Extraordinary government support for REITs is boosting economies across the region.

Economic recovery is beginning for most of the Asia-Pacific region, with stock markets now much more resilient in the early stages of reopening than had been predicted. It is not a completely unexpected outcome, despite the continued uncertainty regarding the development and timing of a vaccine. Most countries are easing restrictions; only Australia, Hong Kong and the Philippines have extended such policies in response to a resurgence in Covid-19 cases. Furthermore, much of the region has benefited from continuing fiscal support, as well as strong financial conditions prior to the pandemic, with most of the region’s central banks having the ability to ease monetary policy and push rates to record lows or near.

The region’s real estate investment trusts have been beneficiaries of extraordinary government support. In Singapore, authorities loosened requirements in April for distributions to be made by up to 12 months. Regulators also raised the leverage limit to 50% for the island’s REITs and deferred to 2022 a new minimum interest coverage ratio requirement. Similarly, the Securities Commission Malaysia announced that it will temporarily increase the gearing limit for Malaysian REITs from 50% to 60% until the end of 2022. Such measures are aimed at providing REITs with greater flexibility to manage their cash flows and raise funds amid a challenging operating environment.

We estimate that China’s REIT market could conservatively be worth initially as much as $600bn to $800bn in market capitalisation

In other ways too, 2020 is turning out to be another landmark year for the development of REITs in the region. In April, China announced a pilot scheme to promote REITs in the infrastructure sector. The scheme’s launch is significant not just as a milestone but also as an important signal to the market, as the government intends to use it as a mechanism to boost the economy in the wake of the pandemic. We estimate that China’s REIT market could conservatively be worth initially as much as $600bn to $800bn in market capitalisation, which will make it the region’s largest. In Hong Kong, meanwhile, the Securities and Futures Commission launched a consultation on its proposed amendments to the Hong Kong REIT code.

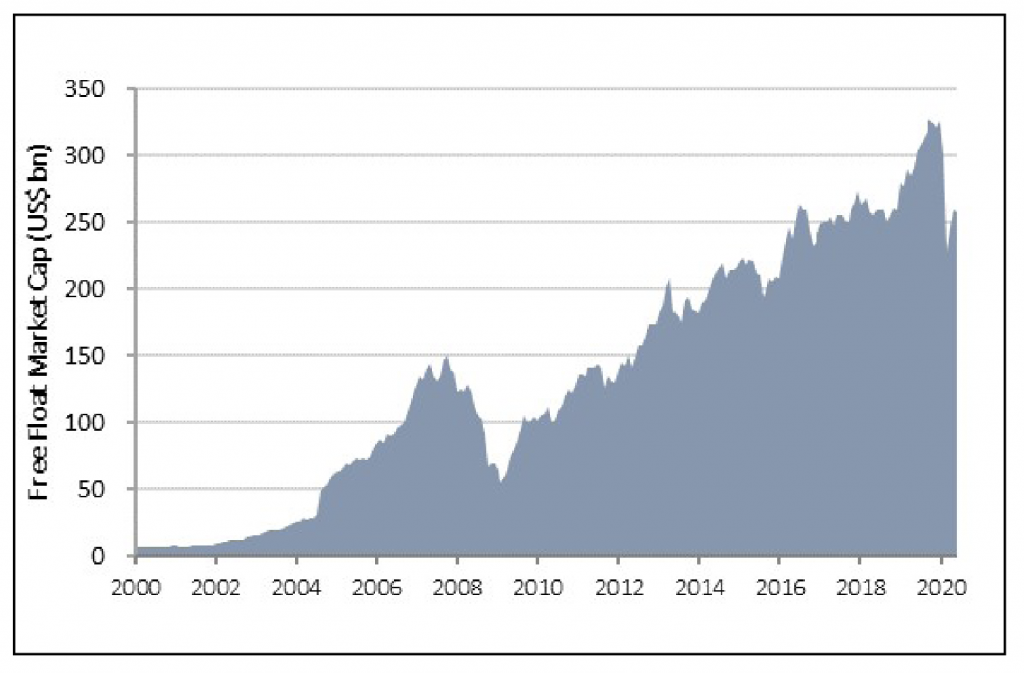

The region’s institutionalisation movement continued to deepen, with the listing of two new REITs in August. The Philippines became the latest country to boast its own REIT framework after the successful listing of AREIT Inc., backed by the country’s largest developer – Ayala Land. Meanwhile, India greeted its second REIT with Mindspace Business Parks REIT, a vehicle sponsored by Blackstone and K Raheja, while its southern neighbour, Sri Lanka, announced the introduction of a REIT framework to the Colombo Stock Exchange. All of this means that the clout of REITs will further strengthen across the region. The REIT market in the Asia-Pacific has grown dramatically over the past 15 years. Market capitalisation has increased by more than 400%, from $63bn to nearly $260bn today (see chart). The rise in liquidity comes on the heels of an increase in institutional ownership in the region.

Note: Data through July 31, 2020; inclusive of constituent stocks only. Free-float market capitalisation excludes locked-in shares.

While a return to former levels of vitality is not guaranteed, the real estate sector in the Asia-Pacific region has always shown itself to be resilient and REITs have the potential to rebound. Notably, REIT returns are now up by more than 16% from their March lows. After all, many of the local economic growth drivers – such as favourable demographics, urbanisation, improving competitiveness and the increasing co-operation in the Asia-Pacific region – will ensure that growth in this part of the world remains the fastest and thus is supportive of the real estate industry.