The prevailing build-to-rent (BTR) model has been seen in various jurisdictions across the US, UK, Canada, Japan, Australia and Singapore in recent years. This unique format has been modelled as ‘multi-family real estate investment trusts (REITs)’ or ‘apartment REITs’, as one of the sub-classes of residential REITs in the US. Within a Pacific Rim BTR-based portfolio, the US and Japan were more significant than Australia and Singapore, according to a new analysis published in my PhD thesis.

Key players of Pacific Rim BTR

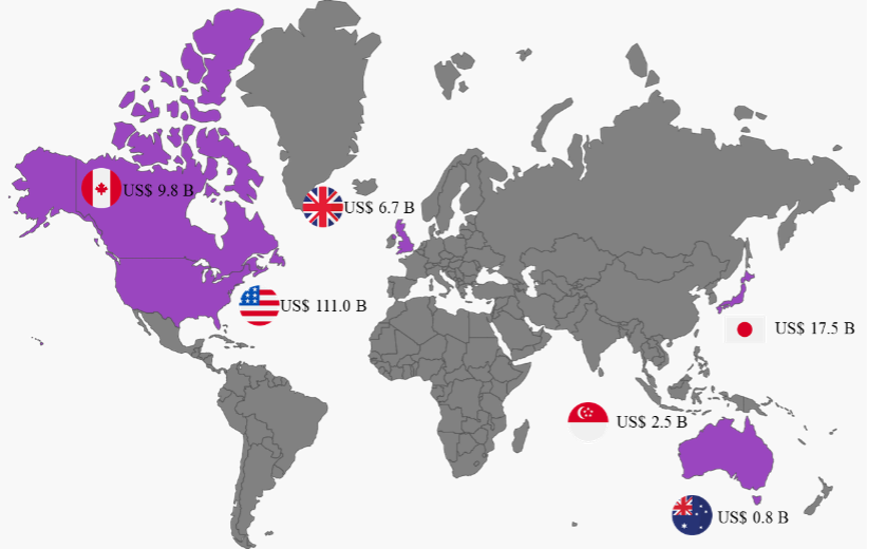

Five of the top six global BTR sectors are in the Pacific Rim region. The Pacific Rim region constituted 93.1% of the size of the global BTR market in 2018, according to my constructed database, with consideration of survival bias. These include the US (US$111.0bn), Japan (US$17.5bn), Canada (US$9.8bn), Singapore (US$2.5bn) and Australia (US$0.8bn). Strong growth of BTR has been evident in the Pacific Rim region. Pacific Rim BTR has increased from US$28.3bn in July 2006 to US$141.7bn in December 2018, with a 501% increase. Particularly, Japan has grown by 649% since July 2006, followed by the US (541%), Canada (327%), Singapore (268%) and Australia (72%).

Players of Pacific Rim BTR are Equity Residential (US; US$30.0bn), AvalonBay Communities (US; US$29.2bn), Essex Property Trust (US; US$19.8bn), Daiwa House REIT (Japan; US$4.3bn), Advance Residence (Japan; US$3.7bn), Nippon Accommodations (Japan; US$2.3bn), Comforia Residential REIT (Japan; US$1.5bn), Kenedix Residential (Japan; US$1.2bn), Ascott Residence Trust (Singapore; US$1.7bn) and US Masters Residential Property Fund (Australia, US$0.4bn).

Investment performance of Pacific Rim BTR

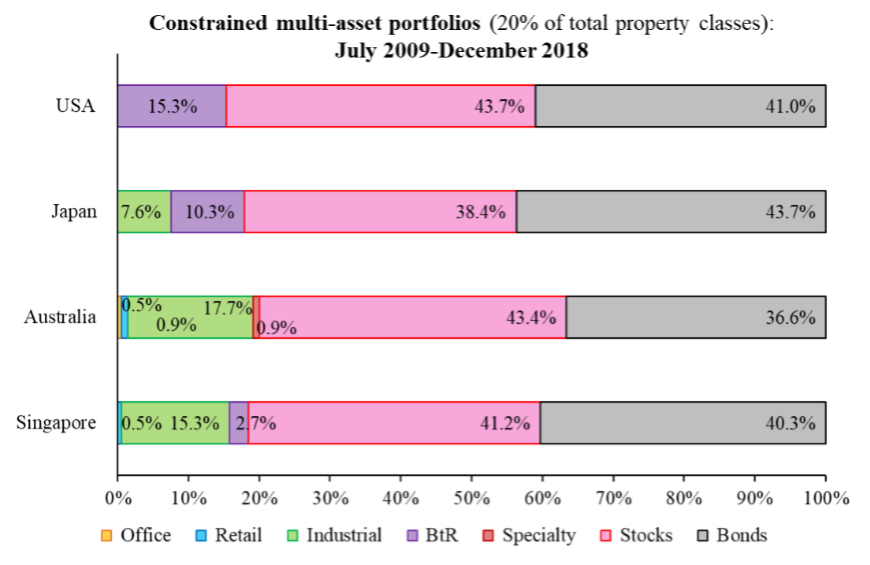

The strong investment performance of BTR was validated as an attractive investment asset coexisting alongside the major asset classes in institutional investors’ portfolios across the US, Japan, Australia and Singapore, offering desirable portfolio diversification benefits with both stocks and bonds for institutional investors seeking portfolio diversifying in each case.

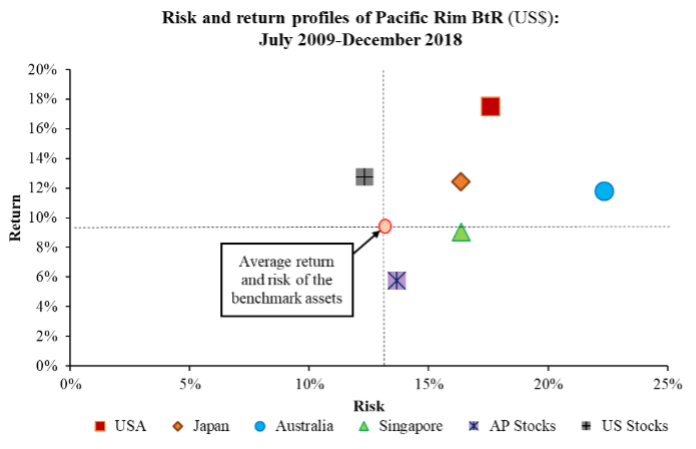

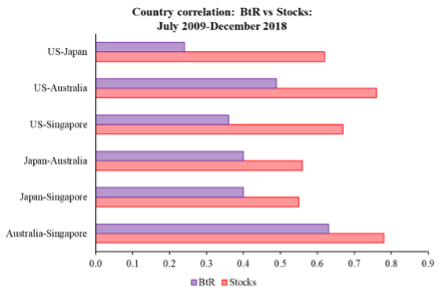

One could make a case that a fund, particularly REMFs and international real estate investors, could have a mandate to invest in regional real estate portfolios from a practical point of view. Thus, the Pacific Rim BTR-based portfolio was constructed and analysed. The US contributed the highest average annual returns at 17.5% p.a., followed by Japan (12.4% p.a.), Australia (11.8% p.a.) and Singapore (9.0% p.a.). The annual risk for Australia (annual risk = 22.4%) was the highest in the region, ahead of the US (17.6%), Singapore (16.4%) and Japan (16.4%). A cross-country BTR investment strategy (average r = 0.42) offered 24% more effective geographic diversifications compared with an inter-stock investment framework (average r = 0.66).

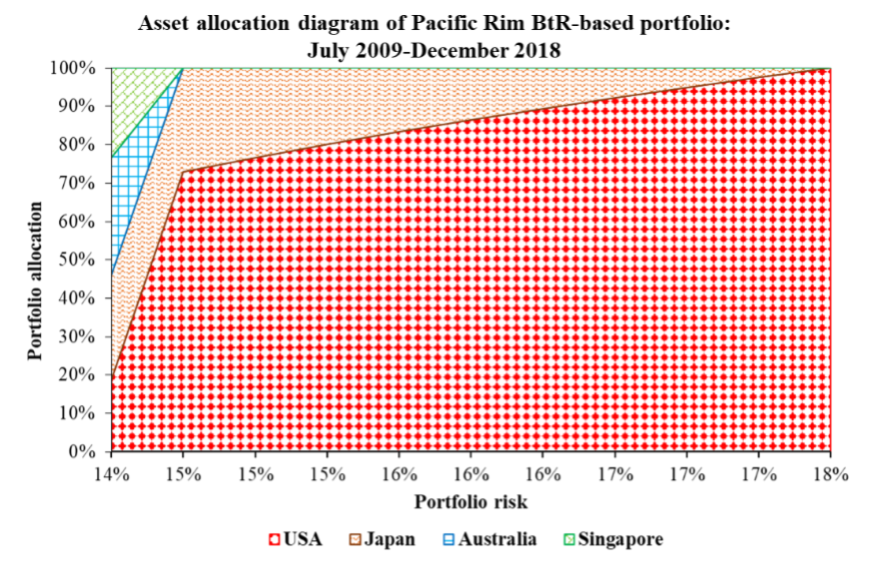

Particularly, international real estate investors can obtain the highest geographic diversification benefits by a US-Japan approach (r = 0.24), followed by US-Singapore (r = 0.36), Japan-Australia (r = 0.40), Japan-Singapore (r = 0.40) and US-Australia (r = 0.49). Within the regional BTR-based portfolio, the US (an average allocation = 81.1%) was dominant across the entire risk-return spectrum, reaching a maximum level at the highest risk-return level and softening Japan (14.0%), Australia (2.8%) and Singapore (2.1%) in the lower end of the risk-return spectrum.

With consistent income and attractive dividends, Pacific Rim BTR has recently attracted a high level of international institutional investors (e.g. PE funds, insurers, pension funds, SWFs) seeking income-focused investment assets in the region. This has been further validated by recent BTR transactions in the region, according to Real Capital Analytics and IPE Real Assets reports.

In Japan, Blackstone focused on a BTR investment strategy and purchased a BTR portfolio from Anbang in 2020, with a record of US$2.8bn. Nuveen Real Estate teamed up with Kenedix to add BTR assets for US$226m in 2020, as well as Allianz Real Estate’s US$1.2bn purchase of multi-family assets in 2019. In the US, Brookfield acquired 18,500 multi-family units from Forest City in 2018, with an acquisition value of US$6.8bn. Meanwhile, Greystar also completed a BTR transaction with EdR for US$4.6bn.

Compared with the US and Japan, Australia has received less attention from cross-border investors, due to Australian tax settings regarding the land tax and withholding tax, as well as a high annual risk level. In Australia, Greystar and Oxford Properties joined BTR projects in Melbourne in 2020 for US$400m and US$450m, respectively.

In short, these have seen Japan and the US as a hotspot for BTR acquisitions in the region. The recent market trend has been echoed by the analysis of strong investment performance and attractive geographic diversification benefits for the US and Japan in the regional BTR-based portfolio.

What next?

Although there is a misconception regarding residential real estate investment as one of the high-risk institutional real estate investment assets, the research findings offer a clear picture regarding the strong investment performance of BTR as an effective and liquid institutionalised residential real estate investment exposure in the Pacific Rim region going forward, particularly for that in the US and Japan.

All research findings were sourced from my PhD thesis entitled “The Risk and Return Characteristics of Sector-specific Real Estate Investment Trusts in the Asia-Pacific” (chapter 7, section 7.5), here. Details of drivers, risk factors and investment performance of BTR in Japan are also available in my recent article entitled “The Significance of Residential REITs in Japan as an Institutionalised Property Sector” in the Journal of Property Investment & Finance here.