Originally published November 2022.

…but REITs look well positioned.

The cost of debt for real estate increased steeply in 2022, as credit conditions tightened, loan margins widened and recession fears started to bite. Rising rates have already caused greater financial market volatility, raising the risk of a market accident, as highlighted by the UK pension fund cash calls in September.

Policymakers’ desire to continue tightening until excess inflation is fully removed from the economy is starting to clash with the need to maintain financial stability, raising the risk of financial market distress. Any forced selling at scale would lead to a more significant downturn in global commercial real estate markets.

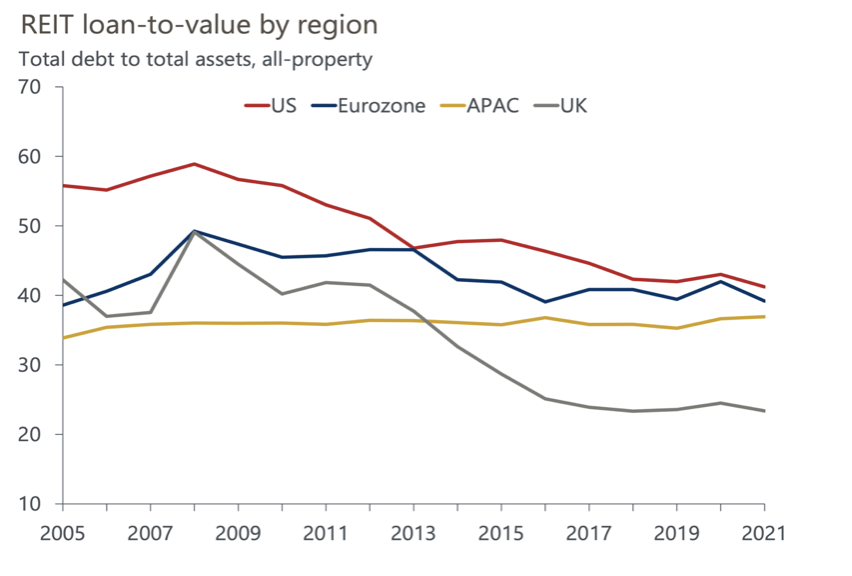

In this context, we believe that REITs look better positioned than the private real estate market due to a combination of lower leverage, limited near-term debt maturities and steep discounts to net asset value (NAV). Loan-to-value (LTV) ratios are lower now than during the global financial crisis (GFC) for most regions; the exception is Asia-Pacific, but LTVs are still low on a global basis (chart 1).

Chart 1: REIT LTVs are generally low

Compared to the private market, LTVs for REITs are typically lower. AEW recently reported that average European LTVs at acquisition were just below 50% in 2021, down from 75% in 2007. Private equity leverage has been even higher. Preqin data suggest the median LTV for US private equity deals completed in 2022 was 69%, but with an upper quartile at nearly 80%.

There is a wide variation in REIT LTVs. At a regional and sector level, US retail stands out as having a higher share of debt to assets than others; that said, it’s still only 50%. At the other end of the spectrum, UK industrial has a very low LTV of 20% on average, partly due to the exceptional capital appreciation experienced over recent years.

REITs also have a relatively low proportion of their debt maturing over the next 12 months (chart 2). This is significant because we expect global inflation to ease during 2023, with most central banks remaining restrictive until their inflation targets are approached in early 2024. That timing would allow the cost of debt to gradually decline in 2023. The one group that stands out are hotel and lodging REITs in the Asia-Pacific region. These hotel REITs are mostly in Japan, where liquidity in the credit market has remained healthier than other advanced economies.

Chart 2: Short-term debt due to mature looks low overall

We expect a recovery in REIT prices to emerge in 2023, ahead of private markets. North America and Eurozone look set to lead the way, but end-2023 prices are still likely to be lower than end-2021. The Asia-Pacific region sees a slightly slower pace of recovery on the back of some oversupply, particularly in the office sector, and also base effects from lower volatility over the pandemic period. Globally, the industrial sector will see the largest correction but also a commensurate recovery, as long-term growth drivers remain favourable. The hotel and retail sectors see less volatility having both experienced large corrections, due to the pandemic and e-commerce over recent years.

The current steep discounts to NAV suggest that small and midsized REITs could become acquisition targets, albeit where the use of debt is limited. Mergers and acquisitions (M&A) allow economies of scale and strategic realignment (sectoral, geographic, climate credentials). Recent evidence of M&A activity in the US involving REITs includes the Prologis acquisition of Duke Realty, while Blackstone has acquired American Campus Communities, PS Business Parks, Preferred Apartment Communities, and Resource REIT, all this year.