Whilst working in “The City” has provided me with a great many things, there is one that I most cherish; it introduced me to colleagues, who quickly became friends; and remained so, even once our careers separated us (full disclosure, there were colleagues for whom I formed not friendship, but fierce enmity, even whilst working together).

Now, though I may not terribly often meet a former colleague turned friend, when our paths cross by intent or chance, our chats are almost seamless from when we last met.

It was not by chance but design, that I had breakfast earlier this week with the charming Phillip Wale. Though our working together may have happened over 20 years ago, I consider Phil amongst the most engaging people I have met in 33 years of working in commercial finance.

Back in the late ‘90s, Germany’s fourth largest bank was on a mission to catch-up in the investment banking race, which its larger rivals were already sprinting forward in. To make-up lost ground as it were, Commerzbank generously spent out of what had until then been a conservatively protected balance sheet.

Just as Phil had been poached from Goldman in a great PR coup, where he was a dynamic market maker, my team were baited from Credit Lyonnais where we were number one rated in UK quants, and yep, it was in the FT.

More widely, in a whirlwind of hirings, generous Commerzbank cheques were written liberally. One particular favourite hired duo on research was Chris “Student” Grant and Matt Unsworth, whilst on sales, there were Allister “Malcy” Malcolmson, Andy Crane and Glenn Coltart. There were indeed far too many such hirings, to name check all those who got a nice large “Comedy Bank” cheque.

From not figuring at all, Commerzbank began to appear ever higher in investment banking activity rankings. Were we mercenary in joining this upstart? Course. Could we resist? Don’t be ridiculous. Was it good for our careers? Well, my team achieved a number one in European quants so it wasn’t only the money that took me to Comedy, though it did help.

Now during my pleasant brekkie with Phil, we not only discussed old German times, but older ones. We reminisced how, before the Germans, it was the Japanese who had stormed into the UK and spent heavily in investment banking.

As previously the Japanese banks flooded in, they upwardly reprised London’s commercial real estate and recruitment. New members from the land of the Rising Sun raised golf course tee-fees and house prices in Maida Vale and wherever they opted to live. Across central London wine bars introduced karaoke; the near comatose pm natures of Japanese management, clear testament to late night warbling at the mike, sake shots in-between.

Anyway, like Phil I found myself being offered job after job by the Japanese banks charging into London, generous cheque books in hand. And though I didn’t decide to take any of the offers, they provided leverage to renegotiate.

Now as we know it all ended badly for the Japanese, as it would for the Germans, French, the Dutch and even the Icelandic’s, who came into The City with ludicrous ambitions and offering lucrative contracts; rewarding for all on the gravy train.

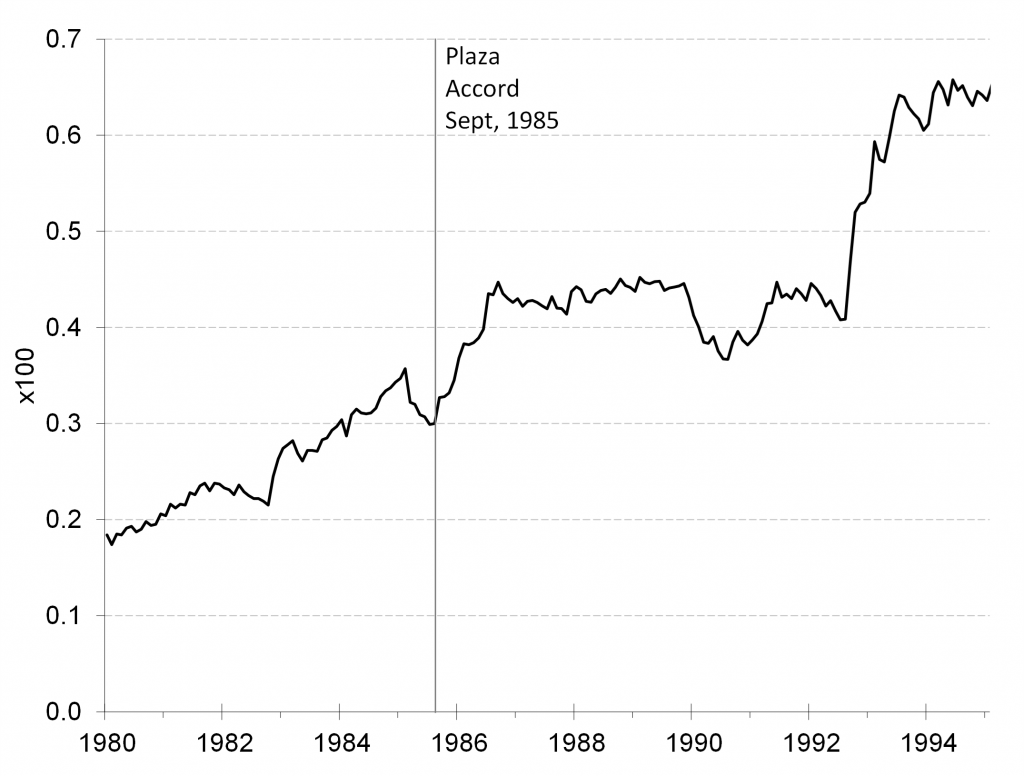

What the chat with Phil brought up was how for the Japanese, and then the Europeans, entering The City had been made ever so cheap by an ever so cheap £. Chart 1 reveals over the ten years from ‘85 the ¥ trebled in value against sterling. For its part, the £ plummeting against European fiats on being exiled from the ERM, made it open season on all things British.

Chart 1: GBP to JPY, then

History will repeat. For the next invasion into The City will come from China, and make all earlier episodes look like mere side-show dress rehearsals for the Big one. Aussie/NZ, Canadian, Malaysian, Indonesian and a plethora of banks with big balance sheets and big ambitions to enter the global Investment banking/Asset Management stage will all want to perform on the London stage. Just wait until these open their cheque books to take up real estate and recruit.