large part of the investable universe.

Nonetheless, this is a good time to step back, take stock and even consider sales. This is not an easy call to make. With question marks over the future of retail and office, where to redeploy this capital is not necessarily obvious, and at a time when the logistics market is still providing double-digit annual returns, investors will certainly worry that they’re leaving too much on the table.

“The strength of investor demand in today’s market provides a clear opportunity to reduce exposure to non-strategic assets at an attractive price”

But, while this fire may burn bright for a few more years, the strength of investor demand in today’s market provides a clear opportunity to reduce exposure to non-strategic assets at an attractive price. Even at the best of times, not all parts of the market have outperformed. If and when performance starts to moderate, this will become even clearer. Now is a good time to get prepared.