My father always encouraged me not to join a political party, nor to reveal my voting preferences for fear of being unable to engage across the political spectrum. That has proven good advice over the years, and I have been fortunate to have had good relationships with many politicians across the political divide.

As an investor, it surprised some of my peers that I have held several “contradictory” political positions over the years. For example, I have found myself arguing on the one hand for what might be perceived as right of centre policies, and on other occasions, promoting policies that might be considered left leaning.

In that light, it might not surprise the reader to hear that I describe myself as something of a floating voter, believing that if any political party’s views veer too far toward the horrors of either financial or moral bankruptcy, they need to be quickly nipped in the bud for the greater good of society.

I wish however that I felt more optimistic. We have to wait to see if we have a new prudent left of centre economic philosophy which can genuinely improve things for the majority, or whether we have elected a wolf in sheep’s clothing. This is democracy of course, and fair play to the victorious, but whether we have the former or the latter is going to matter an awful lot to everyone.

In evidence, I have been particularly struck by some recent analysis indicating that the UK is predicted to suffer the greatest loss of millionaires from its shores of any country in the world by proportion of current population in 2024, and that leaves me feeling more than a little nervous.

A new chancellor, our first female and by all accounts, a prudent and cautious individual, will understand how serious that is and one hopes that she will do much to try to arrest this emigration.

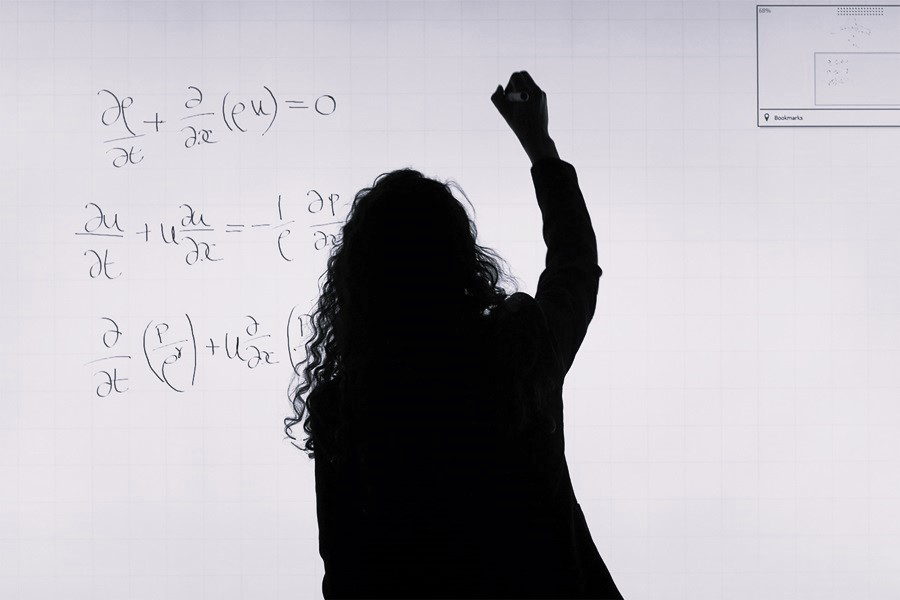

There will be many mathematical formulae that Ms Reeves will bring to bear, but one of the most important will be to understand a simple one: 100% of nothing is always nothing. Aggressively taxing the country’s now ultra-mobile rich will likely come just as unstuck as failing to invest efficiently in public services.

Policies today need to be far more sophisticated than those of the old left-wing/right wing arguments that my generation had to become accustomed to. It was therefore deeply underwhelming to hear those old ideals rear their ugly heads again during the election campaign. Proposing a reduction in tax at a time of failing public services was a crass policy idea, but no more crass than proposals to massively increase tax on those that are capable and indeed are leaving the country.

Thankfully, Ms Reeves will understand this dilemma all too well having worked, albeit in only in a junior position and for a short time, at the Bank of England. She will therefore understand the dual mandate of inflation control and financial stability and the evils of getting either or both wrong. I for one therefore at the outset of this new Labour government, will travel hopefully, though not optimistically, that she will find a sensible balance. She starts well in my view, though of course we have yet to see a Budget.

Let us hope therefore that her boss, the new prime minister, not known for either his grasp of economics or his long-term commitments to anything other than becoming prime minister, will leave her in place long enough to explain to some of her comrades that a tax and spend regime so beloved of prior left-wing chancellors will not work now in our ultra-mobile world. The markets understand that 100% of nothing is nothing, and the long end of the yield curve will shortly tell us all we need to know. Whatever your politics, we should wish her well.