Rents-not-rising, but some markets are (a lot) better than others, a tale of four regions, good and bad news from CMBS, Bye-bye biotech, hello loneliness (reprise)

- Rents are not rising

- the national story obscures the regional one, and the regional one has some unexpected surprises and rockstar cities

- good and bad news from CMBS, because this time it’s different

- bye-bye biotech, hello loneliness (reprise), and no love for dirty water

Real estate dispatch

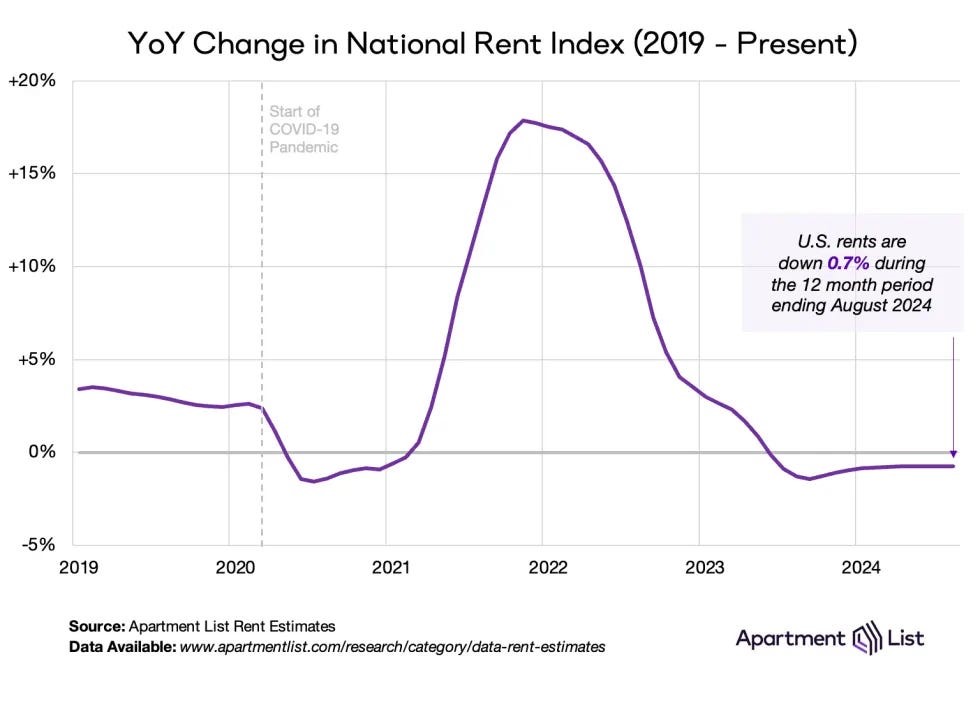

Nationwide, rents are somewhere between growing modestly-to-flat-to-down.

Yoy rents are -0.7%, but are still roughly 20% higher than they were back in 2020.

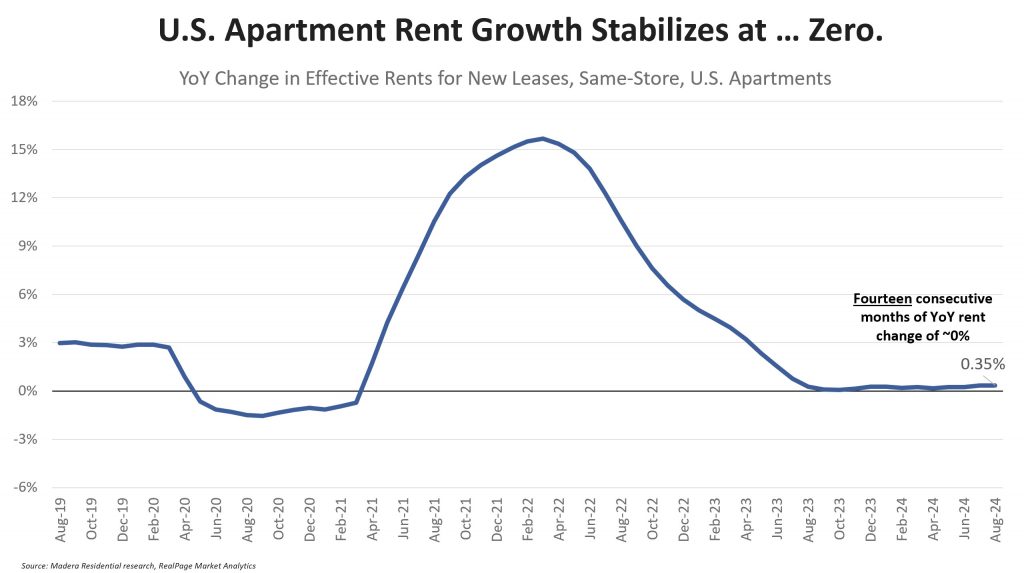

A more recent cut using Real Page data shows basically the same thing:

Flat, but not negative, rent growth nationwide (for basically a full year, now).

Rents aren’t growing all that much because incomes haven’t grown that much, and because there’s lots of new supply to absorb.

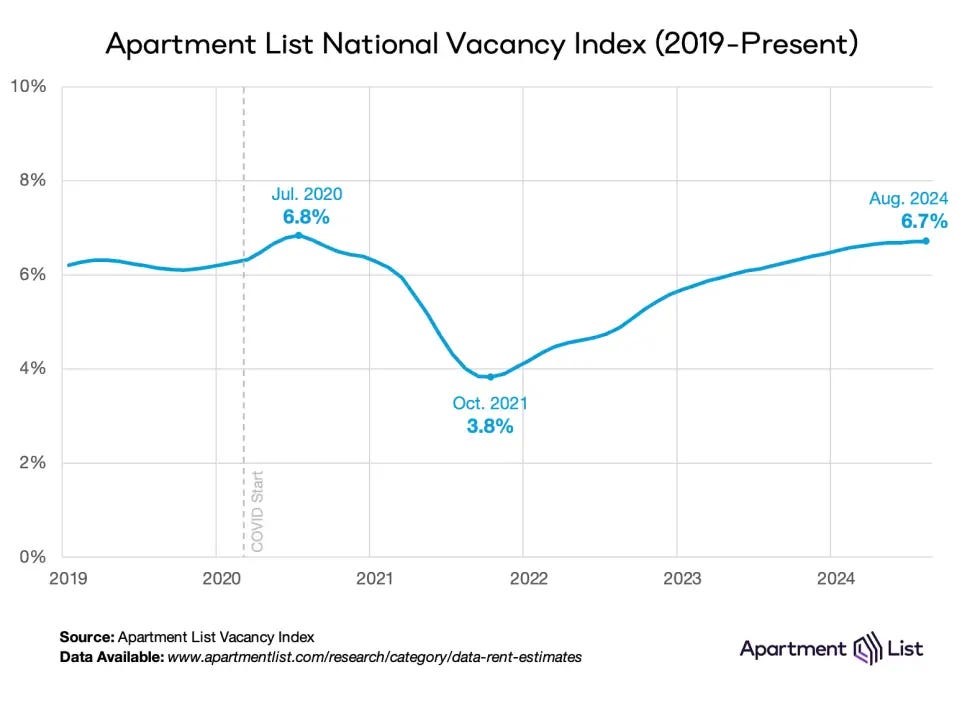

Vacancy rates are now modestly above pre-pandemic levels:

With a 6.7% national vacancy rate, it’s hard to find the housing shortage, such that one might exist.

One very clear implication of rents-not-growing is that developers are going to tap the breaks on new supply (and so they have).

That’s especially true given that labor and capital costs have increased so substantially. The hope is that not-building for a bit will cause rents to rise, and eventually give way to a new up-cycle in a year or so, but we shall see—and the MBA just revised their forward estimates of lending activity.

Anyways, all of this is old news and stuff that Random Walk has written about before.

So, what’s new and interesting?

A tale of four regions (and one rockstar city)

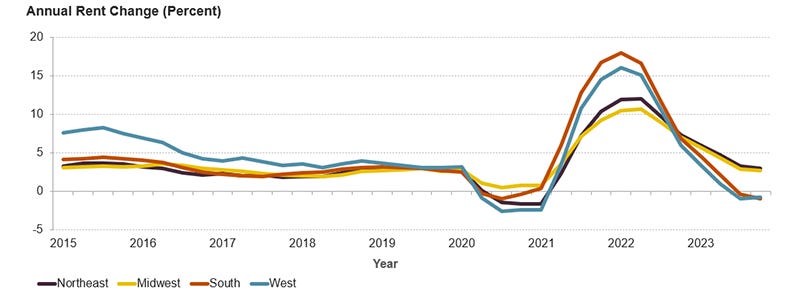

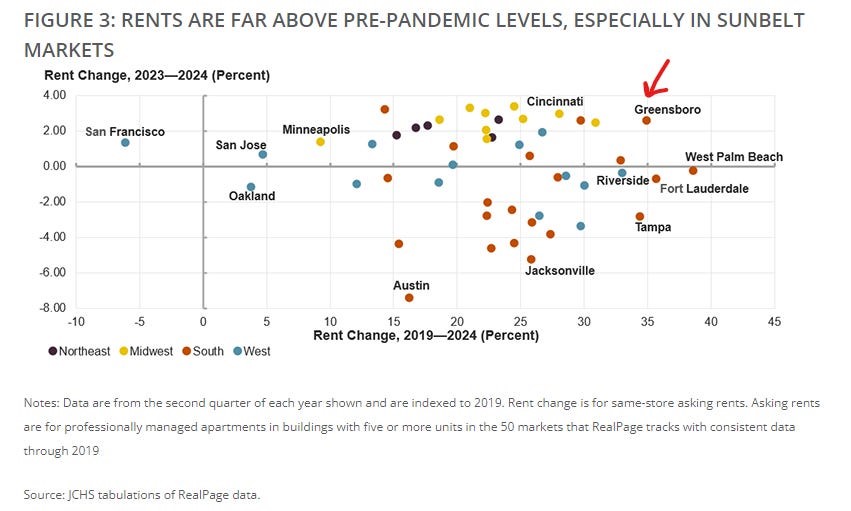

Well, the aggregate picture obfuscates the story somewhat as rents are really two stories: (a) previous high fliers in the sunbelt and southwest that are now cooling substantially; and (b) more slow n’ steady inventory-constrained markets in the northeast and midwest, that were slow n’ steady before, and continue to be slow n’ steady:

Southern and Western markets burned hot, and are now running cold, while Midwestern and Northeastern markets burned less-hot, but are still hottish.

There is, however, one market that stands out as a high-flier both before and now:

Take a bow, Greensboro, NC, for growing rent 35% during the boom run, and still growing rent at a nifty 2% clip.

Between Greensboro and Myrtle Beach, the mid-Atlantic region is firing on all cylinders.

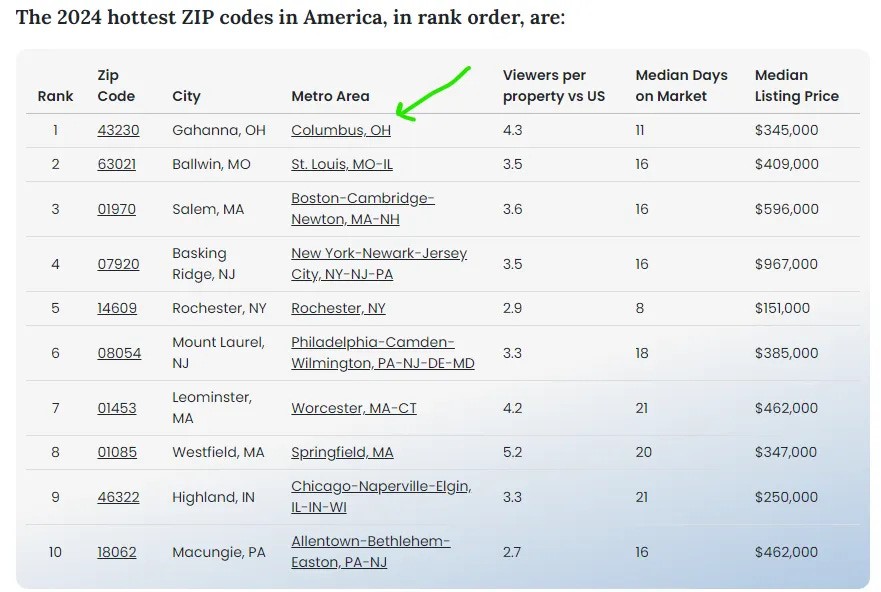

I mean, they’re no Columbus, Ohio, but few places can climb such towering heights.

Columbus is the “hottest zip code” according to Realtor.com.

Random Walk has no real idea of what that means, but Columbus is Random Walk’s old favorite under-the-radar market, so I’ll take the win.

Good and bad news from CMBS

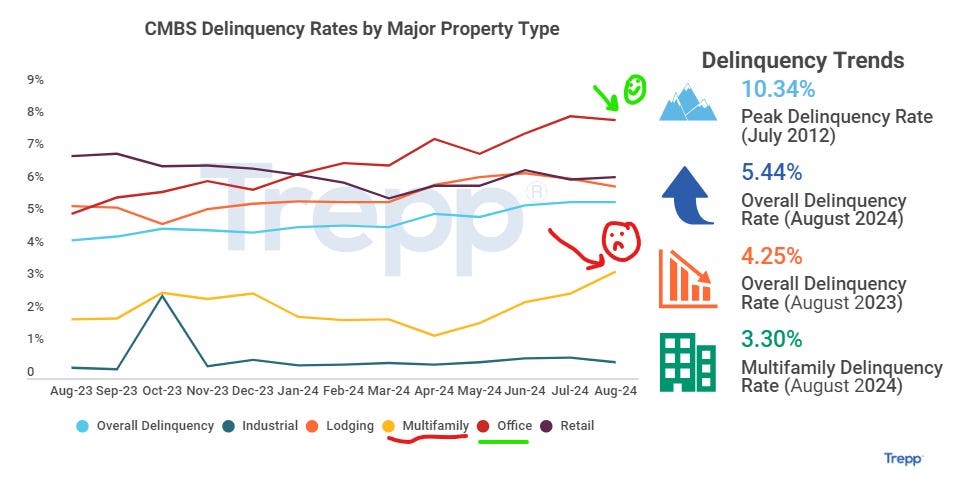

Another thing that’s interesting, but in a good and bad way, is that CMBS delinquencies continue to rise, but this time is different.

The big difference is that delinquency is driven for the first time not by office properties, but multifamily:

CMBS delinquency increased to 5.44%, but multifamily really jumped from 2.63% to 3.30%.

As per Trepp:

This is the highest the multifamily rate has climbed in more than three years. The last time the rate even eclipsed the 3.00% mark was in July 2021. For context, there was a large multifamily loan that accounted for north of 54% of the property type’s newly delinquent total. This was a portfolio loan that had previously been current on payments but now shows a delinquency status of non-performing matured balloon.

The biggest mom jump in multifamily delinquency in ~4 years.

But half of the new delinquency was driven by one portfolio (which could indicate a one-off), but it’s a little troubling that the portfolio was previously current.

But, the good news is that office properties aren’t getting more delinquent, and that’s something, right? It’s certainly more fuel for the “Office has hit bottom” fire.

Bye-bye biotech, hello loneliness (reprise)

Speaking of office space, I was both pleased and surprised to see at least one market that was still building.

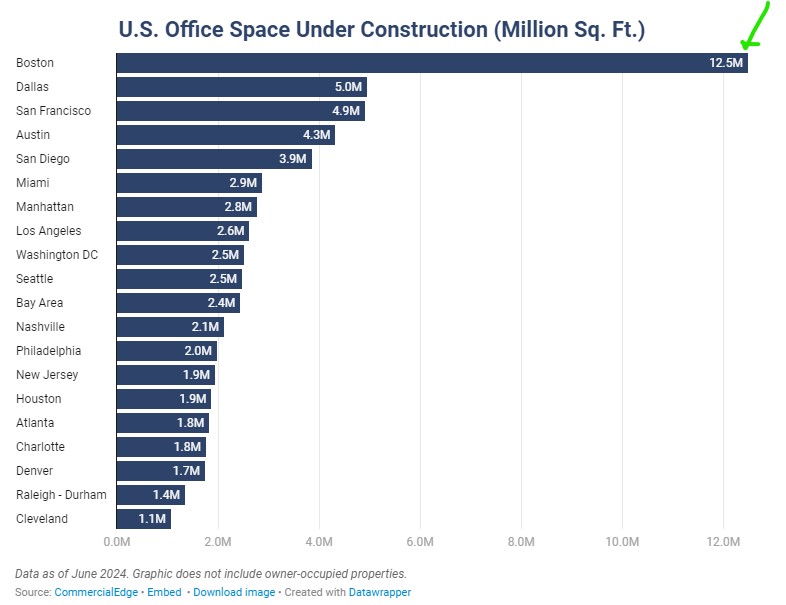

Boston is far and away the nation’s leader in US office space under construction:

At 12.5M sq. ft. in pipeline, Boston has 2.5x as much office construction underway as the next closest metro.

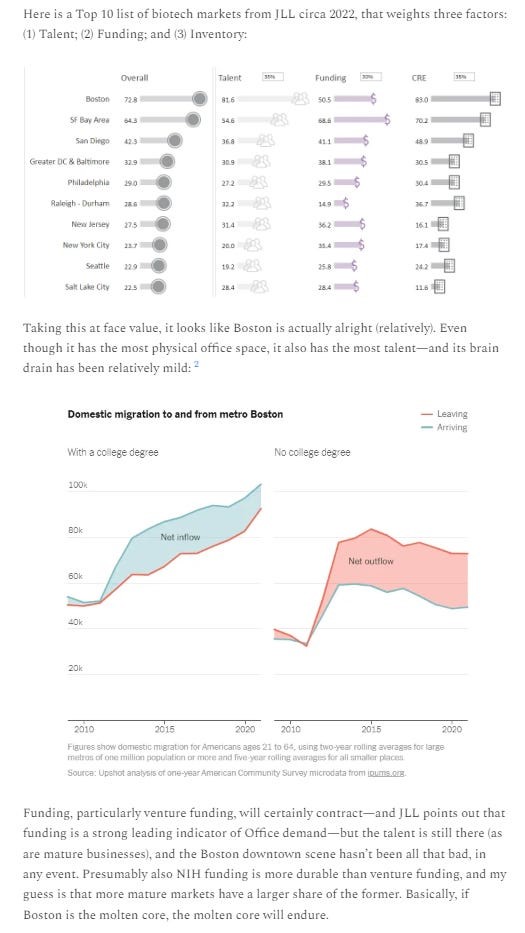

Biotech has long been an office out-performer. While normal office shmoes can work from home, biotech requires a laboratory, and that’s not the sort of thing that one can maintain in the living room.

Given the stickiness of Boston’s biotech scene in particular, many moons ago Random Walk speculated that Boston would probably be OK—even as investors pulled back from biotech companies, more generally.

“If Boston is the molten core, the molten core will endure.”

Well, fast-forward to 2024, and with the nation’s leading biotech construction pipeline, seems safe to declare victory for Boston and for Random Walk.

Hooray for Random Walk, sayer of sooths!

Or not.

As per the WSJ, there is apparently so much life science space, that developers are starting to market it as regular old office space instead:

Biotech and pharmaceutical buildings became one of the hottest investments in commercial property at the start of the pandemic. Now, the glut of life-sciences properties has gotten so bad that some developers are exploring the unthinkable: marketing the space for office use.

In the Boston region, for example, owners of at least 10 life-sciences locations are now offering those buildings for office space instead of lab space, according to brokers and other real-estate professionals. The building owners are willing to lease it for office use even though they can face a 30% haircut on what they had hoped to charge for life-sciences use.

“They’re no longer aspiring to get $100 [per square foot] rents,” said Fred Borges, a senior managing director of Boston-based investment firm Rockpoint Group, referring to the asking rents for lab space. “They will gladly do a deal for $70 on the office side.”

I mean, $70 per sq. ft., isn’t all that bad, considering what some office buildings are trading at.

But still, it’s not the best.

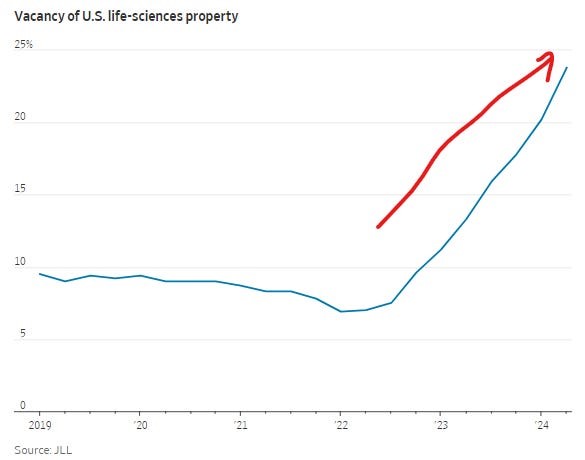

Vacancy rates are already higher than they’ve ever been in recent memory:

25% vacancy is what happens when you add ~60 million square feet of inventory (after years of adding ~4M/year.

In the big scheme of things, life sciences is a relatively small asset class, so it probably won’t matter all that much, but presumably life science tenants will be in the driver’s seat for a good while longer.

Anyways, so much for saying sooths. Random Walk was wrong. It’s happened before, and it will happen again.

This article was originally published in the Random Walk and is republished here with permission.