Investors who rely on dividends for a large part of their income should prepare for significant dividend cuts and suspensions in 2020.

In recent weeks, stock markets around the world have crashed as a direct result of the coronavirus pandemic.

In most corrections and market crashes, dividend investors are able to shrug off paper losses and focus on what really matters; their reliable stream of dividend payments.

But in the current crisis that may not be so easy.

The limitations on free movement of people and goods being put in place to slow the spread of the virus will have (and are already beginning to have) a significantly negative impact on the ability of most companies to generate the cash they need to pay dividends.

Already we’ve seen dividend suspensions from Marks & Spencer, Kingfisher (B&Q and Screwfix), Weatherspoons, ITV, Stagecoach and many more.

So how bad could it get? Of course we don’t know, but history may provide us with a few clues.

S&P 500 dividend cuts during previous crises

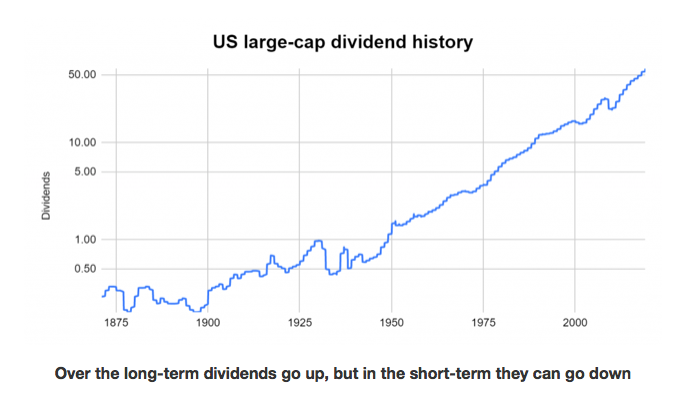

Thanks to professor Robert Shiller we have data on dividend payments of the largest 500 US companies going back more than a century.

This is very handy as it covers a period with multiple world wars, pandemics, oil crises, recessions and depressions.

So let’s have a look at what sort of damage a major economic disaster can do to the combined dividend of 500 very large companies (I’ll refer to these 500 companies as the S&P 500, even though that index didn’t exist 100 years ago).

Over the long-term dividends go up, but in the short-term they can go down

The chart above shows a nice trend, with dividends carried upwards by a mix of inflation, population growth and economic growth per person over the last century and more.

However, within this long upward trend there were many periods where the S&P 500’s dividend declined in both nominal and real terms, and some of the declines were quite severe.

For example:

Post-World War One recession and the Spanish flu pandemic (1918-1926): Dividends decline by as much as 33%

The Great Depression (1931-1937): Dividends declined by as much as 55%

World War Two and related recessions (1937-1949): Dividends declined by as much as 48%

Stagflation (1966-1990): Dividends grew in nominal terms, but thanks to high inflation they declined in real terms by as much as 25%

Global Financial Crisis (2008-2012): Dividends declined by as much as 24%

So the combined dividend of the 500 largest US companies has decline, multiple times, by more than 20% to more than 50% over the last century.

Given that fact, is it reasonable to think that the coronavirus pandemic has the potential to be as damaging to the global economy and to dividends as previous world wars, pandemics, depressions and financial crises?

I think the answer has to be yes.

Dividend-dependent investors should prepare for the worst and hope for the best

I think it is entirely reasonable to assume that the current pandemic has the potential to cause very deep recessions in many countries and perhaps even a global recession.

I also think it’s reasonable to be prepared for dividend payouts from the S&P 500, the FTSE 100 & 250 and other major indices to decline by 50% or more, for at least a few months and possibly a few years.

I’m no financial advisor, but if you depend on dividends for a significant part of your income then I suggest you do some scenario planning in which your dividend income declines by 50% in both 2020 and 2021.

And if you’re heavily exposed to companies that have lots of debt, weak profits and an inconsistent or nonexistent track record of growth, rather than companies with low debts, strong profits and a consistent track record of growth, then you may have to prepare for a significantly larger drop in income.