When looking at a chart of the S&P 500, you would think we were entering a depression or nearing the apocalypse. But what are the real impacts of a pandemic like covid-19? The stock market is an easy gauge to follow for sentiment, but how well can it measure the actual economic impact?

Using data from prior pandemics, I will quantify the estimated impact of the current covid-19 crisis. I will also provide a cost-benefit analysis of preventing future pandemic outbreaks by comparing investments in the necessary precautions and infrastructure to the expected economic fallout and ‘repair costs’ incurred by governments and central bank interventions.

While I’ve never lived through an epidemic of this size (I was not born quite in time for the Spanish flu of 1918), I witnessed firsthand the fundamental economic impacts throughout central and eastern Europe following the fall of the Iron Curtain. Working in an advisory role for Price Waterhouse, I’ve had to value many things that most thought were unquantifiable. Helping to stabilise and develop real estate businesses during and after the 2009 global financial crisis put me into a similar dilemma, especially when there was no reference point or actively traded market available.

What does recent pandemic history teach us?

Pandemic risk is a combination of low probability (est. 1-3% p.a.), infrequent occurrence, and – depending on prevention and containment measures – high to severe economic impact (up to $3trn). While pandemics have been observed in different forms and shapes throughout history, one common element is their constant underestimation combined with public complacency.

However, the unfolding covid-19 crisis made it painfully clear that in today’s globalised and interconnected world, the risk is much more prevalent than ever before. The latter is probably the most distinguishing factor of covid-19 compared with other, more localised pandemics in the past 100 years. As a result, almost every country around the world has been affected, among them large, developed economies like the US, Western Europe, and Japan. Compared with the SARS outbreak almost 20 years ago, this time the impact is felt directly in these advanced economies due to significant loss of human life and full-blown economic impacts.

So, why does this matter, one might be tempted to ask?

Let’s take a somewhat cynical view of the world and assume that the costs of human life are mostly a concern of the actuary profession and barely featured in daily political discussions. However, shedding billions of dollars of stock market valuations within days with the potential to put 30% of the workforce (and electorate) out of a job gets a lot of attention.

How do we quantify the economic costs of a pandemic?

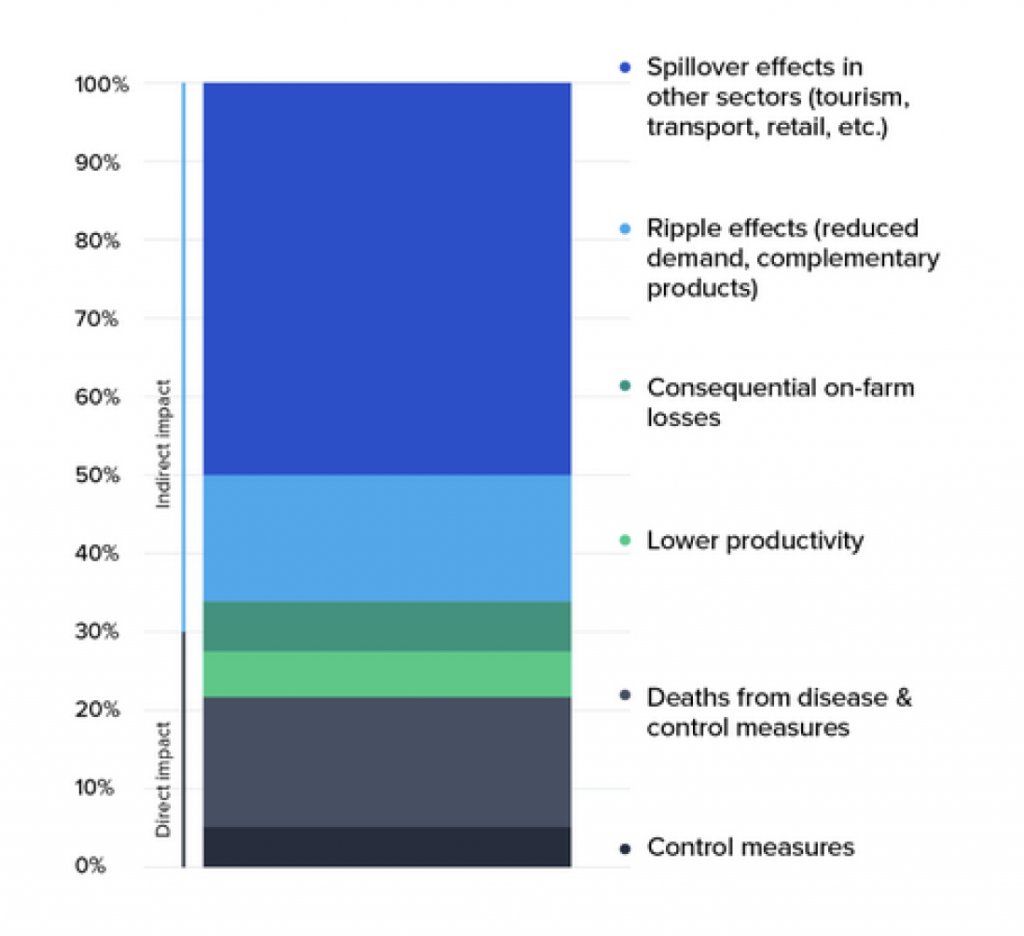

Let’s start with a cost breakdown using an animal disease outbreak as a proxy, which, based on what we know so far, closely mirrors the cause-and-effect relationship in the current covid-19 outbreak. The World Organisation for Animal Health published a study analysing avian flu outbreaks in South America, Asia, Europe and Africa in 2007, which quantified direct costs and losses as well as indirect impacts including ripple, spillover, and wider societal impacts.

As illustrated, 70% of the overall cost impact is indirect but fully attributable to the underlying contagion. Herein lies the biggest dilemma. The diffuseness and time lag (typically one to two years) of occurrence make it rather difficult to identify and measure the full impact. Special circumstances like the First World War (for Spanish flu, 1918-20) or the sheer lack of data (as for Asian flu, 1957-58) are additional factors that explain past political complacency.

Direct and indirect cost impacts of a pandemic

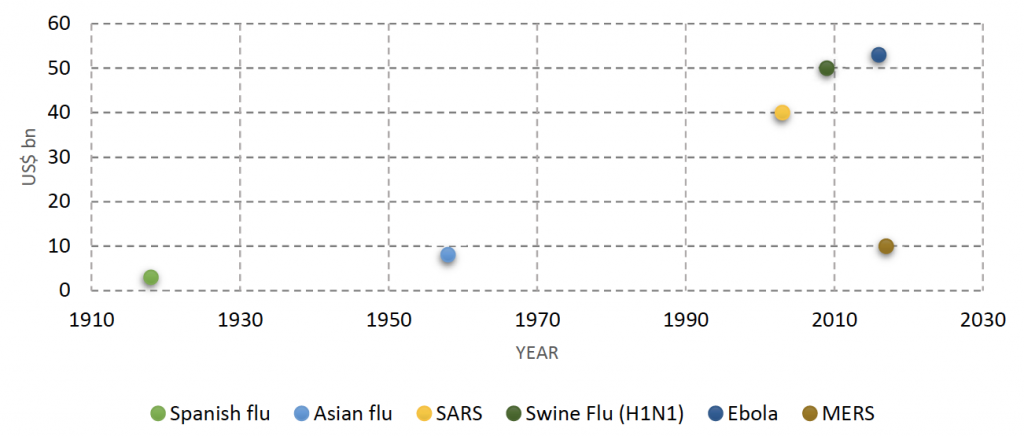

The following provides a summary of major past pandemics that occurred throughout the past century and the associated estimated total economic and social losses.

The costs of pandemics

(estimated total economic and social losses)

This concludes Part I. In next week’s Part II we will look at the economic fallout of covid-19, consider the capital market feedback and map the way forward.

Stay tuned.