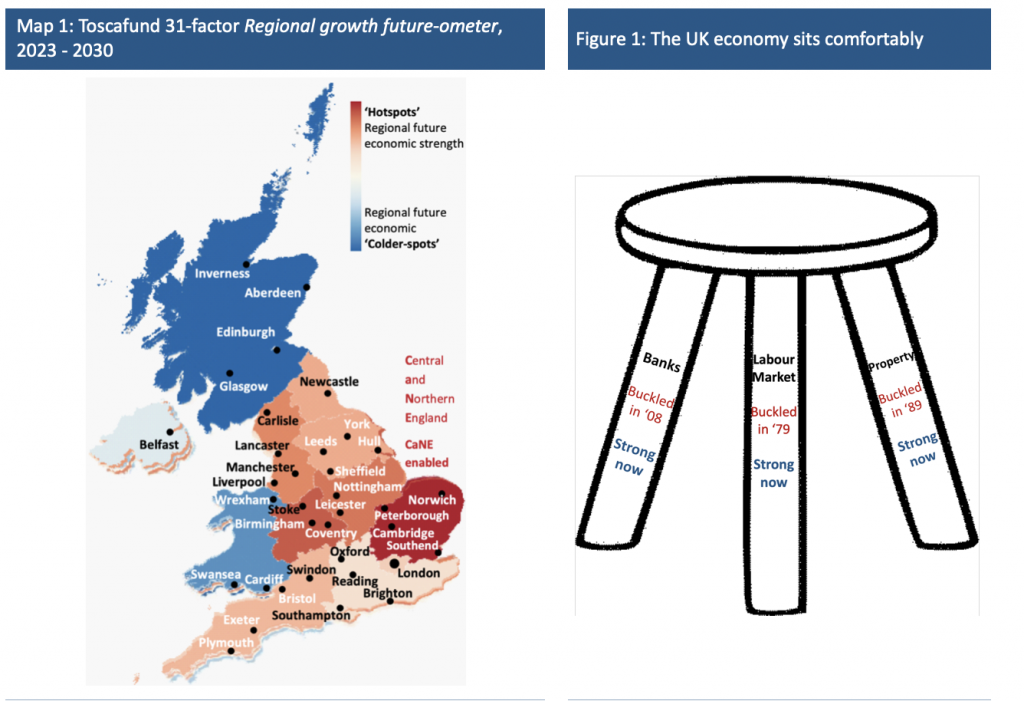

Back in April, we released The UK Economy over Time (‘23 – ‘30) & from Place to Place, which made the case that in the years to 2030, Central and Northern England (CaNE) would record the strongest economic performance of the UK’s 12 regions. Much has, of course, unfolded through the intervening months; lots seemingly unfavourable for the UK economy in aggregate. In the light of the darkening economic clouds building over Britain, there will no doubt be those asking whether our view of CaNE – being the UK’s chief outperformer in future economic growth terms, map 1 – has altered.

Well, to be clear, the piece was penned after the war in Ukraine had already begun. It was written, however, before the UK entered yet another period of political ‘turmoil’. Surely this must force us into downward revisions and accept recession is now inevitable? Well, this is our rejoinder to those who cite the latest political drama as coming at the very worst of times – plus ça change.

Please consider the period since 2010. None can deny how over these years UK politics has for the most part been torturous to watch. And yet, as torturous as matters have been politically – four general elections and three referendums, creating varied forms of uncertainty – the UK economy Kept Calm and Carried On. Even in its somewhat erratic exit from lockdowns – which it should never have endured as it did – the UK has for the most part exhibited no worse signs, and in many instances better ones, than other developed economies.

“Without playing down the challenges which have recently hit it, the UK economy is fundamentally sound in all its key macro elements”

Many others have taken red pens to forecasts for the UK economy, doing so in large part because of the economic headwinds stirred up by what has unfolded in Ukraine and the all-change at Downing Street. We, however, continue to see things very differently, for without playing down the challenges which have recently hit it, the UK economy is fundamentally sound in all its key macro elements. While it may seem a crude or odd representation, one could picture the UK economy as a three-legged stool (figure 1). On three occasions since 1979, one of these three legs has buckled and in doing so has not simply toppled the UK’s stool, but buckled the other two legs to bring the whole economy crashing down. For a raft of reasons, the UK economy now sits comfortably supported by three strong legs.

The UK labour market is sound, as evidenced by job creation and pay growth. This strength is evidenced further still by strike action, which will result in workers getting their just rewards.

For its part, the UK’s varied property markets show no signs of stress in terms of excess supply and evidence of robust occupational demand. Sure, SME’s face higher energy, labour and general costs. This accepted, those involved in manufacturing have a competitive currency and lots of inventory to refill; this demand to rebuild supply lines will help drive revenue growth and generate operational growth benefits. Across consumer-facing businesses, the same challenges will, of course, prove headwinds. This accepted, the simple truth is that the appetite of UK consumers – those in it and those travelling to it – remains strong, retail sales data proving a poor measure of just how strong.

If one turns to the UK’s banks, here too the evidence is reassuring, as it is in the UK’s insurance and pension sectors. True, rising interest rates could become problematic. No less true is the fact that rates lifting off from rock bottom has come as a welcome relief to net interest income for banks and capital provisioning for pension and insurance funds; this edging-up occurring after far too long sitting at an ultra-low base. As to where the base rate will peak, none should be concerned by 3.5%.

Yes, we are currently facing living costs rising much faster than our incomes. This accepted, I have no doubt that this time next year, real wages will be rising and will continue to do so into 2024 and beyond. True, we are being driven to distraction by the higher cost of fuelling our cars than we have enjoyed in the recent past. No less true is that this surge has all the more fuelled the downwards move in our own driving – propelled by the surge in Uber and the like, as well as the street-side availability of scooters and bicycles.

Yes, there is a fear the UK economy descends into an upwards monetary spiral, where rising prices lift wages, which lifts prices all the higher and so on, and, oh dear, here we are back in the 1970s. No, the 70s are not returning, because we have moved so much on from then. The UK no longer relies on low value added manufacturing of products it fails to be competitive in. We have reached a point where the goods we make are much more cerebral in nature and in many instances are positionally unique in their delivery. And, however one judges the position the pound finds itself, it puts it in a place less threatening to import inflation as encourage the export of goods and services, and arrival of tourists and students.

Yes, we are facing frustrating and inflating supply-chain disruptions. These will, however, only encourage greater efforts to invest in improving the UK’s supply security. This will drive demand for a wide range of workers and real estate. And yes, of course rising wages will have to be borne by firms and the state. Borne they will have to be, but higher wages will not prove too heavy a burden against the backdrop of an economy growing well ahead of expectations, and generating higher corporate revenues and higher tax receipts.

War is sadly ravaging Ukraine and spreading problems across continental Europe. But this will actually all the more encourage those EU nationals who left the UK when coronavirus stuck to return; their settlement status providing no friction in doing so. It seems that the Exchequer will once again have to write cheques to compensate/cushion us from an external shock. And while none should want to see the accumulation of state debt, if it allows the economy to perform, then this allows it to pay the debt down.

We are in a political maelstrom where the UK could soon find itself with a coalition Government, with the Lib Dems wielding power and calling for a referendum on altering the voting system. There is also the prospect of the SNP demanding a referendum on Scottish independence. In that case, all I will say is that would take us back to 2010 and the beginning of the dozen years of uncertainty leading up to now. And yet, from 2010 until now, the UK economy performed well despite all the theatricals unfolding in the political arena.

I am in no way playing down the headwinds facing the UK, I am merely pointing to how the UK economy writ large has always had its challenges and has somehow managed to grow despite them. So, yes, we face the prospect of having questionable competence in Downing and Threadneedle Streets, but is this any different from a mere five years ago?